A Small-Cap Wrap Sick of hearing about small caps in Stock Power Daily?

Well … too bad, cause we’re not sick of talking about them!

There’s a good reason we’re laser-focused on small caps right now.

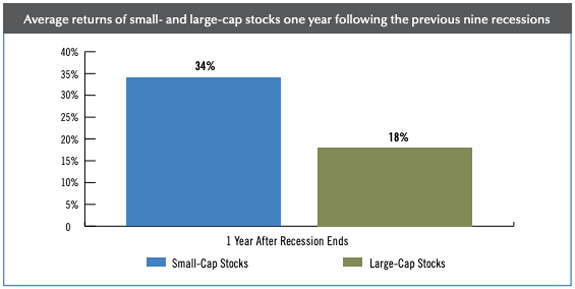

Simply put: Investing in small caps has historically crushed investing in larger companies when coming out of a recession. This chart from Prudential shows that:  I can’t tell you if we’re in a recession right now (or soon will be), but all signs point to a stint of economic weakness ahead: - U.S. gross domestic product for the first quarter came in at 1.1%, well below the 2% expectation.

- Layoffs are dominating headlines. Major companies such as Walmart, McDonald’s, Lyft, Dropbox, 3M and more announced a wave of additional job cuts this month.

- Inflation is still high and the Federal Reserve does not expect to lower interest rates as it continues its fight to lower prices. More than 80% of economists polled by the CMEGroup expect the Fed to even hike rates by another 25 basis points during this week’s meeting.

But even in the face of all this … certain stocks are set to rip higher. And even sooner than you might expect.

Those stocks are small caps, and we can’t stop talking about them because we don’t want you to miss the boat.

Of course, you can’t just buy any old small cap. Only the best of the best will provide the bulk of the returns.

So if you want to see the handful of high-quality small-cap stocks Chief Investment Strategist Adam O’Dell targeted in his “$5 Stock Summit,” click here.

He’s spent the last few weeks screening almost 300 tickers to land on his highest-conviction stocks — the ones that he believes could gain 500% or more over the next year. Watch his presentation to see why these stocks made the cut.

And to catch up on our coverage from the last week, keep scrolling…

| This is the same kind of opportunity Chief Investment Strategist, Adam O’Dell wants to offer you a shot at right now. Because just like how Terns traded below $5, before soaring… Adam believes his favorite $5 stock right now, could surge as much as 500% this year. Click here to see all the details. |

Follow any of the links below to read or reread our Stock Power Daily insights: I hope you have a great week ahead.

Matt will be back tomorrow with analysis of one $5 stock that didn’t make Adam’s final cut … but is still a “Bullish” buy.

Until next time,

Chad Stone

Managing Editor, Money & Markets |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2023 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | |

Tidak ada komentar:

Posting Komentar