| When we started our Stock Power Daily email, the mission was simple: Find opportunities to profit, no matter what the market was doing. In the first three months, we’ve found several solid stocks — even amid the broader market sell-off. Every weekday morning, I send out one stock that rates “Strong Bullish” or “Bullish” according to our Stock Power Ratings system. (Check out the archive here.) And these recent selections look like maximum momentum plays as market volatility continues. Let's check out four of June's top performers.

P.S. Get ready for a bonus company in tomorrow’s episode of The Stock Power Podcast. You’ll find all the details in Saturday’s Money & Markets Daily, or subscribe wherever you listen to podcasts to hear my insights right when the podcast releases. (Click here to subscribe and watch it on YouTube!) Suggested Stories: Buy an IOU? Bond Investing Guide + Our Top Low-Vol Alternative Citigroup Aces the Fed's Stress Test — That's Good News for Dividend Growth

| Stocks are crashing around the world, and the head of the world's biggest asset manager (BlackRock) says the next 1,000 "unicorns" (firms that get to a $1 billion valuation) will come from this sector, which you've probably never considered. | |

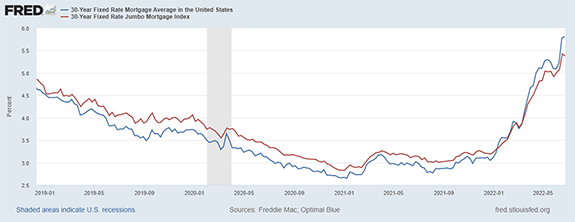

Chart of the Day I’m surprised, but there were unintended consequences to the Federal Reserve’s massive quantitative easing programs. One is in the mortgage market. Borrowers are paying a rate that’s about 0.6% higher than it should be. The chart below shows the issue.

The red line is the rate for jumbo mortgages. Traditional mortgage rates are shown as the blue line. And their recent flip-flop has me worried.  Suggested Stories: Patterns and Recessions: What Investors Spot in the Fed’s Rate Hikes Small-Cap Stocks, Big Bear Market Opportunities (Size Factor Guide)

| We're on the brink of mankind's biggest invention. This breakthrough could turn Big Tech on its ear. Bank of America says it will spur the "fastest rollout of disruptive tech in history." And the CEO of Google says this could be "bigger than fire." But the window for reaping the biggest profits in the shortest amount of time is closing soon. | |

|

1903: And they're off! The inaugural Tour de France started in Montgeron. After 1,509 miles and 19 days, Maurice Garin was crowned the first champion in Paris. Despite its prestigious reputation, many competitors dropped out before the main event due to the difficulty of the pre-race. Today, it remains the most difficult race for cyclists. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar