In partnership with Cognitive Credit | | The Week Ahead Of Us 🔍 | Welcome back! Hopefully you don't have to work tomorrow but a lot of U.S. finance professionals actually do (despite the Holiday) so decided to keep this Sunday night edition. | Here's a look at earnings this week. | Tuesday: United Health, Johnson & Johnson, Goldman Sachs, Bank of America, Citi, State Street, United Airlines Wednesday: Abbott Labs, Prologis, US Bancorp, Kinder Morgan, Crown Castle, Discover, Equifax Thursday: Taiwan Semi, Netflix, Morgan Stanley, Blackstone, Truist, Pool Corp, M&T Bank Friday: Procter & Gamble, American Express, Schlumberger, Regions, Ally Financial

| Here's a look at economic data coming this week. | Thursday: Initial jobless claims, Sept. Retail sales Friday: Sept. Housing Starts and Building Permits, Fed Gov Christopher Waller speaks

| | | A Message from Cognitive Credit | | Over the past few years, we've spoken with senior management at more than 300 global asset managers and hedge funds across Europe and the US.

It's clear that many organizations are still uncertain how emerging technology fits into their traditional credit research process. But, as AI rapidly advances, credit investors who fail to leverage its potential will find themselves struggling to compete with their more agile peers.

Based on those conversations, this white paper spotlights how the credit market is leveraging technology and automation to unlock greater performance. Chapters include: | Credit data operations checklist to benchmark your practices Advantages of implementing a credit data strategy Initial requirements for a successful implementation Examples showcasing current best-in-class

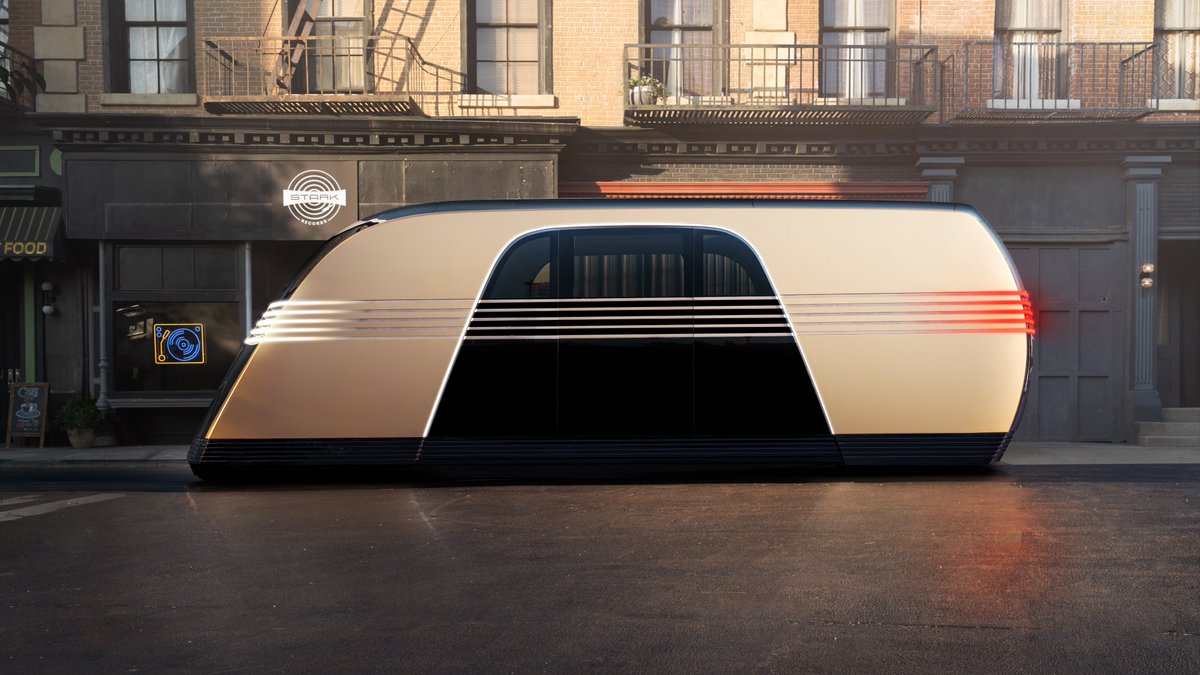

| The Wall Street Rollup subscribers can download their free copy here. | | | The Main Stories 🔍 | The Tesla announcement of Robotaxis and Robobuses is drawing some criticism: Tesla's highly anticipated "We, Robot" event on October 10, 2024, marked the debut of its Cybercab robotaxi, generating both excitement and skepticism in the market. | While the Cybercab isn't expected to be released until 2026, they will cost $30k, but operates at a cost of just $0.20/per mile with goals of reducing the costs to $0.05/per miles. | Secondly, Tesla also announced a Robovan which is supposed to hold up to 20 people and would compete against buses. |  | Tesla @Tesla |  |

| |

Robotaxi & Robovan | |     | | | 3:40 AM • Oct 11, 2024 | | | | | | 66.7K Likes 10.2K Retweets | 2.31K Replies |

|

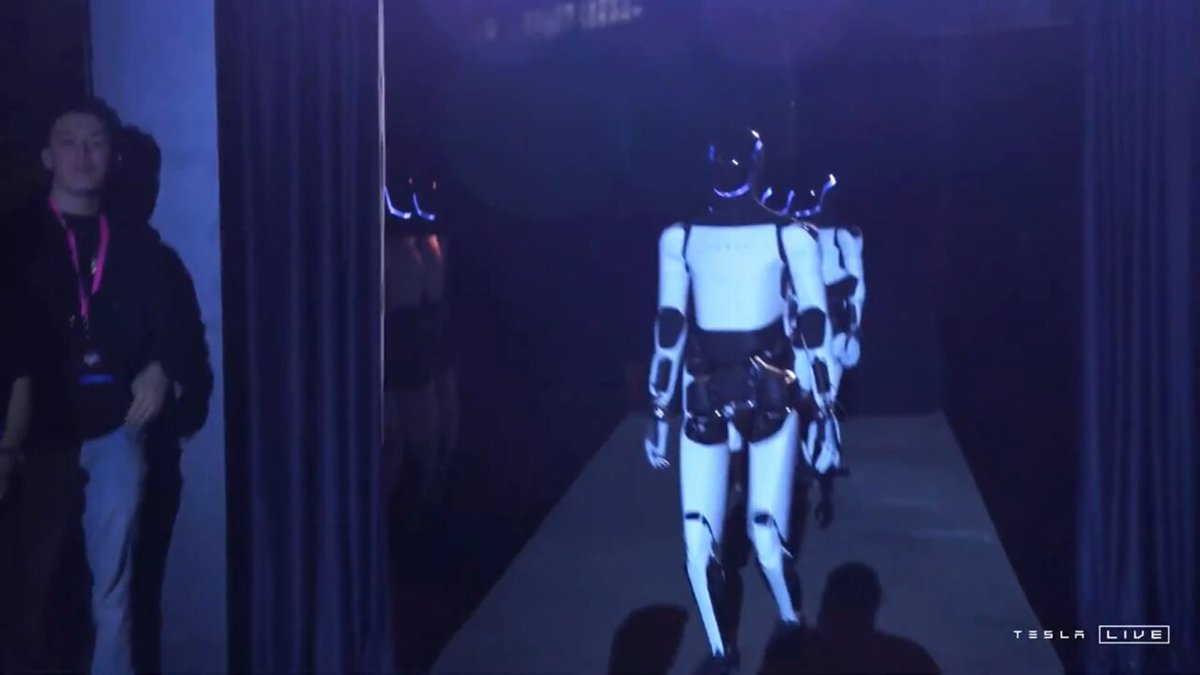

| Lastly, Tesla also revealed a robot helper called Optimus that would cost $20k-$30k and would do tasks such taking out the garbage, cleaning your dishes, mowing your lawn, and watching your kids. |  | Elon Musk @elonmusk |  |

| |

| |  | | | 5:37 AM • Oct 11, 2024 | | | | | | 659K Likes 85.5K Retweets | 33.7K Replies |

|

| Despite these bold claims, the presentation left some investors and analysts underwhelmed due to the lack of specific timelines for deployment and technical details. Tesla's stock dropped in premarket trading following the event, as investors sought more clarity on the robotaxi's commercial rollout and its potential impact on the company's financials. Tesla's approach, which relies on AI and cameras rather than Lidar, raised concerns regarding both technical feasibility and regulatory hurdles, with some questioning whether fully autonomous robotaxis and robovans could become a reality by 2027 as Musk projected. | Secondly, it was rivals that got the last laugh on Friday. Uber shares ended Friday up 10.8% and Lyft shares ended Friday up 9.6%. So Uber and Lyft were perceived as winners due to the lackluster showing and since both companies are evaluating self-driving tech as well. In this YouTube video, CNBC makes the cause that Google's Waymo will actually be the self-driving car winner as well. | However, we won't underestimate Elon and Tesla off of one-day noise (especially given the Starship launch earlier today) - as doubting Tesla backfired for everyone who doubted them in 2019….but the Company has historically been overambitious in its robotaxi goals. | Moody's found out which Private Equity firms are dealing with the most distressed assets: Moody's put out a report last week declaring that private-equity backed companies default at twice the rate that non-sponsor backed companies do. This isn't really a surprise given the high leverage profile of this companies, but the more interesting takeaway was what firms are seeing the most distress in their portfolios. | Platinum Equity, Clearlake Capital, and Apollo are among the firms with the most portfolio companies in distress. This was measuring which firms had portfolio companies that had defaulted or gone through out-of-court restructurings (like a Liability Management Exchange). | | The notable takeaway seems to be that these businesses just had too much leverage on them and weren't the best underwrites/the best businesses. Poor underwriting when buying an asset, coupled with the high leverage profile relative to real Enterprise Value is creating some large stains on some notable private equity firms. | | More Headlines 🍿 | |  | Elon Musk @elonmusk |  |

| |

Starship rocket booster caught by tower | |  | | | 2:10 PM • Oct 13, 2024 | | | | | | 275K Likes 33.6K Retweets | 11.4K Replies |

|

| Stocks on Friday hit news records with the S&P gaining 0.61%, the Dow rallying 409.74 points, and Nasdaq closing just 2% shy of its all-time high. All three have registered a fifth straight week of gains as momentum has built outside the market. Led by the likes of JPMorgan Chase and Wells Fargo, both posting better-than-expected profit and revenue numbers, Q3 earning season is off to a strong start just as slower inflation data has boosted investor optimism that the Fed will navigate towards a soft landing President Biden announced that Hurricane Milton has caused an estimated $50 billion in damages, devastating Florida with tornadoes and severe flooding. The storm left over 3 million people without power, although restoration efforts have already reconnected about 1 million homes and businesses TD Bank has pleaded guilty to federal money laundering charges and agreed to pay nearly $3.1 billion in penalties for facilitating criminal activities over a decade. The bank admitted to having inadequate anti-money laundering controls, which allowed drug traffickers and other criminals to easily open accounts and move funds through its system. As part of the settlement, TD Bank faces restrictions on its ability to grow its U.S. retail banking business and must implement significant reforms to its compliance programs. This case represents the largest penalty ever imposed on a bank for violating anti-money laundering laws in the United States Berkshire cut its stake in Bank of America to below 10%. His divestiture means Berkshire is no longer required to report its transactions related to the bank, as ownership below 10% exempts them from such disclosures. Despite these sales, Berkshire remains the largest institutional investor in Bank of America, which has seen a slight stock increase recently. Buffett's actions reflect a broader trend of selling off significant banking investments amid concerns about the stability of the banking sector Halloween spending in the US is projected to decline by 5% to $11.6 billion this year, according to the National Retail Federation, posing a significant challenge for struggling retailers.This decrease in consumer spending is particularly concerning for merchants who rely heavily on seasonal sales boosts, especially in an already difficult year for the retail industry. This downward trend in Halloween consumption adds to the existing pressures on heavily-indebted retailers, who are already grappling with rising overheads and consumers' shift towards more affordable products The Founders of HPS would reap billions in a sale. The news comes after word spread the private credit firm is considering an IPO valuing the company at $10B+. Several suitors, including BlackRock Inc., Abu Dhabi-based asset manager Lunate, and private equity firm CVC Capital Partners are exploring investment or acquisition opportunities potentially sparking a bidding war With the strike ongoing, Boeing has made significant layoffs - cutting 10% of its workforce, or 17k employees. After struggles have persisted for nearly a month now between the company and the machinist's union, executives announced they will delay launch of new 777X wide-body planes until next year Former President Trump says he would make your car payments tax-deductible. This is another working class friendly policy after his initial proposal to make tips tax free. The announcement came at rally in Michigan, a crucial swing state, and aimed to appeal to auto workers and union members a key demographic in the coming election. Trump's paired his promises with intense criticism of President Biden's electric vehicle mandates and other clean energy initiatives China is taking steps to support its struggling property sector by allowing local governments to issue bonds for purchasing unsold homes. Finance Minister Lan Fo'an announced that special local government bonds and other tools will be used to aid the real estate industry.The central government plans to expand spending and provide assistance to alleviate local government debt burdens. This initiative includes offering a significant one-time quota for local governments to swap their high-interest debt with lower-interest bonds, aiming to stabilize the economy and property market The FDA has agreed to reconsider a September decision to prohibit competitors of Eli Lilly from selling their own versions of wildly successful weight loss and diabetes drugs. A new lawsuit has prompted the agency's to allow compounding pharmacies to continue selling drugs (often cheaper than name brand versions) while it determines whether there is a shortage (in which case, a ban would cease) A recent report predicts Elon Musk will become the world's first trillionare by 2027. The news comes amidst a wave of data revealing that the stock market boom has super-charged America's wealth inequality: as of this year, the richest 1% of Americans owned nearly 50% of all U.S. stocks, while the bottom 50% of Americans hold about 1% of all stocks The National Security Agency (NSA) is conducting an investigation into potential Chinese hacking of American telecommunications companies. NSA Director General Timothy Haugh stated that the investigation is in its early stages and involves collaboration with other government agencies and some private companies. Microsoft has warned that at a group dubbed Salt Typhoon may have been inside US telecoms for months Apax Partners, an $80B AUM private equity firm, has decided to stop making new investments in healthcare assets due to a perceived lack of opportunities in the sector. As a result of this strategic shift, the firm is disbanding its dedicated healthcare team. Most members of the health care team will be reassigned to other roles across the company's offices in NY, London, Hong Kong, Tel Aviv, and elsewhere

