| Supply chain issues cause inflation … stocks fall … cue headlines. But you want to put today’s headlines in perspective? Go to the archives of any major newspaper and find an issue from five years ago. Skim the first few stories. You’ll find that much of the news that seemed so important in 2017 is irrelevant … maybe even trivial, today. How much of today’s news will be relevant a day from now, let alone in five years? Suggested Stories: A Year After GME Short Squeeze: Expect More “Rip Your Face Off” Rallies? Bioharvest Stock Analysis + Cannabis and COVID

| If you own gold or gold stocks, read this warning immediately. An event in 2022 could have a massive impact on gold and other sectors, says the man who predicted the 2020 crash. "Move your money now." The last time he issued a public warning like this, the market went on to see its biggest one-day drop ever. | |

Earnings Edge Last week, both stocks I covered in Earnings Edge, HCA Healthcare Inc. (NYSE: HCA) and T. Rowe Price Group (NYSE: TROW), fell on earnings. It came as HCA and TROW tried to hold a key support. At this point, look for them to break down even further from here. I recommended playing a straddle last week ... and this week presents another opportunity. Suggested Stories: How to Capitalize on Volatility in the Market in 2022 Follow Buffett Into This Dividend Stock While Nasdaq Growth Stocks Fall

| Wired magazine is saying this small company "could be the [next] Intel"… And it's easy to see why. They're both microchip companies. They're both from Silicon Valley. And in a few years' time, they could BOTH be in the stock market Hall of Fame… The only difference is this new company is at the start of its journey … with most of its profit potential still to be realized … intrigued? | |

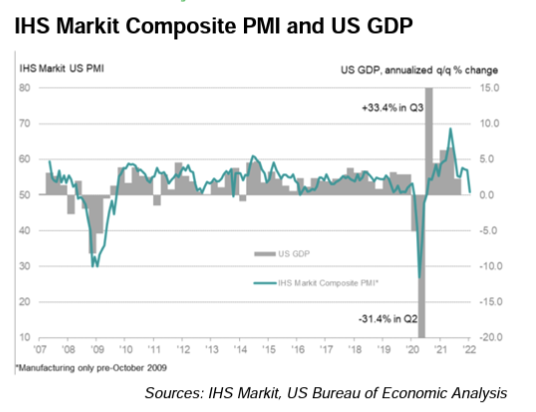

Chart of the Day Economists express complex, even contradictory, ideas in simple terms — the idea that the cure for high prices is high prices, for example. When prices are high, consumers demand less. As demand drops, prices drop to entice consumers back into the market. Sometimes, that idea works. With the Federal Reserve changing its course and Congress deadlocked, high prices are starting to cure high prices. It’s good news on inflation, but it’s bad news for the economy.  Suggested Stories: “Dr. Copper” Tells Us Inflation Will Ease Don’t Expect Back to Normal for the Economy — Here’s Why

|

1606: Guy Fawkes and four other conspirators were hanged for their involvement in the Gunpowder Plot. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2022 Money & Markets, LLC. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar