| In partnership with | | Welcome back! | The Main Story 🔍 | Port Strikes Could Stall The American Supply Chain: Eastern and Gulf coast ports are on strike following the calling of a stoppage from the International Longshoremen's Association. Almost 50,000 dockworkers are involved in this strike - the first in nearly 50 years! This strike hurts transportation of food, autos, and energy products. The weekly impact of a strike would be ~$4.3B of lost imports & exports, and 100bps of GDP growth contribution. | The Maritime association proposed a 50% raise in wages, which was rejected by the Longshoremen who demanded a 77% raise over 6-years, plus commitments to stop all future automation. Longer term, the dock workers are worried about automation taking their jobs, which to be honest might be inevitable. There are worries that regardless of what number they set on, that these increased prices will drive higher product prices that are passed onto the consumer. | President Biden has the power to order a 80-day cooling off period to halt the stoppage, but has indicated he would led the Union negotiate at this time. | Western U.S. ports can take on some capacity over the short-term, but let's hope a resolution is found. | Of course, this strike has given us a supply of The Wire x Port Strike memes… |  | High Yield Harry @HighyieldHarry |  |

| |

Dock Workers realizing AI is going to take their jobs | |  | | | 2:08 PM • Oct 1, 2024 | | | | | | 723 Likes 20 Retweets | 11 Replies |

|

| | More Headlines 🍿 | Here's the latest on Iran attacking Israel. This geopolitical uncertainty has lifted oil prices higher Here's a rundown of Tim Walz and J.D. Vance's relatively respectful Vice Presidential debate Miami Dolphins owner Stephen Ross is in advanced talks with Private Equity firm Ares and billionaire Joe Tsai to sell a 10% and 3% stake respectively in the NFL team and some of his other assets at a valuation of $8.1 billion The Founders of $50B AUM private credit firm Churchill Capital told their story about how getting let go a decade ago from Carlyle led to them creating Churchill. Not bad considering Carlyle has been floundering over the past few years… JP Morgan has chosen their private credit partners: Cliffwater, FS Investments, and Shenkman Capital are among the firms the Banking giant wants to work with. Under the agreement, JPMorgan will originate loans and invest alongside the direct lenders with limited opt-out options. The partnership is the latest in Jamie Dimon's foray into the $1.7T private credit market, as he seeks to reclaim market share and shore up JPM's LevFin business Texas Governor Abbott is hyping up Texas a Finance Hub. With a Texas Stock Exchange coming soon, Governor Abbott is pounding the table and reminding the U.S. that there's more finance workers in Texas than there are in the greater NYC area OpenAI has completed a $6.6B financing round at a $157B valuation (up from $80B nine months ago). Led by Thrive Capital, the round included investments from major tech companies like Microsoft, Nvidia, and Softbank. The company expects $3.7B in sales this year and projects a $5B loss Apollo Global Management has grand ambitions. The asset management titan has set an AUM target of $1.5T by 2029, 2x current levels. Declaring that private markets "will win over banks," Marc Rowan also announced that his firm, with funding costs roughly half the industry average, was intending to raise yearly origination volume to $275B (surpassing JPM's 2023 performance) Samsung is cutting thousands of jobs. Focusing on its operations in Southeast Asia, Australia, and New Zealand, the layoffs are expected to affect approximately 10% of employees in these regions, though the exact impact may vary by country and subsidiary. The move is part of Samsung's broader strategy to reduce operational costs and increase efficiency in response to challenges in key markets, including increased competition in the semiconductor sector Disney is reorganizing their television operations. Merging the scripted drama and comedy teams of ABC and Hulu, the company is laying off 70 employees. ABC Signature will be integrated into 20th Television, marking a major shift in studio structure. The consolidation aims to streamline production processes and reduce costs in response to ever growing dominance of streaming over traditional linear TV Hurricane Helene has devastated Asheville, North Carolina, causing widespread destruction and significant loss of life. The storm's impact has been particularly severe, with flooding and landslides damaging infrastructure, homes, and businesses across the region. Asheville, once considered a potential climate haven, now faces a long and challenging recovery process that could reshape its economy and community. The disaster highlights the increasing vulnerability of all areas to extreme weather events in the face of climate change, challenging previous assumptions about safe locations WeWork's founder Adam Neumann's latest venture WorkFlow is seemingly a WeWork competitor Tom Brady is looking for liquidity. The GOAT is putting up a collection of 27 watches and memorabilia valued around $11M at Sotheby's in December. The seven-time Super Bowl champ's drop comes at a trough in the rare watch and collectibles market and a year after he sold his final game-worn Tampa Bay jersey for $1.4M, below pre-sale estimates as high as $2.5M Charles Schwab's CEO is retiring. Walt Bettinger took the reins in the midst of the GFC. Sixteen years later, client assets have grown from $1.14T to $9.74T, and shares are up 150%. Bettinger attributed his retirement to age (he is turning 65 next year) and will be succeeded by current Schwab president Rick Wurster CVS has been evaluating a large break up of the company. The last year has seen the pharmacy giant's push to transform itself into a diversified healthcare company fall upon the rocks. A disappointing outlook has driven the stock down 20% since January, and the board is in talks with bankers about strategic alternatives — which might mean separating CVS's promising insurance business, Aetna, from its retail chain. Earlier this week, management announced plans to lay off nearly 3000 workers

| | Earnings Corner 📜 | Nike (NKE) reported earnings that beat estimates while missing on revenue. Revenue of $11.59B was down 10% y/y (vs. $11.65B expected), while EPS was $0.70 (vs. $0.52 expected). Mgmt. also withdrew NKE's full year guidance and postponed an upcoming November investment day. These announcements come as CEO John Donahue steps down, with Nike veteran Elliot Hill taking his place, effective Oct. 14. Mgmt. projected Q2 revenue dropping by 8%-10% (vs. 6.9% expected) and gross margins contracting by 1.5%. The stock fell over 6% on Wednesday. | | A Message from Hebbia | | Is your firm solidifying their AI strategy? Hebbia's clients have combined over $4 trillion in AUM. |

Hebbia's Matrix is used by the largest investors in the world.

|

Book a demo today, to see it for yourself.

| | M&A Transactions💭 | The VOWST Business of Seres Therapeutics (NAS: MCRB) was acquired for $525.0M by Nestle Health Science. Houlihan Lokey and Lazard advised on the sale. | Parsec, provider of contract intermodal terminal management services, was acquired for $193.6M by Universal Logistics Holdings (NAS: ULH). Livingstone advised on the sale. | The Nicotine Replacement Therapy Business Outside of the US of Haleon (LON: HLN) was acquired for $660.54M by Dr. Reddy's Laboratories (BOM: 500124). Greenhill & Company advised on the sale. | The Williston Basin Business of Grayson Mill Energy was acquired for $5.0B by Devon Energy (NYS: DVN). Jefferies advised on the sale. | DirecTV, provider of satellite television network and digital television entertainment services, has signed a definitive agreement to be acquired for $7.6B by TPG (NAS: TPG). | Battea Class Action Services, provider of intelligence and claims management services, was acquired for $670.0M by SS&C Technologies (NAS: SSNC). Keefe, Bruyette & Woods and Stifel advised on the sale. | Liquefied Natural-Gas Process Technology and Equipment Business of Air Products and Chemicals (NYS: APD) was acquired for $1.81B by Honeywell (NAS: HON). Lazard advised on the sale. | Vitesco Technologies, an automotive supplier, was acquired for $4.18B by Schaeffler (ETR: SHA). J.P. Morgan and Lazard advised on the sale. | Virgin Money UK (LON: VMUK), a commercial bank, was acquired for $3.83B by Nationwide Building Society (LON: NBS). J.P. Morgan and Goldman Sachs advised on the sale. | TRANZACT, provider of sales and marketing services, has entered into a definitive agreement to be acquired for $632.40M by GTCR and Recognize Partners. Bank of America and Lazard advised on the sale. | Progress, manufacturer of baby food products, has reached a definitive agreement to be acquired for $750.0M by an Undisclosed Investor. | Global Infrastructure Partners, provider of infrastructure asset management services, was acquired for $12.5B by BlackRock (NYS: BLK). Evercore Group advised on the sale. | Clarify Wealth Management, provider of financial planning and wealth management services, was acquired for $450.0M by Credent Wealth Management. | Private Placement Transactions💭 | Newcleo, developer of clean and safe nuclear technology, raised $151.0M of Series A venture funding led by Banca Patrimoni Sella &C., Tosto Group, and Viaro Energy. | Aktis Oncology, developer of a targeted radiopharmaceutical, raised $175.0M of Series B venture funding led by RA Capital Management, RTW Investments, and Janus Henderson Investors. | Kailera Therapeutics, operator of a biopharmaceutical company, raised $400.0M of Series A venture funding led by Bain Capital, Atlas Ventures, and RTW Investments. | Impulse Space, manufacturer of aviation and aerospace components, raised $150.0M of Series B venture funding led by Founders Fund. | | Noteworthy Chart 🧭 | | | Meme Cleanser 😆 |  | 🅿️ @the_P_God |  |

| |

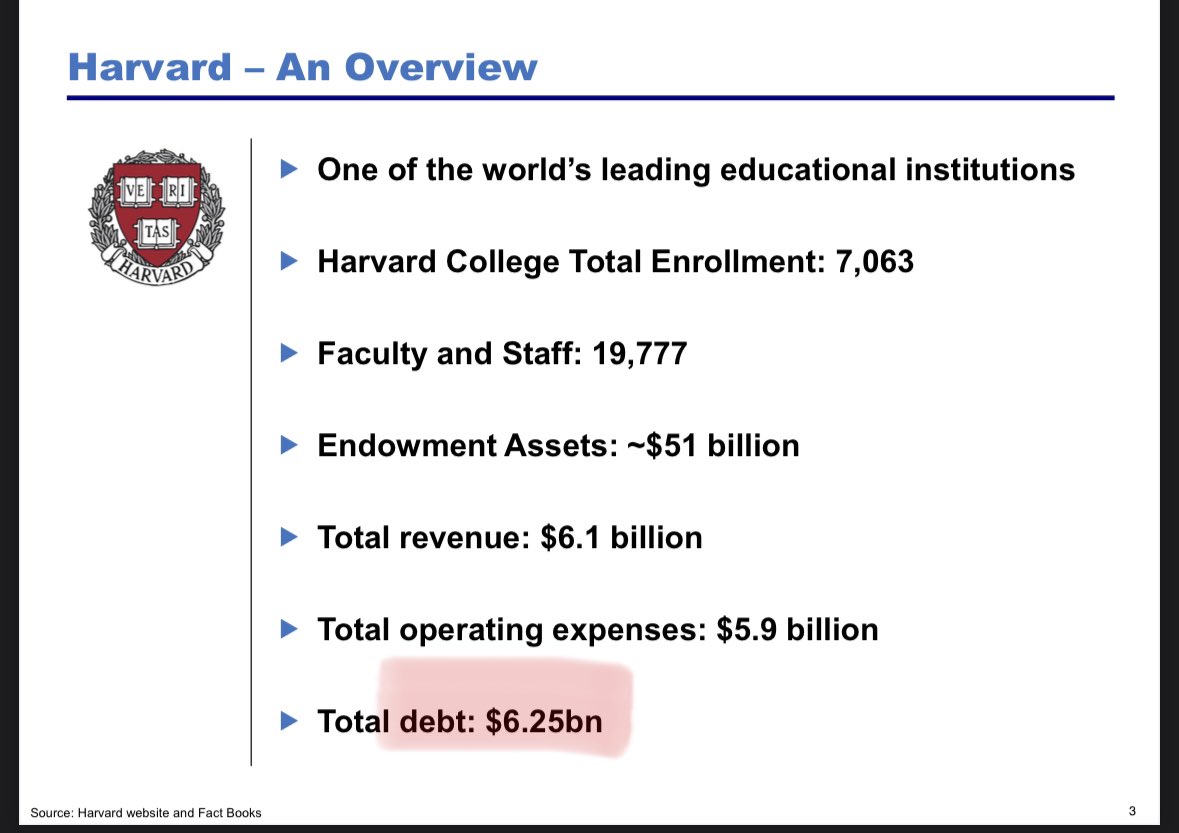

Bill, We expect better out of someone with an Ivy League education. We might as well take a non-target if you're going to make simple formatting mistakes like this on one of the first slides. Please check over your work. This is inexcusable. I expect V2 on my desk. Best,

🅿️ |  Bill Ackman @BillAckman Bill Ackman @BillAckman

Jim Grant asked me to give a talk on "@Harvard Corporation, Buy, Sell or Hold." I complied. The slides: pershingsquarefoundation.org/veritas |

| |  | | | 10:37 PM • Oct 1, 2024 | | | | | | 391 Likes 8 Retweets | 12 Replies |

|

|  | High Yield Harry @HighyieldHarry |  |

| |

MD who spent all his time in the office instead of watching his kids grow up | |  | | | 4:46 PM • Oct 2, 2024 | | | | | | 1.04K Likes 56 Retweets | 7 Replies |

|

|

|

Tidak ada komentar:

Posting Komentar