By Nick Giambruno, chief analyst, The Casey Report For only his most honored dinner guests, French Emperor Napoleon III was rumored to use a rare set of aluminum cutlery. Regular guests had to make do with gold forks and knives. In the mid-1800s, pure aluminum metal was rarer and more prized than even gold. That’s why, at the time, the French government held bullion bars of aluminum as part of the national treasures, and the French elite wore aluminum jewelry. Aluminum is one of the most abundant elements found on Earth. But most of it exists as chemical compounds, not as metal. It used to be an exorbitantly expensive process to turn aluminum chemical compounds into pure aluminum metal. Back then, pure aluminum metal was harder to obtain than gold. And the price reflected that. But in 1886, scientists discovered a way to cheaply produce massive quantities of aluminum metal relative to existing stocks. The price of aluminum plummeted from over $550 a pound in 1852 to $12 in 1880. By the turn of the century, a pound of aluminum cost around 20 cents. In less than 15 years, aluminum went from being the most expensive metal on Earth to one of the cheapest. Today, it’s not used to serve the most honored royal guests or as part of a country’s national treasure. People use aluminum as a component of everyday household items like soda cans and aluminum foil. This story illustrates a crucial economic concept. Understanding it is key to preventing investment losses. But it’s also key to positioning yourself for big profits in one critical asset. | Recommended Link | | REDACTED: What did Dems Hide in Pandemic Stimulus Bill?

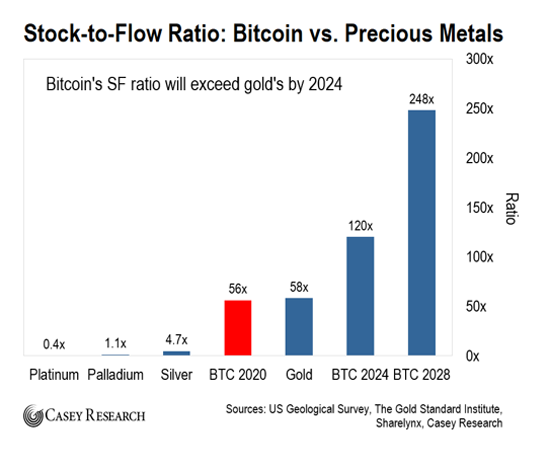

While most Americans were distracted by the media’s pandemic hysteria… Speaker of the House Nancy Pelosi introduced a bill that would forever change the way Americans save, spend, borrow, and invest. It was quickly redacted… But according to MarketWatch, “The end of July looks to be a hard deadline” for the Congresswoman from California to make another push – and if successful, her law could go into effect as soon as August. What’s in the new law the Democrat Congresswoman is trying to push through the House? And what does it mean for your money? From a remote outpost in Argentina, Nick Giambruno has recorded a brief video to lay out all the details of Pelosi’s plan. | | | -- | This Economic Concept Is Crucial to Your Wealth Aluminum’s rapid transformation from a precious metal of the highest order to a cheap, everyday household item is an instructive example of the stock-to-flow (SF) ratio. The “stock” part refers to the amount of something available, like current stockpiles. It’s the supply already mined. It’s available right away. The “flow” part refers to the new supply added each year from production and other sources. The Stock/Flow (SF) ratio is the number of years of new supply needed to equal current supply. A high SF ratio means that the new supply is small relative to the existing supply. A high SF ratio also indicates a “hard” asset – an asset that’s difficult to produce relative to its existing supply. A low SF ratio indicates the opposite. It means that market balance can be swayed by the new supply easily. If an annual supply of something is close to its current stock, the new supply will have a lot of power over the value of that commodity or asset. It should come as no surprise that gold, a perfect example of a hard asset, has the highest SF ratio of all commodities. With an SF ratio of 58, it would take about 58 years of the current rate of new supply to equal the existing gold supply. But now, with the advent of the digital age, people have a new type of hard asset to lean on. Hardest Asset Known to Man I’m talking about Bitcoin. Bitcoin shares many of the same attributes of gold that make it attractive as money. It’s durable, divisible, convenient, consistent, and has strict scarcity. And right now, Bitcoin’s SF ratio is around 56, nearly equal to gold’s. But as the chart below shows, by 2024, Bitcoin’s SF ratio will be nearly double gold’s SF ratio.

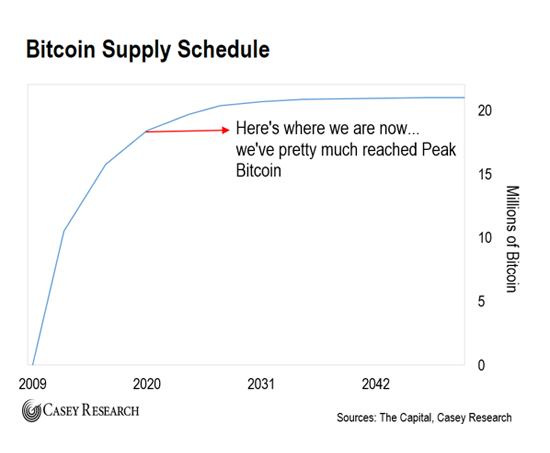

How is this possible? First, because Bitcoin has no central authority. That means no human, or government, can decide to arbitrarily inflate the supply of Bitcoins and steal value from holders. This is what we’re seeing today with rampant and irresponsible money-printing by the government. Instead, it runs on a secure decentralized network scattered around the world on thousands of computers. Bitcoin does not rely on so-called “trusted” intermediaries or third parties. A key feature of the Bitcoin protocol is that the block subsidy gets cut in half roughly every four years through a process known as “halving.” So far, Bitcoin has been through three halvings: One in 2012 when the block subsidy dropped from 50 Bitcoins to 25 Bitcoins, one in 2016 when the subsidy dropped to 12.5, and another in May which brought the subsidy down to 6.25 new Bitcoins per block. The halvings will continue every four years, drastically slowing the rate of increase in the supply of new Bitcoins. By 2024, the block subsidy will be cut to 3.125. By 2028, it will fall to 1.5625. Another key feature of the Bitcoin protocol: There will never be more than 21 million Bitcoins. This, plus the halvings, will result in Bitcoin being the hardest asset known to man. As of writing, there are 18.4 million Bitcoins in existence, or about 88% of the total potential supply. The remaining 12% of new Bitcoins will be added, through the block subsidy, at an ever-decreasing rate. By the end of this decade, over 98% of all Bitcoins will have already been created. The annual growth rate of new Bitcoins relative to the current stock will be close to zero.

| Recommended Link | The Most Exciting Tech Breakthrough for 2020 For the last 13 months, the public anticipated the arrival of a new piece of technology. If 5G is the future, then this technology is what will help make 5G a reality. And one tiny company – with 124 patents and 1/400th the size of Verizon – owns this groundbreaking technology. Telecom giants from the U.S., to China, Japan, the U.K., Brazil, Mexico, Russia, France, Africa, and Australia… They're banging on this company's door with millions in hand to pay for its technology. This company could be the next millionaire-maker. | | | -- | Bitcoin and Gold Are Your Tickets to Financial Freedom I see Bitcoin as a complementary tool for advancing your financial freedom. There is a tendency for people to be attracted to harder money over time. During financial crises or when government-issued fiat currency rapidly loses its value, the process is fast in motion. That’s when people rush toward harder assets. And I believe we are not far off from the next global financial crisis – especially in the wake of the COVID-19 pandemic and massive money-printing. Bitcoin Is Popular in Crisis-Prone Countries Bitcoin is already hugely popular in countries with high rates of inflation, like Zimbabwe, Venezuela, Turkey, and Argentina. That’s no coincidence. Bitcoin offers regular people a haven. They can easily use it to send and receive wealth. That might mean paying for goods and services when the local paper money becomes worthless, or discreetly receiving a much-needed influx from relatives who have managed to get out. In a crisis, Bitcoin is invaluable to the common man. I spend a lot of time in Argentina and have seen it firsthand. At writing, Bitcoin’s market cap is around $177 billion, which is almost three times as large as the monetary base of Argentina. If it were a government currency, Bitcoin would be the 35th largest currency by its monetary base. Bottom line: Think of Bitcoin’s increasing hardness like a black hole sucking in capital from weaker currencies and assets. The bigger the crisis, the bigger Bitcoin gets. And as governments around the world continue printing unprecedented amounts of currency in the wake of COVID-19, I believe this process will only accelerate. Regards, Nick Giambruno

Chief Analyst, The Casey Report P.S. I don’t want anyone to be blindsided by the government’s wrongheaded reaction to this economic crisis. As you know, government bureaucrats never let a crisis go to waste. It’s their modus operandi. So, while everyone is looking in the other direction, there is a plan to confiscate main street Americans’ wealth. I believe it will take effect by January 1, 2021. I put this briefing together to make sure you know how to protect your family’s financial security from this underhanded cash grab. Make sure you’re prepared today.

Like what you’re reading? Send your thoughts to feedback@caseyresearch.com.

In Case You Missed It… This Class of Stocks Has the Potential to Make Investors Rich in 2020 The rare-earth crisis of 2010 had stocks like Quest Rare Minerals up 481%. Alkane Resources scaled 953%. Great Western Minerals soared 706%. Medallion Resources popped 415%. Obviously, these aren't your everyday gains. But it could soon happen all over again. The rare-earth crisis of 2020 is here and these stocks are popping up 10% within days. If you're prepared to take swift and decisive action, this could be right for you. See this briefing for details.

|

Tidak ada komentar:

Posting Komentar