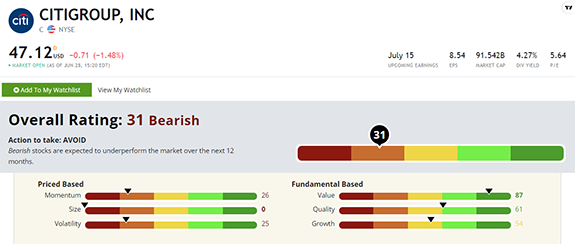

| Well, that’s a relief! The Federal Reserve has given America’s largest banks an official bill of health. The Fed performed its annual stress test on the banking sector and determined that the big boys’ capital buffers are large enough to get through a downturn. No one wants to see a repeat of the 2008 meltdown, which is why the Fed started its annual stress tests. But the result is that they've have kept major banks on a short leash for over a decade. Without the Fed’s blessing, they aren’t allowed to raise their dividends or engage in share buybacks. We operate in a safer financial system because these tests force the banks to be more conservative. But a byproduct of the reforms is that investors have lost interest in the sector. Click here to see why that’s a mistake when looking at C stock — despite its “Bearish” rating.  Suggested Stories: Survive Bear Market With Dalio's Risk Parity Small-Cap Stocks, Big Bear Market Opportunities (Size Factor Guide)

| The TradeSmith app can help you make thousands of dollars… It could save you hours of time … make you a better investor in every way … and it costs just a fraction of what your broker charges. I just put together a free demonstration of what the software that powers the TradeSmith app could do for you. And I'm giving everyone who watches a 50% off discount on the software that powers the TradeSmith app. | |

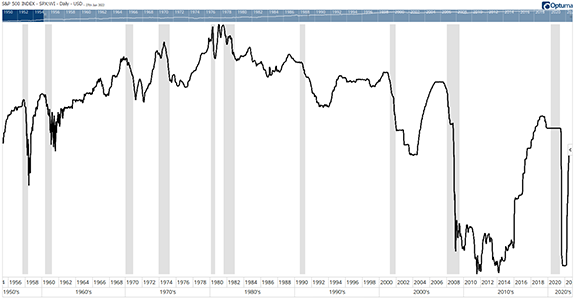

Chart of the Day As the Federal Reserve raises interest rates, one thing seems certain: A recession is near. The Fed doesn’t intend to cause a recession. And officials will do everything possible to avoid it. But history shows higher rates almost always end in recession. The chart below shows the federal funds rate, which is the short-term interest rate the Fed controls. Gray bars highlight recessions. Every time the Fed raised rates, a recession occurred later. Click here to see if we’re in for more of the same, and what it means for the bear market.  Suggested Stories: Small Caps Scream “Buy” Despite Bear Market — PEG Ratio Spotted It 2 Stocks Hold Bear Market Insights (MSM & NG Earnings Preview)

| Over $100 billion has been invested into this "future tech." Companies such as Toyota, Honda, Ford, even Apple and Amazon have all invested big. What are these auto and tech companies up to? It's this. A tech that could trigger a $7 trillion market by 2050. It's set to grow 63,000% ... this decade alone. | |

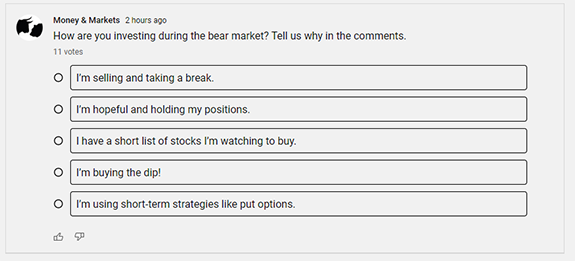

Poll of the Week Don’t miss out on the latest Money & Markets poll. We want to know how you're handling this bear market. Do you see it as a massive buying opportunity or a chance to step away and reassess? Vote in this week’s poll here or by clicking on the image below.

|

2007: The first iPhone rocked the smartphone world. With 16 gigabytes of storage, a 2-megapixel camera and an entire system of new applications for cellphones, the iPhone sold for $600. At the time of its release, Apple Inc.'s (Nasdaq: APPL) market cap was around $100 billion. Today, that value sits around $2.2 trillion! | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets permits editors of a publication to recommend a security to subscribers that they own themselves. However, in no circumstance may an editor sell a security before our subscribers have a fair opportunity to exit. Any exit after a buy recommendation is made and prior to issuing a sell notification is forbidden. The length of time an editor must wait after subscribers have been advised to exit a play depends on the type of publication.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar