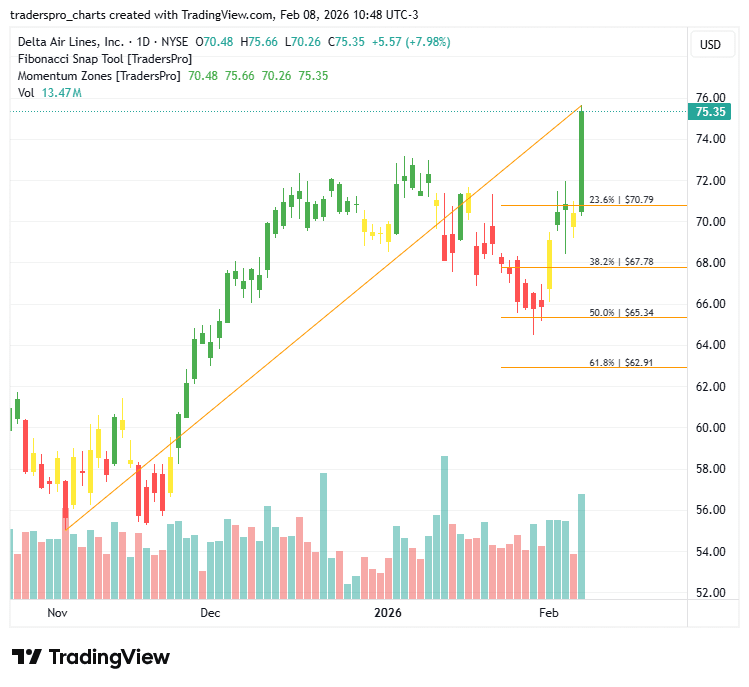

Delta Air Lines, Inc. (DAL): Airline Industry Finds BalanceAs travelers prioritize reliability and experience, premium-focused airlines are capturing higher-quality demand.Follow This Proven Trade Plan Delta Air Lines, Inc. (DAL) is a major global airline providing passenger and cargo transportation across domestic and international routes. The company operates a full-service network with a focus on premium cabins, loyalty programs, and operational reliability. Delta’s strategy centers on differentiated service, a strong hub system, and disciplined capacity management that supports consistent performance across demand cycles. Growth is being driven by resilient travel demand and Delta’s ability to capture higher-yield traffic. Premium leisure and business travel continue to outperform basic economy trends, and Delta’s brand positioning aligns well with travelers prioritizing reliability and experience. Its loyalty ecosystem and partnerships remain key drivers, deepening customer engagement and supporting revenue quality rather than chasing volume. Industry conditions are improving as supply chains normalize and fleet availability becomes more predictable. Travelers remain selective, but demand for experiences continues to hold up, especially on core routes and international destinations. Fuel price volatility and labor costs remain factors, yet Delta’s scale, fuel hedging discipline, and operational efficiency help cushion these pressures relative to peers. From a technical perspective, the stock’s chart shows constructive improvement. Price recently printed a confirmation bar with increasing volume, signaling stronger buyer participation. That move carried the stock into the momentum zone, where trends often strengthen as demand begins to outweigh supply and investor conviction builds. Even with momentum improving, risk management is essential. A trailing stop moves higher as price advances, helping protect gains while allowing upside to continue. Traders often establish trailing stops using Fibonacci retracement levels, implemented with a Fibonacci snap tool to adjust dynamically as new price structure forms. For more information about this company visit their official website. Trade Stocks with Confidence. Follow a Proven Plan. TrendCycle Daily |

Minggu, 08 Februari 2026

Delta Air Lines, Inc. (DAL): Airline Industry Finds Balance

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar