|

|

When one of the world's most respected value investors drops $129 million on a struggling company in three weeks, you need to understand what's happening. |

V. Prem Watsa just made that bet on Under Armour. |

And $UA ( ▲ 0.98% ) jumped 14% in response. |

|

Who Is Prem Watsa? |

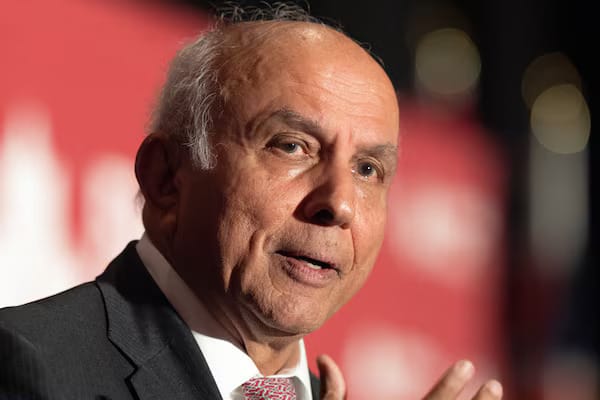

| Prem Watsa, Fairfax Founder (Canadian Press) |

|

Watsa runs Fairfax Financial Holdings, a Canadian investment firm with a track record that earned him the nickname "Canada's Warren Buffett." |

His strategy is simple. Find good companies trading way below their value. Buy massive positions. Wait for the market to wake up. |

He's done this before. And he's made billions doing it. |

So when Watsa personally directs over $129 million into $UA in less than a month, smart investors take notice. |

| | The AI Holding Backed by the World's Largest Defense Investors. | The defense sector is accelerating into AI faster than any industry in the world. | "Speed to field" is the new metric — and funding is pouring in at historic levels. | The major defense contractors are aggressively investing in U.S.-based AI companies built for real-time decision-making. | RAD Intel's team already has a history of Fortune-level exits and now delivers AI tools capable of powering rapid military and commercial decision flows. | This is no longer a theoretical market. | It's a strategic priority. | The $0.85 opportunity window ends soon. | | Disclaimer: The valuation is set by the Company. There is currently no market for the Company's stock.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Please read the offering circular and related risks at invest.radintel.ai |

| | |

|

|

The Numbers Are Staggering |

Here's what happened: |

January 21: Bought 5 million shares for $29.5 million January 20: Bought 1.8 million shares for $9.9 million January 16: Bought 1.8 million shares for $10.3 million January 2: Bought 13.2 million shares for $67.5 million December purchases: Another 12+ million shares

|

Total investment: Over $129 million |

Total shares acquired: More than 24 million |

Average price paid: Around $5.31 per share |

Current stock price: $6.21 |

That means Watsa is already sitting on paper gains. But here's the thing: he's not buying for a quick flip. |

| | | | Is this "smart money"… or a trap? | |

| |

| | |

|

|

Under Armour's Business Model |

Before you understand why Watsa is buying, you need to know what Under Armour actually does. |

The company designs, manufactures, and sells athletic apparel, footwear, and accessories. Think performance gear for athletes and fitness enthusiasts. |

Revenue comes from four main channels: |

Wholesale: Selling to retailers like Dick's Sporting Goods and Academy Sports. This is still the biggest chunk of sales. |

Direct-to-consumer: Their own stores and e-commerce site. Higher margins but requires significant marketing investment. |

Licensing: Letting other companies make UA-branded products for a royalty fee. |

International: Sales outside North America, particularly in Asia and Europe. |

The business model depends on brand strength. When athletes and everyday people want to wear your logo, you can charge premium prices. When they don't, you're stuck competing on price. |

That's exactly where Under Armour has been struggling. |

|

Key Financial Metrics |

Let's look at what the numbers actually say about Under Armour's current health: |

Revenue (TTM): $5.05 billion

Net Income: -$87.7 million (loss)

Operating Margin: 1.9%

Gross Margin: 47.3%

Current Ratio: 2.1

Debt-to-Equity: 0.58 |

Here's what this tells us: |

The company still generates over $5 billion in sales. That's not small. But profitability is the problem. |

Gross margins of 47% are actually decent for apparel. The issue is operating expenses eating up everything. Marketing costs, store operations, and restructuring charges are crushing the bottom line. |

The current ratio of 2.1 is healthy. Under Armour has enough short-term assets to cover short-term debts. They're not facing a liquidity crisis. |

Debt levels are manageable at 0.58. For context, Nike's debt-to-equity is around 0.70. Under Armour isn't over-leveraged. |

So why is the stock so cheap? Because investors don't believe the turnaround story yet. They see declining revenue, weak margins, and no clear path back to consistent profitability. |

Watsa sees something different. |

|

Under Armour vs Nike: A Tale of Two Brands |

To understand Under Armour's potential, you need to compare it to the market leader. |

Here's how Under Armour stacks up against Nike: |

|

What jumps out? |

Under Armour generates 11% of Nike's revenue but trades at less than 3% of Nike's market value. |

Gross margins are actually comparable. Under Armour's 47.3% beats Nike's 44.8%. The product economics work. |

The problem is operating margin. Nike runs a 12.1% operating margin. Under Armour barely scratches 2%. That's where the entire valuation gap lives. |

