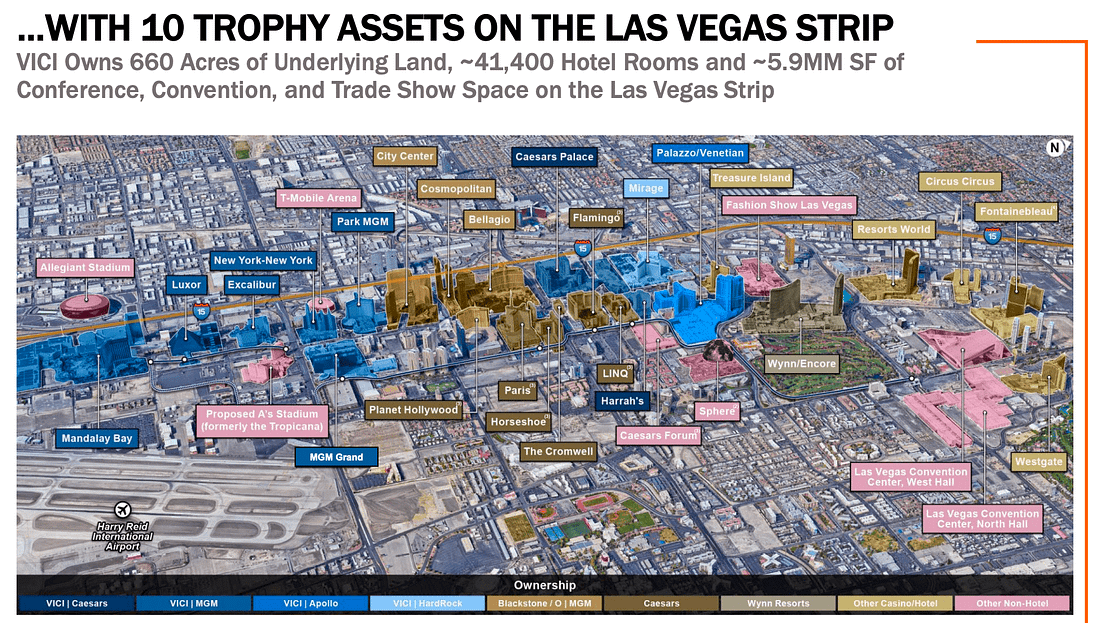

This 5.5% Yield Changed How I See "Gambling"The Vegas Secret That Pays a 5.5% Dividend (Even When the Strip Goes Dark)Dear Reader, Viva Las Vegas. I’m walking through the bright casino at 3AM, MoneyShow badge swinging around my neck, when it finally hits me. Not the scent of burned-out cigarettes. Not the relentless clacking of slot machines. In this city built for losing, the house isn’t the only winner — and it’s not who you think. There’s another, quieter beast raking in the dough. And most folks have no clue. Let me show you. Sin City’s Real SecretMost people see Las Vegas and think, "Rigged games, lost fortunes, suckers everywhere." I don’t blame them. Like I tell people, I’m not a gambler. Not in the Vegas sense. Trading? Sure. Casino floors? Not a chance. Because the odds are always stacked against the guy at the table. But where there’s no edge, I walk. Where there’s clues, I follow the money. And in Vegas, the real edge isn’t in the cards. It’s in the real estate. Landlord of the StripA few months after I finished my talk at MoneyShow in late 2019, the world fell off a cliff. The Strip went black. Even Times Square and Vatican City went dead quiet. But there’s one company the chaos didn’t touch. While airlines scrambled, hotels boarded up, and restaurants prayed for takeout orders, VICI Properties just kept cashing checks. Here’s what most Vegas visitors never see. Those glitzy casinos are tenants. They rent the land and buildings from VICI. So when Caesar’s Palace or MGM Grand looks packed? VICI’s cash register rings. When the floor is dead? The rent’s still due. That’s the kind of edge you want. During the 2020 panic, VICI didn’t flinch. They collected full rent. They paid out every penny of their dividend, on schedule, without blinking. That’s a clue most folks miss. When outfits scrambled to cut payouts or beg for a bailout, VICI kept humming like a slot machine stuck on jackpot. Why It Works (Even in Bad Times)You might think, "Isn’t gambling the first thing people give up in a recession?" But here’s some Wall Street heresy. People don’t stop gambling when times get tough. They might skip a cruise or pass on a steak dinner. But those neon lights are still a siren song. If anything, tough times feed the need to chase luck. That’s why gambling is one of the sneakiest recession-proof businesses on earth. And the landlords like VICI are always at the top of the food chain. Their business isn’t to hustle at the tables. It’s to collect rent from the hustlers. Check the ScoreboardVICI’s got 93 prime properties. Think Caesars, MGM, Venetian, Mandalay Bay. You couldn’t build a collection like that if you tried. The barrier to entry is spicier than a Vegas blackjack dealer’s attitude. It’s a hard club to join. So the few in it can set the rules. And here’s the kicker... Their tenants can’t move. You ever try picking up the Bellagio and hauling it over to Reno? Didn’t think so. Which is why VICI’s properties are nearly always 100 percent occupied. Better yet, their contracts are written tight. Built-in rent bumps. So when prices go up everywhere else, so does VICI’s payday. What’s It Worth?Dividend? 5.5%. Way better than any Vegas slot. They’ve raised it every single year since 2018. Share price right now? Thirty one bucks. Normal price-to-earnings is around fifteen point seven. Today, you’re grabbing it for just thirteen point nine. And management? These folks aren’t blowing the bankroll on bottle service. They’re solid, sharp, and allergic to drama. You ask me, $31 with that yield is a buy. If you can get it under twenty eight? Even better. I see a ceiling at $35 for now. But smart money catches up fast in this market. Eventually, $40 isn’t out of the question. The House AdvantageThe biggest fortunes in Vegas aren’t made at the craps table. They’re made by owning the floor itself. The story’s not on CNBC. The herd still thinks the game is inside the casino. Don't buy that lie. Watch the landlords. VICI’s a cash cow making money when everyone else is sweating. That’s how you stack real odds in your favor. Trade smart. Until tomorrow, Josh Belanger Disclaimer: Some of the links above are part of paid promotions. If you take action, we may earn a small commission. I only share stuff I believe is worth your attention. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Kamis, 15 Mei 2025

This 5.5% Yield Changed How I See "Gambling"

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar