"Moneyball" Secrets from the

Market's #1 Forecaster |

Money & Markets Daily,

It’s the most powerful tool in a pro trader’s arsenal — and also one of the most expensive.

It looks exactly like any other modern desktop trading computer.

Except the mighty Bloomberg terminal features an iconic (and admittedly ancient) text-based display … and a $30,000 annual subscription fee.

You read that right.

Just having accessto a single Bloomberg terminal will cost you as much as buying a brand-new Honda Accord every single year.

That kind of price is obviously ludicrous for the everyday investor. But for professionals and top-tier analysts like our own Matt Clark, it’s worth every penny.

Because when compared to the alternatives, the Bloomberg terminal has always provided more price data, more historical data — more of everything.

Matt’s Bloomberg allows him to provide deeper analysis, quicker turnaround, and ultimately more accurate results to help optimize our systems and maximize our profits.

The terminal’s extensive library of data isn’t limited to stocks, bonds, options and crypto, either.

Bloomberg also tracks the market’s top forecasters and financial experts. You can pull up their track record of past predictions, view their outlook on the future, and even see a full list of rankings for each category.

And when it comes to forecasting key economic data like payroll statistics and jobless claims, there’s ONE name you’ll always find at the very top of the list…

| Adam O’Dell wants to connect you to a special contact inside his inner circle… A man that has developed a unique trading strategy that could flip a looming $6.5 trillion Pre-Inauguration Shock into a potentially massive opportunity. As you’re about to discover, it could be the chance to target years, potentially even decades, of stock market returns… in just a matter of days! Adam has been working closely with this forecasting genius ahead of what’s coming.

Click here to get this intelligence ASAP. |

A New Generation of Forecasting

From the first moment I met with Andrew Zatlin this September, I could tell he wasn’t your typical Wall Street expert…

Instead of a three-piece suit, Andrew showed up to Banyan Hill’s office wearing a Hawaiian shirt. He only had a few hours to spare between meetings with his hedge fund clients and a flight back to California.

And in that short time, Andrew casually laid out why so many of the world’s biggest banks and funds can never keep up with his forecasting.

He explained that mega-firms like Goldman Sachs and JPMorgan still rely on outdated data and methodology to predict key economic data like jobless claims and payrolls.

This jobs data is an extremely powerful leading indicator for the stock market, but there’s little incentive for the biggest players to evolve their approach.

So Andrew developed his own unique system from the ground up, focusing on real-time data to better reflect the fast-moving economy, and pushing modern trading technology (like the Bloomberg terminal) to its very limits.

Much like the “Moneyball” strategy that revolutionized baseball starting back in 2002, Andrew’s unique new system for predicting jobless claims and payroll data has completely reinvented the game.

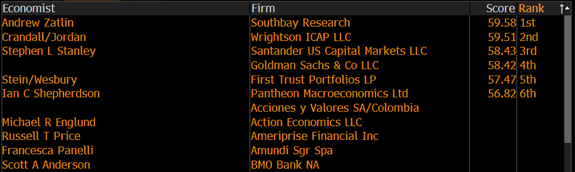

Andrew’s system catapulted him to the top of Bloomberg’s forecaster rankings, reaching the #1 spot on numerous occasions as you can see here:

Andrew Zatlin tops Bloomberg’s List of Forecasters,

Beating Goldman, Santander and More

Andrew’s consistently accurate predictions caught the attention of countless hedge funds. And it also helped him spot what could become the BIGGEST investing opportunity of 2025…

2025’s $6.5 Trillion “Pre-Inauguration Shock”

Right now, there’s an estimated $6.5 trillion in cash that’s sitting on the sidelines in money market funds, savings accounts or otherwise uninvested.

You can’t blame investors for being a little timid, either. After all, we’ve seen a massive rollercoaster in equities we’ve seen these last four years.

From the lightning-fast Covid crash in 2020 to the “Everything Bubble” that peaked in 2021 … to another crash and subsequent bear market when the Fed started raising rates the following year … the stock market has gone through some very sharp ups and downs over a very short period of time.

But interest rates are steadily coming down, and Trump 2.0’s pro-business agenda is now locked in for the years ahead.

That means cash will soon start piling back into equities … it’s just a matter of when and how much …

And as Andrew Zatlin explained to me in that first meeting, his forecasting system can help him pinpoint the exact day (down to the hour) that this tidal wave of cash will start flooding back into the market.

Obviously, I needed to hear the whole story. And so do you.

So click HERE to watch Andrew Zatlin’s free video presentation, so that you can prepare your portfolio for what’s coming on January 6th, 2025…

Adam O'Dell

Editor, Money & Markets Daily

Tidak ada komentar:

Posting Komentar