Editor’s note: After OPEC+ agreed to deeper oil production cuts yesterday, we wanted to highlight a recent story from Adam about the best ways to track oil’s next bullish run. We’ve updated the Green Zone Power Ratings for the stocks below, so check it out!

Of course, if you’re ready to follow his guidance with his No. 1 U.S. oil stock as we head into 2024, click here to see how. | Crude oil last reached an all-time high of $147 per barrel in the Summer of 2008 — just months before the global economy unraveled.

Now, in 2023, the World Bank is warning that oil could surge even higher if the conflict in the Middle East escalates into full-blown war. Its economic assessment breaks down three possible scenarios for the Middle East’s impact on oil prices heading into 2024: - Small Disruption: Even a limited-scale conflict (like we’re already seeing) could reduce oil production by up to 2 million barrels per day, driving oil prices to $93 to $102 per barrel.

- Medium Disruption: On par with the Iraq War in 2003, this would drive oil prices as high as $121 per barrel.

- Large Disruption: A multilateral conflict like the Yom Kippur War of 1973 could derail production and drive oil prices up to $140 to $157 per barrel.

So even if the situation in the Middle East doesn’t escalate further, we could still see a substantial run-up in the price of oil over the next year.

And this massive global disruption is part of the reason why we’re seeing the start of a new merger mania among the world’s biggest energy companies.

Recently, Chevron bought Hess for $53 billion in stock. And just two weeks before that, ExxonMobil announced that it would be acquiring Pioneer Resources for $60 billion.

These deals are also happening because oil companies’ stocks are now greatly undervalued after years of ESG talk and green energy initiatives, which led to investors’ shunning of them.

So instead of spending years building a stake in North Dakota’s Bakken Formation, or in Guyana’s offshore oil fields, Chevron can affordably add those operations (and its earnings) to the business overnight.

Which leaves us to wonder — if Big Oil is pouring tens of billions into the industry … should you be investing too?

| Oil is in high demand, but the supply is low and under threat. Putin could cut crude-output at any time. And Arab nations can place more oil embargos on America over our support of Israel. This oil shortage has created a new bull market in energy. Which Adam O’Dell’s research shows could grow into $10 trillion market over the next 10 years. Starting with this tiny oil stock with the potential to surge by January 31, 2024. Click here to see all the details. |

Winning the “Energy War” As I’ve said in the past, the ongoing “energy war” between fossil fuels and green energy will have a surprise winner: YOU, the investors.

Because it’s going to be decades before we find out whether renewables can truly replace Big Oil. In the meantime, investors are going to see a wave of lucrative opportunities from both sides of the energy war.

The green energy industry is growing at rates that far exceed both economic growth and growth within the fossil fuels industries.

Identifying the best early movers in the green space isn’t easy, but can be highly rewarding when you get in on the ground floor of just a few of them.

Meanwhile, and just as importantly, oil and gas companies are raking in gobs and gobs of free cash flow today.

The best oil and gas companies have lean and mean cost structures … so every extra dollar they get selling oil and gas on the open market falls directly to their bottom line … and then to shareholders in the form of dividends, buybacks and capital gains.

And with these massive new acquisitions for Chevron and ExxonMobil, the biggest oil and gas companies are massively increasing their production — which results in even more cash flowing back to investors.

But for every outstanding new energy investment, there are bound to be a boatload of duds. Fortunately, we can use Green Zone Power Ratings to quickly tell one from the other. Breaking Down Big Oil Our proprietary Green Zone Power Ratings system uses a combination of technical and fundamental analysis to give every stock a rating from 0 to 100.

It’s a simple but extremely powerful tool. And it’s the first thing I look at every time I’m evaluating a stock.

For example, let’s take a look at Hess.

As far as Chevron is concerned, Hess is worth every penny of its $53 billion buyout. Guyana is set to become the world’s fourth-largest oil exporter, offering some much-needed diversification at a time when European oil markets are in upheaval.

Hess’ shale assets are icing on the cake, giving Chevron the chance for a massive payday when oil prices spike again.

That’s all great news for Chevron. But as far as retail investors are concerned, Hess’ stock is still in the doghouse:  (Click here to view larger image.) Hess sports Green Zone Power Ratings of just 50.

Hess is especially hindered by its massive size and poor value compared to competitors. None of these factors are really an issue for Chevron. But since investors are only buying a few shares (and not the whole company), it’s worth considering.

The same is true on the other side of these mega acquisitions as well.

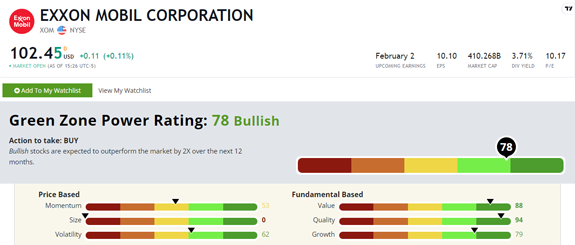

ExxonMobil’s Green Zone Power Ratings are much higher at 78 out of 100:  (Click here to view larger image.) It rates much higher than Hess on most factors, especially Value and Quality. But due to its dominance in the industry, it rates a 0 out of 100 on Size.

(Editor’s Note: You can check the Green Zone Power Ratings for any stock by visiting www.MoneyandMarkets.com and typing the ticker symbol or company name into the search bar.)

A 78 out of 100 is still set for “Bullish” outperformance, so ExxonMobil is a good investment at these prices.

But if we dig a little deeper, and look past the headlines, we start seeing even bigger opportunities among smaller energy stocks…

| Most people don’t know this…

But sixty percent of the energy that’s generated each year in America is wasted.

That’s right — sixty percent!

Yet a tiny Silicon Valley company has just discovered how to use AI to tap this trillion-dollar treasure trove of wasted energy … and turn it into power we can use…

Meaning this company’s growth could be almost unimaginable…

To watch this video for free, click here. |

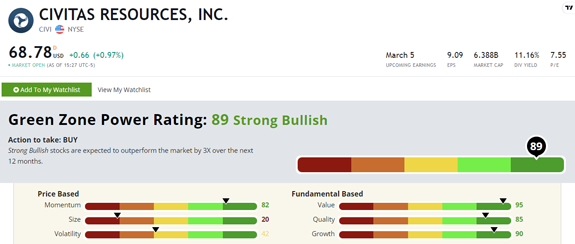

Smaller Stocks = BIGGER Returns At $7 billion in market capitalization, Civitas Resources (NYSE: CIVI) is practically microscopic compared to Big Oil.

But as far as investors are concerned, it’s far more promising — with Green Zone Power Ratings of 89 out of 100:  (Click here to view larger image.) Civitas has already completed its own round of acquisitions, including a relatively large $2.1 billion takeover of Vencer Energy’s Midland Basin assets. As a result, the company is on track to produce 335,000 barrels of oil (equivalent) per day in 2024.

Even if prices stay steady at around $70 per barrel, Civitas will produce $1.5 billion in free cash flow this year alone. You can expect that to come back to shareholders in the form of a $7 per share dividend.

This is the kind of stock that could make your year as an investor. But you’d never find it unless you take a systematic approach to the market using something like Green Zone Power Ratings.

I originally recommended Civitas to my Green Zone Fortunes readers back in March of 2021.

Since then, we’ve locked in a 100% gain on half the position and are sitting on open gains of 145% on the other half.

Civitas is currently a hold at today’s price, but it’s also a great example of what happens when you look past the headlines and zero in on the real mispricing in today’s energy markets.

For more on the market’s best energy investing opportunities, I recommend taking a look at my newest oil summit, where I shared the details on how to access my No. 1 oil stock as we head into 2024.

Adam O'Dell

Chief Investment Strategist, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar