Market News: |

Gold surpassed its all-time high of $5,300 per ounce Trump says he's not concerned with the decline of the US dollar SpaceX considers a $1.5tn IPO timed to 'align with Musk's birthday and the planets' in June Keir Starmer arrives in Beijing and says the China trip 'will bring benefits back to the UK' Amazon slashes 16,000 roles in the latest phase of a broader reset. Earnings reports today: Microsoft, Meta, and Tesla Missed Nvidia? Missed Reddit? Missed Tesla? Here's Your Second Chance. (ad)

|

|

You know that feeling when something just doesn't add up? |

That's what's happening with the dollar right now. |

Just last week, we wrote about Trump's European strategy and how the dollar's global dominance depends on keeping Europe divided. |

Well, here's the plot twist nobody saw coming: Trump's own words just sent the dollar tumbling to a four-year low. |

And gold? It's hitting record highs above $5,300 per ounce. |

Let me explain what's really going on. |

|

Trump Says the Dollar Is "Great" |

President Trump was asked if the dollar had fallen too much. His answer? The value of the dollar is "great." |

That's it. No concern. No plan to strengthen it. Just... great. |

And that's when traders hit the panic button. |

| Bank research reports, January 2026 |

|

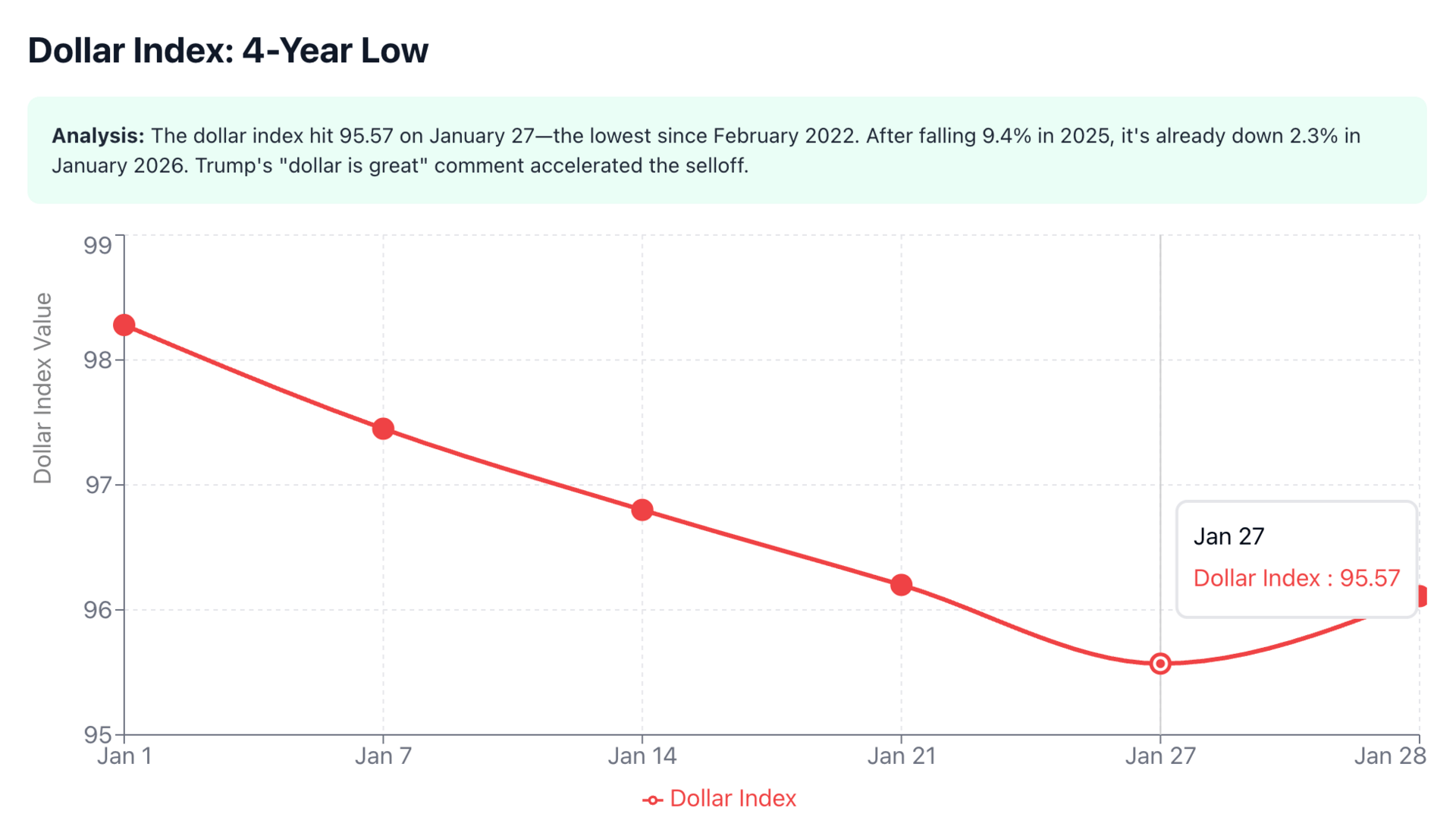

The dollar index dropped over 1% in a single session, reaching 95.57, its lowest level since February 2022. Think about that. Four years. That's a long time in currency markets. |

The euro jumped past $1.20 for the first time since 2021. The British pound hit its highest level in over three years. Even the Japanese yen surged despite Japan's own economic troubles. |

Why? Because Trump's casual response told markets exactly what they needed to know: the administration is comfortable with a weaker dollar. Maybe they even want it that way. |

Those are the official forecasts. But Kolanovic's warning cuts through all of it. He's betting on mean reversion, hard and fast. |

| | | | What do you trust more right now? | |

| |

| | |

|

|

|

The Hidden Logic Behind a Weak Dollar |

Here's where it gets interesting. |

A weaker dollar does help American exporters. When the dollar falls, U.S. goods become cheaper for foreign buyers. More sales abroad means more jobs at home. From a purely exports perspective, it makes sense. |

But, and this is a big but, the U.S. has $39 trillion in debt. |

Rob Kaplan, vice chairman at Goldman Sachs, put it bluntly in a Bloomberg interview: When you have that much debt, stability of the currency trumps exports. |

Every percentage point the dollar drops makes it more expensive to service that debt. Foreign investors start wondering if U.S. bonds are such a sure thing anymore. The borrowing costs creep up. The whole system gets shaky. |

And remember what we talked about last week? The dollar's reserve currency status is built on foreign countries parking their money in U.S. Treasury bonds. If confidence wavers, that systematic demand dries up. Interest rates spike. The deficit becomes a nightmare. |

That's the real risk nobody's talking about. |

|

What the Data Actually Shows |

Let's look at the numbers because they tell a real story. |

Over 2025, the dollar fell 9.4%, its worst annual performance in eight years. In January alone, it's already down another 2.3%. |

The dollar index is sitting at 96, having touched 95.57 this week. That's a four-year low. Not three years. Not two. Four. |

|

Meanwhile, gold has jumped 22% YTD in 2026. Silver is up nearly 60%. These aren't small moves. This is real money flowing out of dollars and into precious metals. |

And here's what should worry policymakers: the euro now represents over 20% of global currency reserves. |

That's up from barely 18% just two years ago. The dollar still dominates at around 58%, but that's down from over 70% back in 2000. |

The dollar is losing ground. Slowly but steadily. |

|

The Fed's Independence Problem |

Want to know what's really spooking markets? It's not just the weak dollar. It's what's happening at the Federal Reserve. |

Trump has repeatedly attacked Fed Chair Jerome Powell. |

There's now speculation that a new, more dovish Fed chair could be announced as early as this week. |

Fed set to pause rate cuts, with no clear path to resuming after three consecutive rate cuts in 2025. But, markets are still pricing in two rate cuts this year based on that expectation. |

When the Fed's independence gets questioned, global investors get nervous. The whole system is built on the idea that the Fed makes decisions based on economics, not politics. |

Goldman Sachs analysts wrote: "We expect concerns over central bank independence to persist into 2026." That's banker-speak for "this is a real problem." |

|

Why Gold Is Surging Right Now |

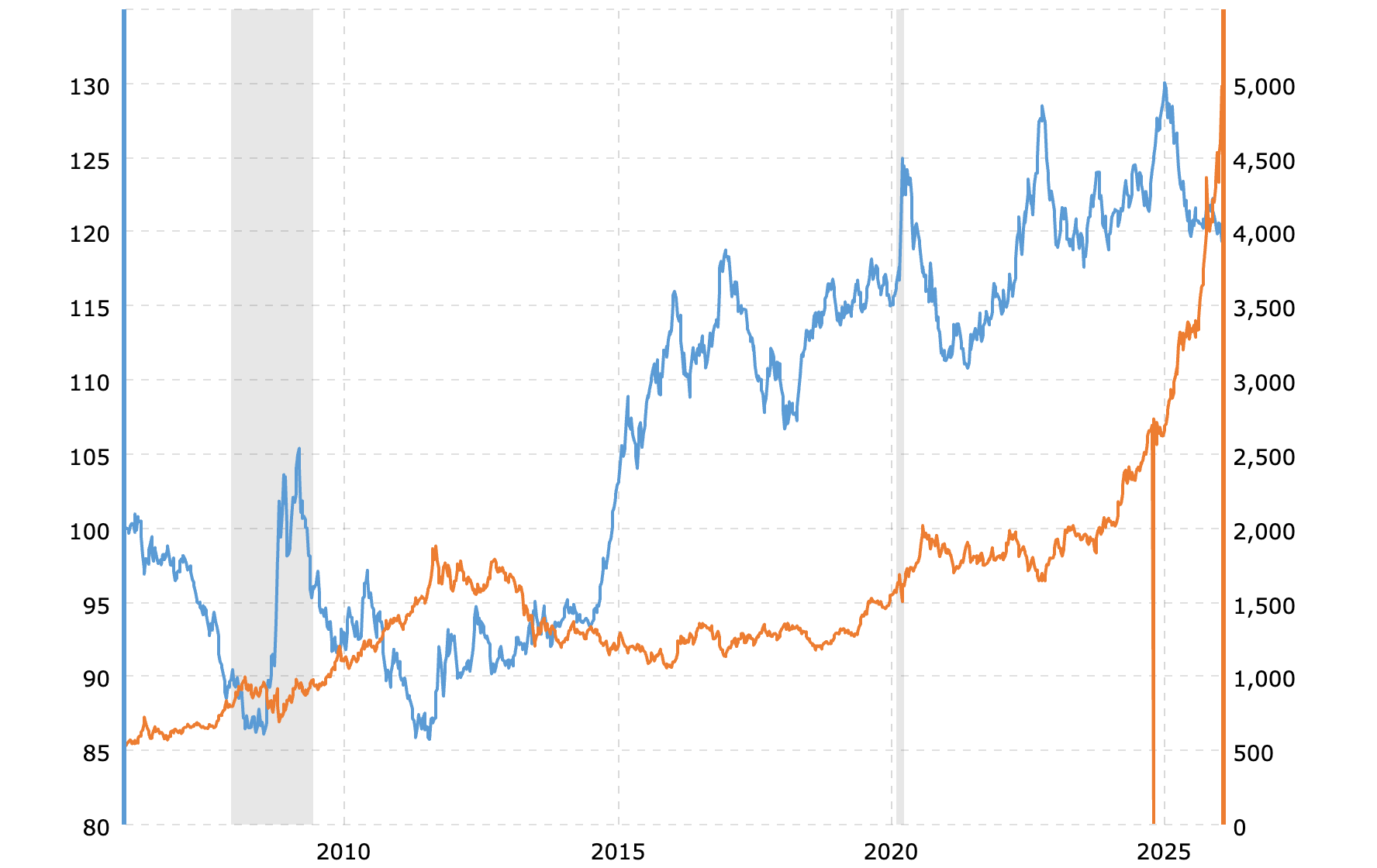

| Gold Prices and U.S. Dollar Correlation - 10 Year Chart |

|

Gold breaking above $5,300 isn't a coincidence. |

It's a direct response to dollar weakness and policy uncertainty. |

Here's how it works. When the dollar falls, gold becomes cheaper for foreign buyers. They buy more. Prices rise. But that's just part of the story. |

The real driver is confidence, or the lack of it. |

Investors are fleeing into what's called the "debasement trade." That's a fancy way of saying they don't trust currencies or government bonds anymore, so they're buying physical assets that governments can't print more of. |

Gold. Silver. Real things. |

Central banks are loading up too. They purchased over 1,000 tonnes of gold annually for the past three years. That's double the pre-2022 average. Even at $5,000+ per ounce, they're still buying. |

Why? Because they see what's coming. |

Bank of America sees prices hitting $6,000/oz by spring 2026. Goldman Sachs raised its year-end 2026 target to $5,400/oz, driven by emerging market central bank purchases

|

The World Gold Council laid out scenarios ranging from a 5% dip (if the economy booms and rates rise) to a 30% surge (if we hit a recession). |

But their base case? Continued gains driven by lower rates, a weaker dollar, and strong central bank buying. |

|

The Euro Gets Stronger |

The euro is strengthening precisely because the dollar is weakening. |

The EU-India trade deal announced this week gave the euro another boost. Brussels and New Delhi just created a free trade zone covering a quarter of global GDP and two billion people. |

That's huge. |

The euro hit $1.20 this week, its strongest level since June 2021. Over the past year, it's up 15.4% against the dollar. That's not normal currency fluctuation. That's a structural shift. |

And while Trump is trying to keep Europe divided to protect dollar dominance, the market is saying something different: people want alternatives to the dollar right now. |

The euro is the only currency on Earth with the scale and liquidity to actually replace the dollar's dominance. |

And with the dollar in free fall, it's getting closer to that reality every day. |

|

Historic Parallels |

|

Here's something important to understand. The dollar has been here before. |

Back in 2000, the dollar held over 70% of global currency reserves. Then the dot-com crash hit. Then the 2008 financial crisis. Confidence wavered. The dollar dropped to around 57% by 2010. |

Where did that lost share go? Almost entirely to the euro. |

Even after Europe's own debt crisis, the euro never fell below 20% of reserves. And that's with a fragmented union, no common army, and 27 different countries with different priorities. |

The pattern is clear. When confidence in the dollar cracks, the euro gains. When the dollar stumbles, gold surges. It's happened before, and it's happening again right now. |

The difference this time? The cracks are appearing while the U.S. has $39 trillion in debt and political leadership that seems unconcerned about currency stability. |

That's new. And it's dangerous. |

| | $200 Billion Tech Revolution Will Change Data Centers | The tech analyst who called smart phones 16 years before they appeared is now revealing what he believes is the biggest tech advance in the past century. Three companies are building a new type of computing technology that could make current AI investments obsolete with processing power 100X faster than today's AI systems and a 90% reduction in energy costs. Discover the three companies making data centers obsolete. | *ad |

| | |

|

|

The Real Economic Impact |

Let's talk about what this means for ordinary Americans. |

A weaker dollar makes imports more expensive. That phone you're planning to buy? More expensive. Gas prices? They go up because oil is priced in dollars. Vacations abroad? You'll pay more for hotels and meals. |

On the flip side, if you work in manufacturing or agriculture and your company exports goods, business might pick up. Foreign buyers find your products cheaper. |

But the U.S. imports far more than it exports. So for most Americans, a weaker dollar means higher costs without the offsetting benefits. |

And if foreign investors start pulling money out of U.S. bonds, interest rates rise across the board. Mortgages get more expensive. Car loans cost more. |

The dollar's decline isn't some abstract financial concept. It hits your wallet directly. |

|

What Investors Should Do |

Look, I'm not here to tell you to dump all your dollars and buy gold bars. But I do think you need to pay attention to what's happening. |

Here are three concrete things to watch: |

First, the Fed's next move. If they announce rate cuts later, especially with a new, more dovish chair, that's bearish for the dollar and bullish for gold. Powell's term ends in April. What happens after that matters. |

Second, foreign Treasury holdings. If you start seeing headlines about China, Japan, or European countries reducing their U.S. bond holdings, that's your early warning signal that the dollar's privileged position is eroding. |

Third, gold's $5,000 support level. As long as gold holds above that breakout zone, the technical picture stays bullish. A sustained drop below would signal consolidation, not collapse. |

For portfolios, the standard wisdom still applies. 5% to 10% in gold or precious metals provides diversification without over-concentration. It's insurance, not speculation. |

Gold ETFs offer the easiest access. Physical bars and coins work if you want tangible assets. Gold mining stocks add leverage but also risk. |

Whatever you choose, don't ignore what the market is telling you. The dollar's weakness isn't temporary. The policy uncertainty isn't going away. Gold's surge isn't a fluke. |

This is a structural shift happening in real time. |

|

The Bigger Picture |

The U.S. dollar has been the world's reserve currency for nearly 80 years. |

That status has given America enormous economic advantages: lower borrowing costs, higher living standards, outsized influence in global trade. |

But reserve currency status isn't a birthright. It's earned through stability, predictability, and trust. |

Right now, all three are being tested. |

Trump's casual dismissal of dollar weakness. The attacks on Fed independence. The policy unpredictability. The mounting debt. These things add up. |

Other countries notice. They start thinking about alternatives. The euro gains ground. Central banks buy gold. Diversification accelerates. |

Could the dollar lose its reserve status entirely? Not overnight. Not even in the next few years. The infrastructure supporting the dollar, the deep bond markets, the global banking system, decades of established relationships, doesn't unravel quickly. |

But cracks? Those are appearing now. |

And once confidence starts to erode, it's incredibly hard to rebuild. |

Goldman Sachs and Morgan Stanley both told clients to expect a 10 to 20 percent drop. (ad) |

|

Why This Time Feels Different |

I've been watching currency markets for years. And this moment feels different from past dollar selloffs. |

In previous episodes, 2008, the COVID crash, the dollar eventually recovered because global investors still viewed it as the safest haven. The least bad option. |

This time, they're not just selling dollars. They're actively seeking alternatives. |

The euro is rallying. Gold is hitting record highs. |

The narrative has shifted from "the dollar is temporarily weak" to "maybe we need alternatives." |

That psychological shift is what matters. Because reserve currency status is ultimately about belief. Belief that the U.S. will honor its debts. Belief that the Fed will stay independent. Belief that policy will be stable and predictable. |

When that belief wavers, everything changes. |

|

Your Takeaway |

Here's what you need to remember. |

The dollar just hit a four-year low after Trump signaled he's not concerned about its weakness. That sent gold soaring above $5,300 per ounce to record highs. The euro is at its strongest level since 2021. |

This isn't random market noise. It's a coordinated move out of dollar-denominated assets and into alternatives. Central banks are buying gold at record rates. Investors are fleeing to safety. |

The Fed's independence is being questioned. Policy uncertainty is rising. The U.S. has $39 trillion in debt. And the administration seems willing to accept a weaker currency to boost exports, despite the risks. |

Watch the Fed's next moves. Track foreign Treasury holdings. Monitor gold's technical levels. |

And remember what we talked about last week: the dollar's dominance has always depended on political strategy, not just economic fundamentals. Right now, that strategy seems to be shifting in ways that could have lasting consequences. |

The dollar's four-year low isn't the end of the story. But it might be the beginning of a new chapter. |

Make sure your money is ready for whatever comes next. |

|

| | | | Quick ratingHow was this one? | |

| |

| | |

|

Disclaimer: This analysis is for educational purposes only and should not be considered investment advice. Always do your own research before making investment decisions. |

Items marked with an asterisk (*) are promotional and help support this newsletter at no cost to readers. |

Tidak ada komentar:

Posting Komentar