| Chile is known for its narrow geographical shape — it’s about 2,700 miles long running down the western coast of South America, but only averages 110 miles wide.

And this slim strip of land is fertile ground if you’re a miner.

The country has made headlines for being the second-largest supplier of lithium in the world behind Australia.

Because of its vast mining industry, the country needs massive amounts of electricity.

Energy consumption of the world’s mining industry is equal to the energy consumption of Australia, Mexico, South Korea, Italy and Canada … combined!

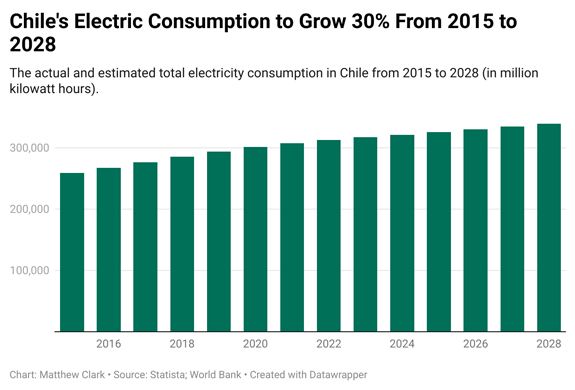

And Chile’s demand continues to grow:  (Click here to view larger image.) World Bank expects electricity consumption in Chile will expand by 30% from 2015 to 2028.

One of the biggest distributors of electricity in the country is Enel Chile SA (NYSE: ENIC).

The smaller company — with a market cap just south of $4 billion — serves more than 10% of the entire population of the country.

What’s even more impressive is the company is building out solar, wind, hydroelectric and geothermal energy production with the intent of creating an 80% renewable generation matrix by next year.

So it works both sides of the energy equation — old, dirty energy and new, clean energy — that Adam has talked about before.

Now let’s see why ENIC is a solid stock priced under $5 using our proprietary system. Why ENIC? Over the last few weeks, my friend and colleague (as well as Money & Markets’ Chief Investment Strategist) Adam O’Dell pulled together an impressive list of stocks.

They all had one thing in common: Each stock was priced under $5 per share.

Using our proprietary Stock Power Ratings system, he’s eliminated those considered “High-Risk,” “Bearish” and even “Neutral” stocks to isolate the best of the best.

Adam just unveiled a small selection of tickers from that list. These are the stocks he believes have the best chance to secure 500% gains or more over the next year. Click here if you want information on how to access that list.

But there were still plenty of companies that didn’t make the final cut that are still solid investments, according to Stock Power Ratings.

ENIC is one of them. Here’s why…

| From our Partners at Banyan Hill Publishing. A year ago, Biden’s Executive Order 14067 set in motion a government plot so potentially explosive — it could destroy our American way of life forever.

Six months ago, Ian King revealed the details of this plot — called “Project Hamilton.”

Project Hamilton’s “official” research ended this past December — but its impact will soon affect every man, woman and child in America for generations to come.

But now, we’re just three months away from what could be the greatest financial upheaval in our history ... as the U.S. government and the Federal Reserve take what Ian believes is the first step toward launching a program that will “fundamentally change the structure of America’s entire financial system.”

See Ian King’s breakthrough research here — before it’s too late. |

ENIC’s Strong Stock Power Ratings Our Stock Power Ratings system rates more than 6,000 stocks on a scale from 0 (High-Risk) to 100 (Strong Bullish).

We use six different factors to determine that rating: momentum, size, volatility, value, quality and growth.

Those six factors come together to create one overall rating.

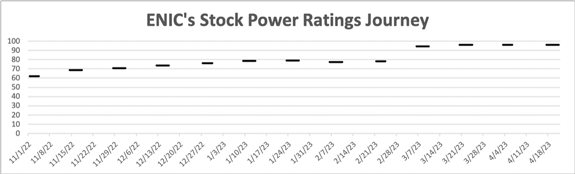

Every stock has its own journey on our system. Some start high and move lower and vice-versa.

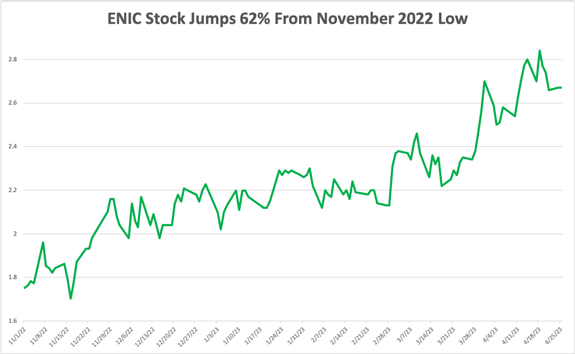

Here is ENIC’s stock price and ratings journey:  (Click here to view larger image.)  (Click here to view larger image.) ENIC rated “Bearish” for much of last year, but steady gains throughout the latter half of 2022 pushed it into “Bullish” territory in November.

It gained 62% from November to its 52-week high in mid-April.

That’s a tidy gain in a short amount of time for a stock priced under $5 a share.

And the beauty is the rating has only gone up since then … it currently rates a “Strong Bullish” 97 out of 100.

That means it’s set to beat the broader market by 3X in the next 12 to 24 months.

This is why it pays to use our Stock Power Ratings system. If you would have bought ENIC when it moved into “Bullish” territory, you’d be sitting on nice gains … with the opportunity for even more ahead.

Pro tip: ENIC has great potential based on our Stock Power Ratings system, but Adam has a handful of stocks he believes have the best chance to gain 500% over the next year.

If you haven’t already, I invite you to check out his research on the absolute best stocks priced under $5 per share.

Like ENIC, these are stocks the Big Money on Wall Street can’t touch (yet) … but you and I can, meaning we can capitalize on the potential for massive gains.

Make sure to look at Adam’s research here and learn more.

And remember … this might be the only time I ever talk about ENIC, but by joining Adam’s 10X Stocks, you’re also gaining access to Adam’s guidance on these positions, including the best times to buy more shares — or sell for a tidy profit. Stay Tuned: How Momentum Creates Market-Crushing Opportunities Tomorrow, Adam is going to walk you through the momentum factor of his proprietary system and show you how it leads to incredible gains in the stock market.

Until then…

Safe trading,

Matt Clark, CMSA®

Chief Research Analyst, Money & Markets

Check Out More From Stock Power Daily: |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar