| The price of gasoline and groceries is near all-time highs. I don’t need to remind you of that.

But you know what else is sitting at all-time highs?

Dividends.

S&P 500 companies paid $140.6 billion in dividends last quarter. For perspective, the figure was $123.4 billion for the same quarter last year.

That’s 14% growth in dividend payouts over the past year — nearly double the rate of inflation!

Again, this isn’t some cherry-picked collection of high-dividend growers. This is the S&P 500, aka “the market.”

Howard Silverblatt, Standard & Poor’s senior index analyst, expects dividend growth in the S&P 500 to be up about 10% for the full-year 2022.

But we need to remember that dividend hikes are never guaranteed.

That’s why my two keys to dividend investing are critical right now. Suggested Stories: SECURE Act 2.0: How the Gov’t Wants Better for Your Retirement

Beat the Bear With 3 Tools: Dividends, Dividends and Dividends

| The number of Nasdaq stocks down 50% or more has now hit a near record. And on July 19, it could get worse – much worse. At 4:00pm ET that day, one of America's most beloved firms will make an announcement that could send it plummeting. And take down hundreds of other stocks with it. | |

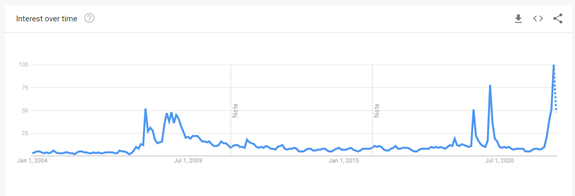

Chart of the Day Recessions seem easy for consumers to understand.

Ronald Reagan explained the concept when he ran for president in 1980: "Recession is when your neighbor loses his job. Depression is when you lose yours."

Unemployment is low at 3.6%. But for consumers, it feels like a recession.

Many of us know someone who lost a job. Others are now insecure about their own positions. It feels like unemployment should be higher.

Today’s chart shows that’s just the start of the story.

Suggested Stories: 3 Reasons the Recession Hasn't Started — What It Means for the Future Small Logistics Co. Keeps Shelves Stocked (20% Industry Growth Ahead!)

| As the world suffers an oil shock… And gas prices rip higher…

One tiny company could have the answer to the global energy crisis. It’s using AI to crack open the largest untapped energy source on the planet… 5X larger than the biggest oil field on Earth.

| |

|

1985: Live Aid, the benefit concert to raise money for famine relief in Ethiopia, took place simultaneously in Wembley Stadium in London and JFK Stadium in Philadelphia. The televised event pulled in 1.5 billion viewers worldwide, while raising millions of dollars for relief. The band Queen’s iconic performance rocked the audience. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | |

Tidak ada komentar:

Posting Komentar