If Under Armour could improve operating margins from 2% to just 8-10%, the stock would re-rate significantly. You wouldn't see a $2.6 billion market cap on $5 billion in revenue with healthy profitability. |

That's the bet Watsa is making. He's not betting on revenue growth. He's betting on margin improvement through better cost management. |

| | Strange "black dust" is set to fulfill Trump's military visions? | A new breakthrough tech is offering up a huge opportunity for investors… | And no, this is NOT about AI. | It's about a strange "black dust" that is rarely talked about in the mainstream media… | But could very well be the catalyst for Trump's military revolution. | It has the potential to revolutionize our army with uses like: | Improved armor and ballistic protection… Cutting-edge stealth and camouflage technology… And even the creation of real life exoskeletons and augmented soldier gear!

| I believe that it's perfectly positioned to transform our military capabilities… | Secure global dominance for America… | And enrich investors of ONE small company! Get The Full Story Right Here > | *ad |

| | |

|

|

What Does Watsa See That Others Don't? |

Under Armour is struggling. No question about it. |

The company lost $19 million last quarter. Revenue dropped 5% year-over-year. Margins are shrinking. Competition from Nike and Lululemon is brutal. |

So why is Watsa buying? |

Because the stock is priced for disaster, not difficulty. |

Under Armour has a market cap of just $2.6 billion. That's tiny for a brand everyone knows. |

The company still generates over $5 billion in annual revenue. It has loyal customers, quality products, and global distribution. |

But the market has given up on it. |

Watsa hasn't. |

|

The Turnaround Story |

Under Armour isn't sitting still. |

Management expanded its restructuring plan in November and raised the operating income outlook to $95 million to $110 million for fiscal 2026. |

CEO Kevin Plank, who founded the company and returned to lead it, calls 2026 a "reset year." The plan is to stabilize operations, cut costs, improve margins, and set up for growth in 2027. |

Will it work? Nobody knows for sure. |

But Watsa clearly thinks the odds are in his favor at these prices. |

|

What About the Risks? |

|

Let's be honest. This is not a safe stock. |

Under Armour is still losing money. Sales are declining. The brand has lost some of its cool factor to competitors. |

Turnarounds take time. And they don't always work. |

If you buy Under Armour today, you're betting on execution. You're betting that management can cut costs, stabilize revenue, and eventually return to profitability. |

That's a bet with real downside risk. |

|

The Potential Upside Is Massive |

But here's what makes this interesting. |

If Under Armour gets back to where it was in 2021-2022, the math changes completely. |

Back then, the company had revenue around $5.8-6 billion with operating margins of 12-14%. The market valued it at $8-12 billion. |

Today, it's worth $2.6 billion. |

If the turnaround works, if revenue stabilizes and margins improve, $UA could easily triple or quadruple from current levels. |

That's the bet Watsa is making. |

And when you look at the valuation gap vs Nike, it's not crazy. Under Armour doesn't need to beat Nike. It just needs to run a profitable business with decent margins. |

At 8-10% operating margins on $5 billion revenue, you're looking at $400-500 million in operating income. Put a 15-20x multiple on that, and you get a $6-10 billion market cap. |

From $2.6 billion today, that's 2-4x upside. |

|

What Should Investors Do? |

Under Armour is not for everyone. |

If you need stable cash flow, dividends, or predictable earnings, look elsewhere. |

But if you have a long time horizon, can stomach volatility, and want exposure to a potential turnaround backed by one of the best value investors in the world, this deserves serious consideration. |

The signal from Watsa's buying is clear: he sees value where others see only problems. |

|

Key Takeaways |

Legendary investor Prem Watsa invested $129M+ in Under Armour over three weeks His average purchase price around $5.31 suggests he sees major upside from current $6.21 Under Armour generates $5B revenue but trades at only $2.6B market cap Gross margins (47.3%) are healthy but operating margins (1.9%) need improvement Nike comparison shows massive valuation gap even accounting for performance differences High risk, high reward: not suitable for conservative investors If turnaround works and margins improve to 8-10%, stock could triple or quadruple

|

|

The Bottom Line |

When a billionaire investor with Watsa's track record puts this much money into a beaten-down stock, you can't ignore it. |

Under Armour is risky. It's volatile. |

But at $6.21 per share with gross margins that work and a brand people still recognize, it might be one of the most undervalued names in athletic apparel. |

The math is simple. Improve operating margins from 2% to 8-10%. That's it. You don't need explosive revenue growth. You don't need to beat Nike. You just need to run a profitable business. |

For patient investors who believe in the turnaround story and trust Watsa's judgment, the current price could be a gift. |

For everyone else, it's a reminder: sometimes the best opportunities come when everyone else has given up. |

|

P.S. Personally, I'm putting 5% of my portfolio into Under Armour — because moves like this don't happen often, and if this turnaround story is real, I don't want to be watching from the sidelines. |

|

| | | | Quick ratingHow was this one? | |

| |

| | |

|

Disclaimer: This analysis is for educational purposes only and should not be considered investment advice. Always do your own research before making investment decisions. |

Items marked with an asterisk (*) are promotional and help support this newsletter at no cost to readers. |

Tidak ada komentar:

Posting Komentar