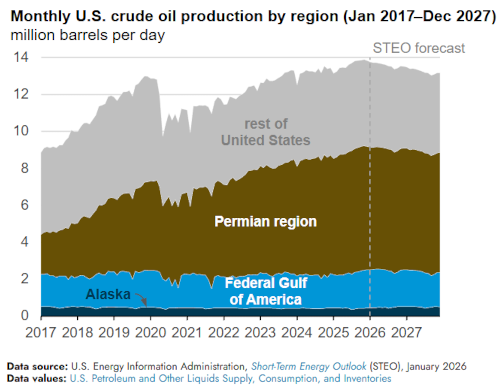

Practical Investment Analysis for the New Energy EconomyTwilight Comes to the U.S. Shale PatchThe U.S. oil industry needed a miracle back in 2008. For nearly 40 years, our domestic oil production had fallen into a seemingly impossible situation. Except for a brief period when oil output plateaued after Prudhoe Bay came on-line, but it wasn't enough to turn the tides. U.S. oil production continued to decline each year for the next 23 years, even falling below 4 million barrels per day briefly in September of 2008. We needed a miracle, and Harold Hamm answered by helping to deliver us the Bakken. A cold, windswept patch of North Dakota covering more than 51,000 square miles helped drag America out of its post-2008 energy hangover and turned the state into an oil-producing heavyweight. You see, Harold Hamm and his company Continental Resources was one of the key players in the Bakken boom. Now Hamm is hitting the brakes. If you've been waiting for a sign that oil is too cheap for our drillers, this is it. Hamm recently announced that Continental is officially halting Bakken drilling for the first time in about 30 years, idling rigs as oil prices sag and the math turns ugly. That is not a casual budget tweak, mind you. It's the kind of thing you see when you've looked at the rocks, the decline curves, the service bills, the royalty checks, the debt market, the hedges… and realized you're barely surviving with oil trading around $60 per barrel and a President that wants that price to drop lower. And you can't say we didn't see this one coming. How to Get a Six-Figure Payday From China's China's recent export ban on gallium, antimony, and germanium has sent shock waves through global markets, threatening to cripple U.S. national security. These critical metals are the backbone of America's defense infrastructure, essential for producing missiles, satellites, and fighter jets. Without them, the U.S. military is paralyzed. That's why the U.S. government is turning to a tiny American mining company to secure a reliable domestic supply of these vital materials. Welcome to the Twilight Phase of U.S. Shale For years, the Bakken was the proof-of-life for shale. But if the Bakken is blinking "pause," then the rest of the shale patch should be checking its pulse. Why? Because at $60 per barrel, shale growth doesn't die with a single headline, it slowly grinds to a halt. That's the part that nobody wants to say out loud. Remember, the shale boom has always been about speed. Drill fast, complete faster, bring production online quickly, pay the bills, rinse and repeat. However, this strategy worked because companies were operating on the best acreage, and efficiencies increased — laterals got longer, fracs got bigger, and capital was practically free. When prices crashed and the free ride was over, the industry got "disciplined," which is a polite word for "we can't keep outspending cash flow forever." Now the pressure is coming from the other direction. If there's one clear message out of the Trump White House for the past year, it's that he wants cheaper oil. Damned if you drill, damned if you don't. Well, we're finally starting to see cheap oil prices affect production. Last October, U.S. oil output was averaging a monster 13.87 million barrels per day. I'll be the first to admit that I didn't think we'd see it hit that high during a low price environment. Go ahead and take a quick look at how things have gone over the past decade:

Notice anything peculiar? Perhaps at the forecast portion of the chart above? For starters, it finally appears that we've hit the long-awaited plateau in the most prominent oil regions such as the Permian Basin. By the way, production in the rest of the lower-48 states is expected to start declining… again. That's not nothing, dear reader. Keep in mind that oil production from North Dakota is sitting around 1.16 million barrels per day, roughly 8% of our total oil output. If the rest of the operators in the Bakken follow Hamm's lead and halt drilling, production will fall off a cliff. The reason why is due to the sharper decline rates that our tight oil wells experience — there's a reason you have to drill at a frenzied pace to keep production steady, let alone increase it. I'm not the one saying this, it's the industry's unfiltered mood — one you don't need an analyst note for. Missed Palantir at $6? Don't Miss This. Palantir armed the Pentagon with AI — and soared 1,759%. Now, a tiny defense firm behind Trump's new $5.3 TRILLION "Golden Dome" is following the same hidden path...

Ignored by Wall Street. Backed by the Pentagon. We were warned about this cliff nearly a year ago, when the Dallas Fed's energy survey told us it was coming. A few months ago, top oil execs in the Permian Basin reiterated this sentiment, flat out saying that the U.S. shale business was broken. Again, this wasn't the part that people paid attention to. Why would they? All year, places like the IEA have been screaming about supply gluts and tempered demand. The easy narrative has been simple: oversupply is coming, prices must fall, and OPEC will eventually blink. It's a clean little bedtime story, isn't it? The problem is that reality keeps refusing to cooperate. And the capitulation is a case of too little, too late. In fact, the IEA just revised its 2026 demand growth forecast upward (AGAIN!), now putting global oil demand growth at roughly 930,000 b/d this year. That's the IEA's pattern in a nutshell — imagine our lack of surprise. Start conservative, talk about surplus, then wait a few months or years and quietly admit demand is sturdier than expected. The market hears "surplus" and sells oil like it's a broken product. But the physical market keeps tightening in inconvenient places, at inconvenient times, for inconvenient reasons. Like Kazakhstan. Chevron's Tengiz field — one of the world's giants — has been shut due to power supply problems, with sources saying the outage could last 7 to 10 days, and possibly longer depending on repairs and logistics. That's not a 2027 problem, it's a right-now problem. But shale isn't coming to the rescue this time. At least, not at $60 per barrel. And it certainly won't come as more rigs start idling in the Bakken. Watch and see for yourself, because when the shale patch stops growing, we lose the one source of non-OPEC supply that everyone has been counting on to put more barrels on the market. So here we are. Of course, it's also happening while the market is still pricing oil like geopolitics is background noise, not the main event. But the smart money won't chase the next headline. It'll pick up the last must-own oil stocks that'll survive the squeeze, keep drilling only their best rock, and still have the balance sheet muscle to buy distressed assets when the weaker players blink. That's the next phase of the oil trade. Not the boom. I think it's time you check this one out for yourself. Until next time,

Keith Kohl A true insider in the technology and energy markets, Keith's research has helped everyday investors capitalize from the rapid adoption of new technology trends and energy transitions. Keith connects with hundreds of thousands of readers as the Managing Editor of Energy & Capital, as well as the investment director of Angel Publishing's Energy Investor and Technology and Opportunity. For nearly two decades, Keith has been providing in-depth coverage of the hottest investment trends before they go mainstream — from the shale oil and gas boom in the United States to the red-hot EV revolution currently underway. Keith and his readers have banked hundreds of winning trades on the 5G rollout and on key advancements in robotics and AI technology. Keith's keen trading acumen and investment research also extend all the way into the complex biotech sector, where he and his readers take advantage of the newest and most groundbreaking medical therapies being developed by nearly 1,000 biotech companies. His network includes hundreds of experts, from M.D.s and Ph.D.s to lab scientists grinding out the latest medical technology and treatments. You can join his vast investment community and target the most profitable biotech stocks in Keith's Topline Trader advisory newsletter. |

Tidak ada komentar:

Posting Komentar