| | Earnings Corner 📜 | JPMorgan Chase (JPM) reported earnings that beat estimates, with revenue of $43.32B up 6% y/y (vs. $41.63B expected) and EPS of $4.37 (vs. $4.01 expected). The bank beat expectations for net interest income, investment banking fees, and trading revenue, and raised its FY net interest income guidance to $92.5B (vs. $91B previously). The stock was up 4.4% at Friday's close. | Wells Fargo (WFC) reported earnings that beat estimates, with revenue of $20.37B down 2.3% y/y (vs. $20.42B previously) and EPS of $1.52 (vs. $1.28 expected). Mgmt. noted that net interest income fell 11% versus last year, due to more customers utilizing high yield deposit products, but also emphasized the bank's offsetting increase in fee-based revenue. The stock was up 5.6% at Friday's close. | BlackRock (BLK) reported earnings that beat estimates, with revenue of $5.2B up 14.9% y/y (vs. $5.02B expected) and EPS of $11.46 (vs. $10.38 expected). Mgmt. noted that the period saw AUM grow $2.4T to a new high of $11.5T, which was largely responsible for the revenue outperformance . The stock was up 3.6% at Friday's close, hitting another all-time high. | Delta Air Lines (DAL) reported earnings that missed estimates, with revenue of $14.59B up 1.2% y/y (vs. $14.67B expected) and EPS of $1.50 (vs. $1.53 expected). Mgmt. noted that July's CrowdStrike outage cost the company $380MM in revenue and $0.45 in adjusted earnings, while also releasing a disappointing Q4 sales growth outlook. The stock fell on the announcement but was up 2% at Friday's close. | Domino's Pizza (DPZ) reported earnings that beat estimates, with EPS of $4.18 (vs. $3.64 expected) driving the stock up 5% at Friday's close. | | | M&A Transactions💭 | Cheney Brothers, distributor of food and grocery products, was acquired for $2.1B by Performance Food Group (NYS: PFGC). Morgan Stanley advised on the sale. | Environmental Solutions Group, provider of collection vehicles, waste compaction systems, and automation solutions, was acquired for $2.0B by Terex (NYS: TEX). Centerview Partners advised on the sale. | Nevada Copper, a mining company, was acquired for $128.0M by Kinterra Capital. Moelis & Company advised on the sale. | Ascential PLC, engaged in providing specialist information, was acquired for $1.59B by Informa (LON: INF). Morgan Stanley, Bank of America, and Goldman Sachs advised on the sale. | Home Federal Savings Bank, a stock savings bank holding company, has reached a definitive agreement to be acquired for $116.4M by Alerus Financial (NAS: ALRS). D.A. Davidson Companies advised on the sale. | The UK Municipal Business pf Renewi (LON: RWI) was acquired for $165.28M by Biffa. Greenhill & Company advised on the sale. | NCAB Group (STO: NCAB) acquired The PCB Division of DVS Global for $200.0M. | Ten Nine Communications, provider of human capital services, was acquired for $1.67B by IFIS Japan (TKS: 7833). | Ohlins Racing, manufacturer of suspension products, has reached a definitive agreement to be acquired for $405.0M by Brembo (MIL: BRE). | Heubach, manufacturer of pigment preparation, has reached a definitive agreement to be acquired for $141.32M by Sudarshan Chemical Industries (BOM: 506655). | Chuy's Holdings, a restaurant concept, was acquired for $605M by Darden Restaurants (NYS: DRI). Piper Sandler advised on the sale. | Private Placement Transactions💭 | Nelly, developer of signature and billing tool, raised $110.9M of venture funding led by United Volksbank eG Dorsten-Kirchhellen-Bottrop. | Nalu Medical, developer of neuro-stimulation devices, raised $115.06M of Series E venture funding led by Novo Holdings at a pre-money valuation of $260.0M. | Form Energy, developer of an energy storage system, raised $405.0M of Series F venture funding led by T. Rowe Price Group. | CytoVale, developer of biophysical markers, raised $100.0M of Series D venture funding led by Sands Capital. | | Noteworthy Chart 🧭 | Looks like you can out pizza the hut…. | | | Meme Cleanser 😆 |  | High Yield Harry @HighyieldHarry |  |

| |

Albert Einstein building the first ever Adjusted EBITDA bridge | |  | | | 2:39 PM • Oct 12, 2024 | | | | | | 899 Likes 44 Retweets | 11 Replies |

|

|  | sophie @netcapgirl |  |

| |

building in something other than AI in 2024 | |  | | | 8:10 PM • Oct 8, 2024 | | | | | | 744 Likes 38 Retweets | 35 Replies |

|

|

|

Tidak ada komentar:

Posting Komentar