Focus on what happens before the paperwork, the roadshow, the bankers… and the "too-late" headlines.

Because once a story like this files, the early edge is gone.

This is the phase where individual investors like you and me can still position alongside the system with the ultimate insiders — not underneath it.

And right now, NatGold Digital is still in the "pre-filing" phase — where early positioning is still possible.

And the reason this window exists at all is simple: The most valuable gold on Earth isn't above ground yet.

The "Next MEGA IPO?" Setup Isn't SpaceX-Only Anymore

SpaceX has rockets.

NatGold Digital has something even more politically explosive:

Gold… that may never be mined.

Most gold products track price movements. Very few change what gold actually is.

This isn't "paper gold." It's not another gold ETF — although that might come later.

And it's not a futures contract with over 100 claims on the same bar.

I'm talking about the hardest-to-monetize asset class on Earth:

Certified, proven unmined gold resources.

They've always existed on balance sheets and geological reports — but until now, they couldn't move, clear, or function as financial assets without being mined.

NatGold changes that by converting certified resources into a blockchain-native asset via a token mint.

This is my MoneyQuake thesis wearing a tailored suit:

- Monetary Reformation (gold becomes spendable, auditable, digital)

- Meets the Conjoined Twins: AI and the commodities needed for the national and global AI data center network buildouts

- With a mechanism that doesn't require blasting a mountainside to "unlock" value

The gold stays buried AND protected forever in mother nature's vault. The value, however, flows to the holder.

And the part most people still don't understand:

NatGold isn't "another gold token."

It's a system designed to certify mineral resources and convert them into tokens using defined tokenization ratios.

That's not over-the-top language. That's architecture.

Certified resources → defined tokenization ratios → minting without mining → liquid, auditable value.

And architecture is where multi-billion-dollar outcomes are born.

Here's the "Unmined Gold" Reality Wall Street Can't Ignore

When you hear "there's always more gold," people picture endless supply.

But the economically meaningful number is reserves (not "stuff somewhere in the crust").

According to the U.S. Geological Survey's Mineral Commodity Summaries, estimated global gold reserves are about 64,000 metric tons.

That's over 2 billion ounces of gold!

And that's $10.29 trillion worth of gold sitting beneath the ground.

As gold prices continue to go up, the value of the in-ground gold resource goes up as well.

Wouldn't it be nice to unlock that massive, trapped wealth? Unleash it to the world?

Now zoom in — I'll break it down by continent…

This isn't theoretical — the reserves already exist. Proven by the world's best geologists. Accepted as fact by governments, banks and stock exchanges.

North America (Economic Reserves)

From the USGS country reserve estimates:

- United States: 3,000 tons = $500 billion!

- Canada: 3,200 tons = $514 billion!

- Mexico: 1,400 tons = $225 billion!

That's 7,600 metric tons of reserves across North America. And remember, these are the conservative of the conservative estimates!

South America (Economic Reserves)

- Brazil: 2,400 tons

- Peru: 2,500 tons

- Colombia: 700 tons

That's 5,600 metric tons across key South American reserve holders.

Australia

- Australia: 12,000 tons — one of the largest single-country reserve figures on the planet. That's $2 trillion!

This is what NatGold Digital is looking at as its tokenization pool in one breath:

North America (7,600 tons), South America (5,600 tons), Australia (12,000 tons) — and the world total sits around 64,000 tons of reserves.

And that's before we even step into the bigger idea: resources (measured/indicated/inferred), which can be far larger than reserves — but harder to finance, permit, and monetize in the traditional system.

USGS even notes a historical assessment of U.S. gold resources indicating 33,000 tons (identified and undiscovered), underscoring how enormous the "not-yet-a-mine" universe can be.

This is the pool NatGold is trying to connect to capital.

Why Natgold Digital Has "Platform Math," Not Just "Gold Math"

A normal gold miner is valued like this:

(ounces in the ground) × (a discount) × (time) × (risk) ÷ (financing + permits + politics)

That model is brutally punitive — especially in 2026.

NatGold is attempting something structurally different...

It's building a mint that can monetize certified resources without the mine.

That's not just a commodity play.

That's a financial infrastructure and technology play.

And infrastructure is where the monster valuations live.

This isn't something a crypto team can spin up — it requires geological verification, jurisdictional compliance, and standards institutions already recognize.

Think about what investors pay up for:

- Exchanges

- Clearing rails

- Payments networks

- Settlement systems

- "Picks-and-shovels" platforms that profit from flow, not "one project"

NatGold Digital's thesis is that certification + tokenization creates a new "flow."

And once a system like that becomes accepted…

The valuation isn't tied to a single deposit.

It's tied to the size of the pipeline.

Your Window to Claim the Next "AI Equity Check" Is

Closing on March 31.

If you weren't already aware...

AI firms have been caught "stealing" our personal data to train their AI models.

And the U.S. government has decided to step in.

This has led to the discovery of a brand-new passive income stream I call "AI Equity Checks."

In short, AI firms are legally required to pay a handsome fee to a few special companies...

Which then distribute these checks to everyday Americans like you.

Right now regular folks are receiving as much as $3,452.50 per month (that's $41,430 every year for life).

And you can too.

It takes just five minutes to get set up before the next payout on March 31.

Go here to get set up with "AI Equity Checks" before it's too late.

The "Before the IPO Filing" Tell: Watch the Milestones They're Already Publishing

When something is gearing up to be institutional-grade, it starts leaving a paper trail.

NatGold Digital has been doing exactly that — releasing milestone updates around tokenization readiness, ratios, and submissions tied to resource certification.

Here's the point…

You don't wait for CNBC to explain it.

You position while it still feels "weird."

Because the moment it feels "obvious," the upside is already screaming to the moon.

How to Position Ahead of the Crowd (Useful, Not Vague)

This is the actionable part — the "what do I actually do with this information" part.

1) Stop thinking like a trader. Start thinking like an early stage investor.

Early wins come from being in the right place before the "official narrative" hardens.

The earliest public signal I care about is reservation momentum — because it shows demand before listings.

That's why tens of thousands of investors across more than 161 countries have already raised their hands — quietly, before institutions are even allowed in.

NatGold Digital has publicly reported that its Pre-Market Reservation Program for its tokens has reached US$420 million, and because of unprecedented demand, it has extended the reservation window through February 24, 2026.

Extensions don't signal openness — they signal strain. When windows like this close, they don't reopen on better terms.

Lock in your spot now.

That date matters.

Because it's a clock.

It's not a deadline for marketing — it's a cutoff for access.

2) Understand what the reservation window really is.

A reservation window is not a press release.

It's a gate.

It's where the earliest investors get in before the floodgates opens up.

That's why I keep hammering this in MoneyQuake terms:

When monetary reformation happens fast, it doesn't ring a bell first.

It closes doors.

3) Follow the "mint economics."

The entire NatGold Digital story becomes orders of magnitude more valuable if:

- Tokenization scales across jurisdictions, and

- Certification becomes a standard, and

- The market begins to treat "certified unmined gold" as a legitimate digital reserve asset

That's when you start hearing phrases like:

- "Institutional onboarding"

- "Strategic partnerships"

- "Compliance rails"

- "Exchange listings"

- "Custody integrations"

And then the IPO talk becomes real — because Wall Street loves "toll roads."

Why I'm Comfortable Using the Phrase "Trillion-Dollar" (and Why It's Still a Could)

Let's be precise.

I'm not saying NatGold is a trillion-dollar IPO.

I'm saying the shape of this opportunity has trillion-dollar optionality if it becomes a dominant platform for a global asset category.

This isn't about gold going up.

It's about turning one of the largest asset classes on Earth into a programmable financial system.

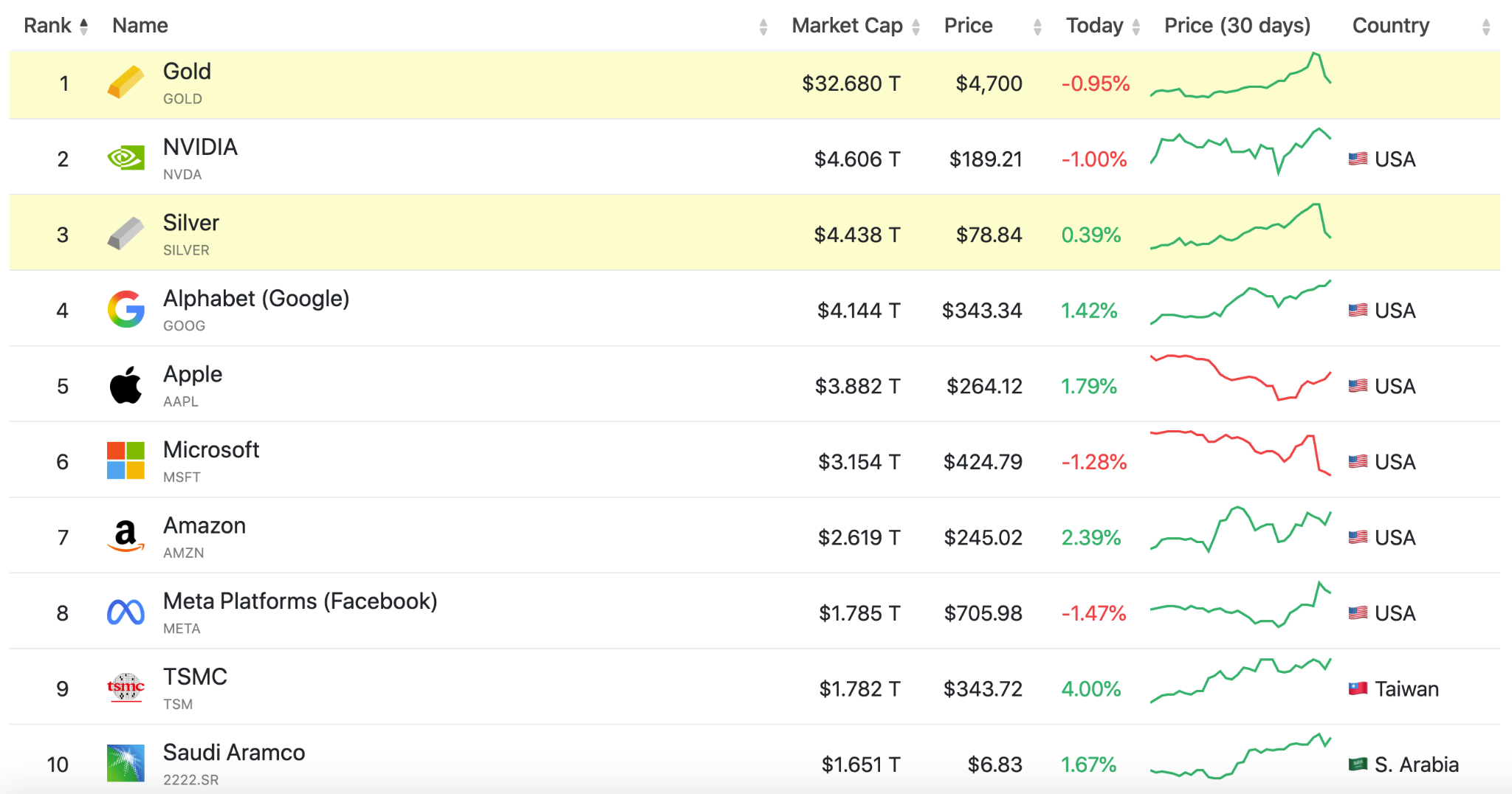

Look, Bitcoin's total market valuation is currently $1.46 TRILLION. It's been as high as $2 TRILLION!

Ethereum's market valuation is currently $257 billion! Tether is $185 billion!

Imagine what NatGold Digital's market valuation will reach once it starts minting unmined, proven gold reserves into tradable tokens?!?

And gold is not a "small category."

Right now, gold is the largest asset — in dollar terms — on the planet.

And this is just the "above ground" gold… the stuff that's already been dug out of the ground at great cost.

The "below ground" gold reserves could be bigger.

Even the USGS framing — tens of thousands of tons of economically viable reserves globally — tells you the scale of what the world still considers "countable" gold.

NatGold's pitch is that a chunk of the world's gold value is stranded — and tokenization can unstrand it.

Read that again – tokenization can "unstrand" all of that gold, releasing trillions of dollars of wealth!

If that clicks at a global scale, you're not valuing "a coin."

You're valuing an operating system for gold.

The Urgent Part (Read This Twice)

NatGold's reservation window has a published endpoint:

February 24, 2026.

That's not "someday."

That's days away.

What comes after isn't the same opportunity — it's the institutionalized version, with less flexibility and fewer advantages.

And in my experience, windows like this don't stay open — they narrow, then they vanish, then they get replaced by the version that's worse for latecomers.

So if you're looking for the cleanest "do this now" takeaway:

Focus on what happens before the filings.

Before the product is everywhere.

Before the gate closes.

That's where asymmetric positioning lives.

Invest in the future, now.

One Last MoneyQuake Punch Line

SpaceX is a bet on leaving Earth.

NatGold Digital is a bet on what's in the earth!

More importantly, NatGold Digital is a bet on what happens when the world decides:

"We don't trust paper promises anymore."

When that switch flips, gold doesn't just go up.

Gold becomes infrastructure on blockchain.

And the companies that own the rails don't get valued like miners.

They get valued like kings.

Get to the good, green grass first…

The Prophet of Profit,

Tidak ada komentar:

Posting Komentar