You are receiving this email because you signed up to receive our free e-letter the Wealth Whisperer

Anyone with half a brain knows debt is both a financial and moral obligation.

Yet, Washington stacks onto the debt snowball as it rolls downhill. That snowball will eventually obliterate anything in its path.

Unfortunately, we've crossed the Rubicon to a place where a default is inevitable.

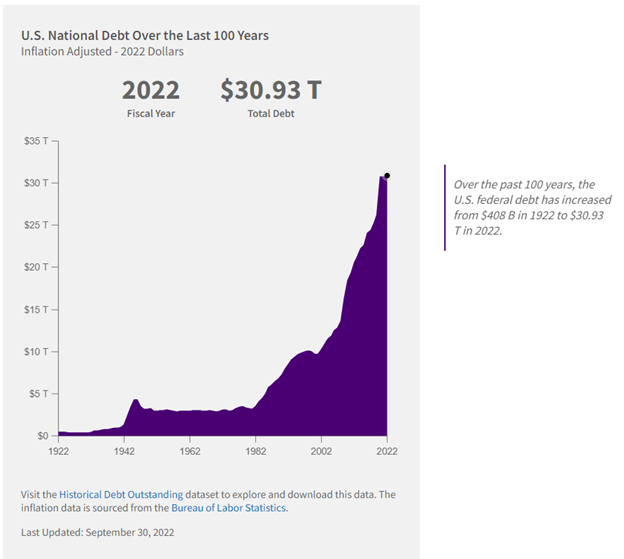

Our national debt has grown at an exponential, not linear, rate.

Source: Treasury.Gov

The worst part is everyone pretends as if we cannot put our fiscal house in order.

Yet, let's throw some history at you to put things in perspective: - Between 1796 and 1811, our nation ran 14 budget surpluses and two deficits.

- The War of 1812 sharply increased our debt. Yet, we followed that war with budget surpluses during 18 out of the next 20 years.

- On January 8, 1835, President Andrew Jackson paid off the entire debt.

- Budget controls in the 1990s helped the United States deliver budget surpluses by the end of the decade. Those surpluses were subsequently squandered in a multi-decade war and a Wall Street bailout.

The problem is that people have to contend with idiotic ideology at a historic level. - Modern Monetary Theorists pretend our national debt isn't real like unicorns or that hole-in-one your buddy claims he got even though he's a total hack.

- Liberals perform mental jumping jacks to convince themselves and their Tik Tok followers that businesses are the enemy and would be better off owned "collectively" by the employees.

- Politicians, who used to have a backbone, throw their hands up in the air and play the victim card, rather than have the tough conversations that could make them look bad.

So… yeah… default isn't just likely, it's inevitable. | | | SPONSORED CONTENT Why This Crypto Bear Just Turned Bullish... You might be surprised to learn that, after years as a crypto skeptic, investment expert Nilus Mattive now says THIS could be the very best time to start buying certain cryptos. And not just Bitcoin or Ethereum, either!

Click here now to watch this shocking interview. | | | That doesn't mean that we, as individual investors, are stuck with the same fate.

You see, our economy ebbs and flows, with expansions, recessions and even depressions, none of which you or I have any control over.

Trying to keep track of a portfolio containing a couple dozen stocks can be a challenge when markets are calm, let alone when they hit the skids.

But what if you could handily outperform the market with a well-crafted portfolio of just three stocks?

Yes, that flies in the face of all the financial wisdom pumped out of our universities… you know, the ones that cry whenever some speaker offends their delicate sensibilities…

Here's the thing…

Jim Woods put together what he calls "The Perfect Portfolio" comprised of just three stocks.

And we kid you not, this simple portfolio has not lost during major market crashes AND has outperformed the S&P 500 by nearly 15x.

Now, you might assume that it's three high-volatility tickers that have been cherry-picked to get these results.

Yet, Jim isn't one to throw his money on a random roulette number.

He relies on decades of experience that helped him craft this portfolio out of low-volatility stocks.

You see, most people assume that volatility and payout are proportional. However, that's not entirely accurate.

The trick isn't to simply bet more on more volatile stocks.

You want to make more per dollar of risk. | | | URGENT WARNING: Millions of Retirements Are At Risk Congress is spurring on the most dangerous retirement threat of the last 50 years. America's top retirement researcher reveals the deadly truth behind this government move…

Plus the ONLY way to fully protect your wealth in the coming months.

Click Here for the Full Story. | | | Think of it this way…

Imagine you have two stocks to choose from: - Stock A averages 7% gains per year with maximum draw-downs of 10%.

- Stock B averages 30% gains per year with maximum draw-downs of 50%.

Assume we use draw-downs as a measure of risk.

Simple math says if we bought 5x our typical amount of stock in stock A, we'd achieve similar draw-downs to stock B, yet achieve 35% in average gains.

Conversely, we could buy 20% of our typical position size in stock B and achieve the same results.

Here's the crazy part…

More often than not, those seemingly lower volatility strategies yield MUCH BETTER returns per dollar of risk.

That sounds hard to believe when we see stocks like Tesla shoot to the moon.

However, that's more the exception than the rule, because if you look at the Russell 2000 Small Cap Index and compare it to the S&P 500 Large Cap Index, since 1988, small-cap stocks have underperformed their larger brethren.

Source: Tradingview | | | Defy Volatility Using Artificial Intelligence Have you ever heard if you are having issues in your trading, it could be that it's not you - it really is the market?

Well, you're in control. You can anticipate massive trend reversals with A.I.

You've got to see it live to understand it.

Save a Seat for this Free Live Training > | | | So, not only do small-cap stocks not outperform per dollar of risk, since small caps are more volatile, they don't outperform, period.

Hopefully you're starting to see the theme here.

But you're probably wondering how do you come up with the RIGHT three stocks?

After all, if you picked IBM or Intel 20 years ago, you'd have lost your money to inflation. And if, heaven forbid, you bought Nokia, you'd have been screwed.

That's why we're asking for five minutes of your time to read through Jim's captivating article, which explains exactly how he selects his three portfolio pillars.

CLICK HERE TO LEARN MORE ABOUT JIM WOODS' PERFECT PORTFOLIO! | | To Your Wealth,

The Wealth Whisperer Team | | | |

Link

Link

Tidak ada komentar:

Posting Komentar