In This Issue: • Do Stocks Go Down Anymore?

• ETF Talk: Hedge Against the Euro with This Fund

• The Backwardation of Joe Biden

• The Color of Capitalism | | Do Stocks Go Down Anymore? | | Join Me at the Las Vegas MoneyShow Join me at the 2020 MoneyShow Las Vegas, so can I help you navigate the "new normal," from Aug. 16-18. I will be joined by world-class financial experts who will predict what's ahead for markets and individual stocks for the rest of the year, but more importantly, identify the most compelling sectors and industry groups, as well as the specific buying opportunities for optimal growth and value. Click here now to reserve your spot. | | | Do Stocks Go Down Anymore?

Are stocks ever going to go down again?

That's a question many people are wondering these days, especially after what we've seen in the market over the past month.

Of course, we know that stocks can and will go down at some point. But over the past month, every time that stocks have faltered even the slightest bit, they've come roaring back -- and that's despite the continuous rise of coronavirus cases throughout many of the "hot spot" states such as Arizona, California, Florida and Texas.

My friend, macro analyst extraordinaire and contributor to my Successful Investing and Intelligence Report newsletters, Tom Essaye of Sevens Report Research, was literally asked that question over the weekend by a friend. And though his friend was only kidding, the sentiment behind the question here is understandably a good topic to ponder now that we have entered what I think is a crucial inflection point for stocks.

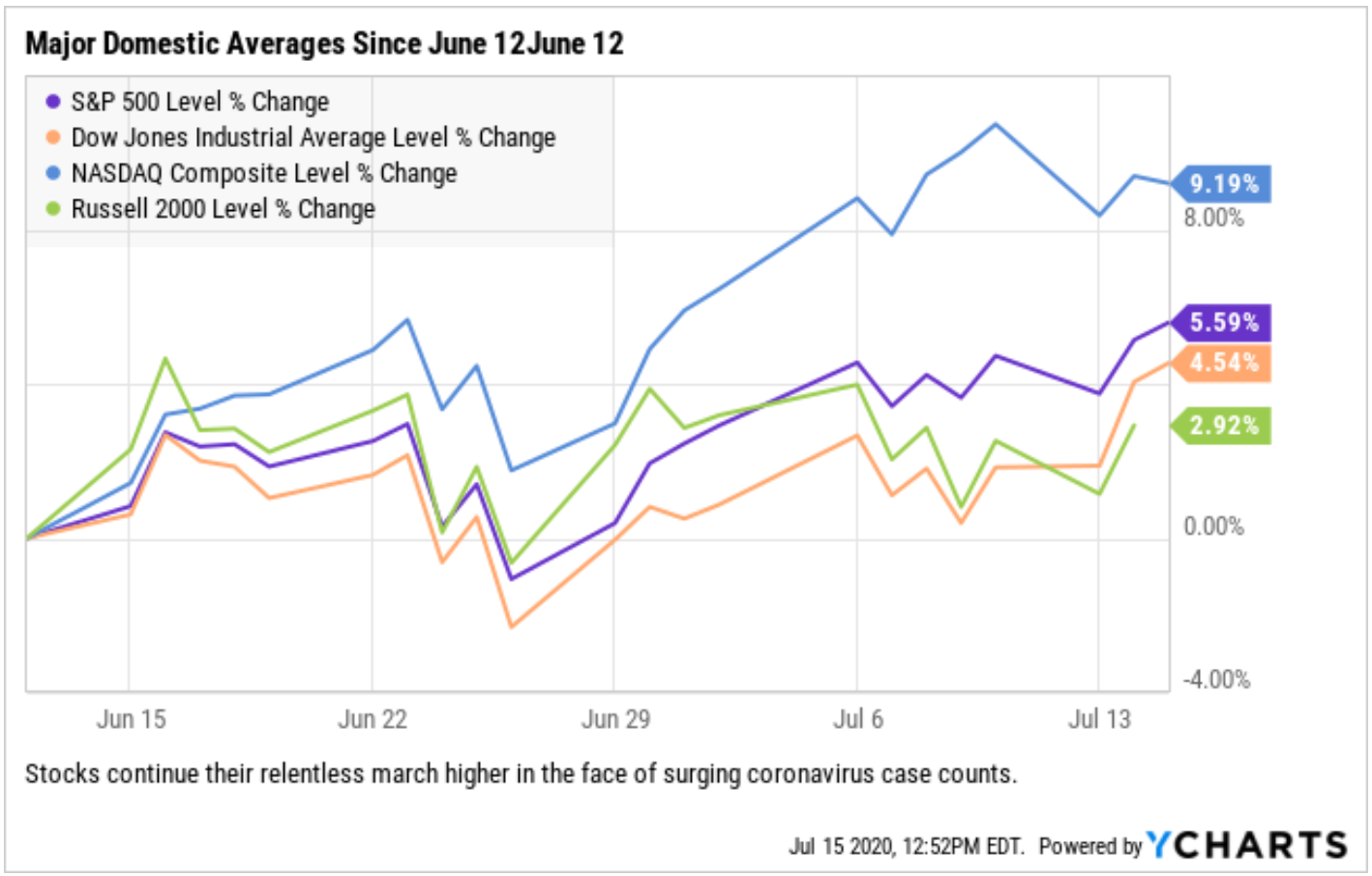

As you can see by the chart of the major domestic averages since June 12, stocks have been remarkably resilient. This is most impressive, especially when you consider the downbeat coronavirus headlines we've seen over that time. There's been an alarming surge in the number of coronavirus case counts nationwide and a new uptrend in the amount of hospitalizations and deaths due to the virus.

More importantly, and from purely a market-centric point of view, the new coronavirus metrics have caused many states to pause, and/or reverse their economic reopening.

Where I live in Southern California, we had enjoyed a few weeks where we could go back to bars and restaurants, gyms and hair salons. This week, however, Governor Newsom moved to close gyms and hair salons, put the kibosh on indoor dining and shut down bars. Similar circumstances are occurring in Arizona, Texas and Florida.

Yet so far, the market has basically looked past these shutdowns because traders don't believe that there's going to be a full-blown, nationwide lockdown of the sort that was imposed upon us earlier this year. Yet if the coronavirus counts continue their disturbing rise, we will see more and more restrictions on economic activity.

But, will that cause the stocks to go down again?

Logically, it should. However, conventional logic in this COVID-19 market doesn't really apply. Let me explain.

Right now, there are two primary reasons why it seems like stocks are never going to go down again. As Essaye explains, "The first reason is that markets are assuming that a vaccine (or a game-changing therapeutic) will come to market relatively soon. The second reason is something that market watcher Mohamed El-Erian of Allianz stated last week, the government is looking to 'socialize' the downturn."

Regarding the first reason, well, that's easy to understand. A vaccine and/or a pharmaceutical therapeutic will allow the world to go back to "normal" (remember what that is?). Moreover, the encouraging vaccine headlines over the past several days from companies such as Moderna (MNRA), Pfizer (PFE), BioNTech (BNTX), Johnson & Johnson (JNJ), Gilead Sciences (GLID) among others have been fueling the bull run. "As long as one of them is successful within a year or so, then we should see a relatively quick economic bounce back in 2021 and 2022," said Essaye.

The second reason, what El-Erian calls "socializing the downturn," simply means that governments around the world have stepped up their activity to ameliorate the financial pain of the coronavirus shutdown. In fact, they've done so in a very big way via central bank intervention, stimulus checks, loans to businesses (the Paycheck Protection Program), increased unemployment checks, lines of credit, etc.

"Instead of standing by and letting the downturn hit the economy in a traditional way, the government is essentially giving citizens money and in turn taking on massive debt, i.e. socializing the downturn. This limits the economic pain for citizens, but the risk is we create massive debt and deficits," Essaye remarked.

While the threat posed by massive debt and deficits is a real and long-term issue that could wreck the U.S. economy at some point, from a market standpoint, it represents a tailwind that can keep stocks pushing higher.

So, will stocks ever go down anymore?

While the real answer is yes, of course, stocks can and will go down eventually, the short- and medium-term fate for equities that are being driven by the euphoric cloud of vaccine hopes and a socialized downturn can keep the bulls running a lot longer than anyone suspects -- so invest accordingly. | | The #1 Question We're Getting From Our Readers: "With worldwide fears causing all these ups and down in the market...

...What should I do with my money?"

Fortunately, one of the world's top-ranked stock pickers has the answer:

His "fail-safe" system has kept investors safe from every bear market and crash for the last 43 years.

Click here for a free look at the fail-safe system -- including how his readers have fared since his system last signaled on Feb. 27. | | | **************************************************************

ETF Talk: Hedge Against the Euro With This Fund

(Note: Second in a series on Europe-focused ETFs)

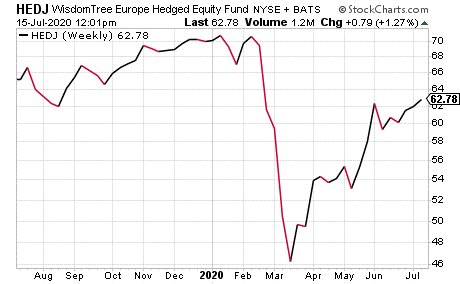

The WisdomTree Europe Hedged Equity Fund (HEDJ) seeks to provide exposure to the European equity market while hedging against fluctuations between the U.S. dollar and the euro.

The fund is hedged against the euro for U.S. investors. HEDJ targets dividend-paying firms, and, as the ticker implies, aims to remove euro currency exposure for the benefit of investors who are based in the United States. However, this exchange-traded fund (ETF) adds another twist: it screens to find publicly traded companies that obtain at least 50% of their sales from exports outside the Eurozone.

Such stocks should do well when the euro is weak or weakening. The WisdomTree currency-hedged equity funds use its currency-hedging strategies by entering one-month forward contracts each month and rebalancing at each month's end.

In a weakening euro scenario, the hedge seeks to protect local gains from getting lost in the conversion back into U.S. dollars. In a strengthening euro environment, the fund is designed to safeguard against poor local returns and no foreign exchange gain. Effectively, HEDJ doubles down on its bet against the euro.

The fund charges a hefty fee, but it has had no trouble attracting assets. Consequently, it is one of the most liquid ETFs in the developed European space, making it ideal for short-term tactical trading. Investors may want to consider trading in the morning (New York time), when European markets are still open, for the best price.

HEDJ is heavily weighted in three countries; France, 32.35%; Germany, 30.10%; and the Netherlands, 18.75%. Its sectors are heavily weighted in five sectors: Consumer Non-Cyclicals, 22.16%; Consumer Cyclicals, 20.27%; Health Care, 15.58%; Industrials, 14.72%; and Basic Materials, 14.28%.

Source: StockCharts.com

The fund has $2 billion in assets under management, 103 holdings and an average 0.02% spread. It has a 1.52% distribution yield and an expense ratio of 0.58%, meaning that it is more expensive to hold in comparison to many other exchange-traded funds.

To sum up, HEDJ tracks an index of Eurozone dividend-paying companies that derive a majority of revenue from exports outside that zone. This fund could be beneficial for short-term tactical traders, but please exercise your own due diligence in deciding whether or not this ETF is suitable for your individual investing and portfolio goals.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk. | | Urgent: Why You Need Market Plunge Protection NOW How do I know when the market is going to crater? Because every time the market plunges 20% or more, like it did at the end of 2018, the rebound curve looks pretty much the same. It shows you how high the market will bounce back… just before it plunges again.

Goldman Sachs claims this has been happening since 1945, and that we're about to get slammed with another round of volatility. But my five-point strategy could be a lifesaver for your portfolio… in fact, even in volatile markets, it wins up to 86% of the time! Click here now to download your free guide. | | | ***********************************************************

In case you missed it…

The Backwardation of Joe Biden

If you've ever traded futures contracts, you likely know about the concept of "backwardation." Backwardation is a condition where contracts for future months are decreasing in value relative to both the current and most recent months.

Backwardation is considered a bearish sign, as it indicates that traders expect prices over the long term to decrease. This term came to mind recently as I saw a host of presidential election polls showing the substantial lead in the race by presumptive Democratic nominee Joe Biden.

Former Vice President Biden is up nearly nine points in the Real Clear Politics Average of nationwide polls, and he is well ahead of President Trump in each of the key swing states that are likely to determine the winner.

In fact, even Wall Street executives are starting to brace for a potential Biden win as President Trump's numbers are fading. But would a Biden victory in November represent a sort of "backwardation" for the country?

I definitely think the answer is yes, as I think that an administration which is intent on raising taxes, increasing regulations and pandering to the anti-capitalist social justice warriors in the "woke" wing of the Democratic Party would be bearish for America.

Yet, my experience of Joe Biden's backwardation tendencies goes back to my personal experience with the man during a transcontinental airplane ride some 12 years ago. I first wrote about that experience in August 2008, and I have shared that experience in this column many times since.

Given the latest buzz about a potential Biden presidency, I thought I'd share my observations of the "backward" nature I observed from the then senator. Yes, my observations are intentionally humorous, but they also are designed to expose the inner workings of the man's thought process.

So, let's dive right in.

We All Scream for Ice Cream: A Joe Biden Tale

(August 27, 2008)

You can tell a lot about a man by the way he eats.

Some men like to sit down to a meal, take their time and savor each and every morsel of food and drink. People like this tend to be thoughtful, meticulous, confident and, in many cases, hedonistic. How do I know this? Well, I've been known to spend more time than most in getting through a multi-course, wine-paired meal.

Still, other men like to dig right into their prize, attacking the meal with fervor and a literal hunger for life that reveals their carpe diem approach to the world. This type of person tends to be decisive, purposeful, driven and a born leader. My favorite example of this type of eater is my good friend and investment guru extraordinaire, Doug Fabian.

But what do you say about a man who eats his meal in reverse order?

That thought has plagued me ever since I sat next to Sen. Joe Biden on a flight from Washington, D.C., to my hometown of Los Angeles, California. Sen. Biden was on his way to L.A. for an appearance on HBO's "Real Time with Bill Maher," while I was returning home from my annual pilgrimage to the nation's capital for a meeting with friends, publishers and the members of some of my favorite think tanks.

After exchanging pleasantries with the senior senator from Delaware, Biden wasted no time in digging right into his criticisms of the war in Iraq and what he perceived to be the folly of the Bush administration. I expected nothing less from the senator, as he's known for his outspoken critiques and his shoot-from-the-hip commentary.

What I didn't expect was a lesson in how to eat a meal backwards.

Now, since I had the benefit of being seated in first class during this flight, the flight attendants were very attentive when it came to serving what was a surprisingly tasty meal. The first course was a salad with Italian dressing, which was followed by a main course of a plump, well-seasoned chicken breast and a side of rice. The best part of the meal, for me, was the dessert, which was a generous scoop of gourmet chocolate ice cream.

I ate my meal with my usual casualness, and in the aforementioned order. Sen. Biden, however, took a different path. Biden accepted the salad, but he put it aside and saved it for later. When the main course came, he politely rejected it. But when the ice cream came, Biden's fervent personality really came out. He emphatically asked for a serving, although he had not yet eaten any food.

Biden ate his ice cream while we discussed Kevin Phillips' book "American Theocracy," the then-latest critique of the Bush administration's religious overtones. After eating the ice cream, Biden pulled out a hefty ham sandwich from his briefcase and consumed it in a deliberate and determined fashion. Once the sandwich disappeared, the Senator turned to the only remaining bit of food left on his tray table, the salad.

As I watched this reverse-order meal consumption, a thought occurred to me: Is this why the federal government is so screwed up? Is Sen. Biden's backwards approach to a meal indicative of what's wrong with Washington? Does this backwards-eating pattern explain why the government does everything less efficiently and less effectively than the private sector?

Given my theories on discerning knowledge regarding a person based on how they eat, what was I to make of Sen. Biden's meal habits? The only logical conclusion is that Biden looks at the world -- shall we say -- differently from the rest of us. And while there is nothing wrong with a slightly different perspective on things, I don't think I want someone a heartbeat away from the presidency who eats his ice cream first.

The next thing you know, this person will advocate raising taxes to stimulate the economy, negotiating with our ideological enemies as a means of portraying strength and railing against judges who think interpreting the Constitution is the only proper function of the courts.

Wait a second… that's what Biden wants? I knew there was a reason why he ate the ice cream first.

*********************************************************************

The Color of Capitalism

"Capitalism knows only one color: that color is green; all else is necessarily subservient to it, hence, race, gender and ethnicity cannot be considered within it."

--Thomas Sowell

This brilliant economist has a way of cutting through issues with rapier-sharp wit. In this quote, he reminds us that the essence of capitalism is the pursuit of profits and not some kind of social justice pursuit that divides us along racial, gender and ethnic lines.

Companies exist to create a product and/or service that people are willing to pay for and ensure that the product or service can be offered at a lower cost than it can charge (i.e. at a profit). That profit motive cares not if you are black, white, yellow, red or any combination thereof -- nor should it. It's this colorblind nature of the profit motive, and the ability to create what others are willing to pay for, that makes capitalism the most moral and most efficient system ever created.

Wisdom about money, investing and life can be found anywhere. If you have a good quote that you'd like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my newsletters, seminars or anything else. Click here to ask Jim. | | In the name of the best within us,

Jim Woods

Editor, Successful Investing & Intelligence Report

| | About Jim Woods:

Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Intelligence Report, Successful Investing and The Deep Woods (formerly the Weekly ETF Report). Jim Woods is a 20-plus-year veteran of the markets with varied experience as a broker, hedge fund trader, financial writer, author and newsletter editor. Jim is the editor of Intelligence Report, Successful Investing and The Deep Woods (formerly the Weekly ETF Report).

His articles have appeared on many leading financial websites, including StockInvestor.com, InvestorPlace.com, Main Street Investor, MarketWatch, Street Authority, and many others. | | | | | |

Tidak ada komentar:

Posting Komentar