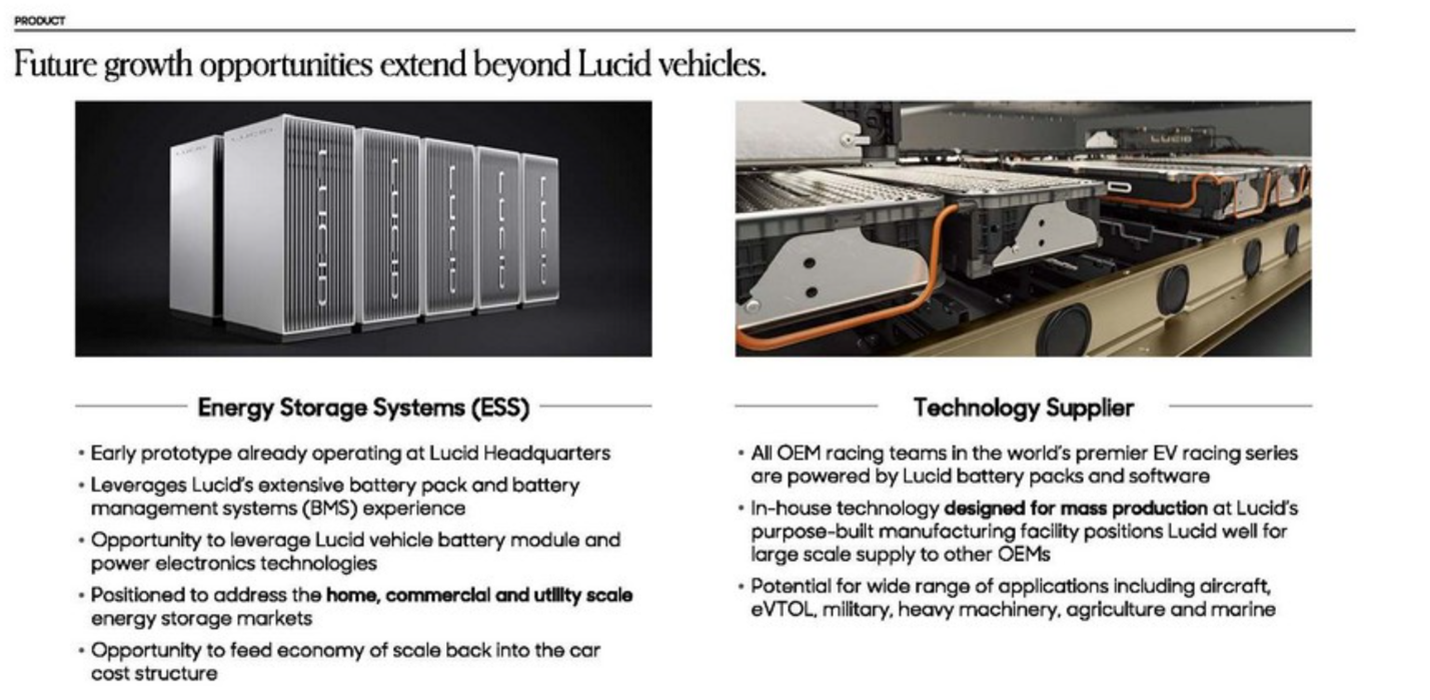

What's in a Name? For Lucid Group, It May Be Everything  | | Luke Lango | By now, you know that I'm bullish on electric vehicle maker Lucid Motors (LCID). In fact, at the beginning of this month in these very issues, I told you that Lucid Motors was Tesla 2.0 – and one of the best electric vehicle stocks to buy right now. Well… looks like the market agrees (for now)… as Lucid Motors stock is up about 50% in September alone. But I'm not writing you today to tell you about how hot Lucid stock is right now. You can look up the chart and see for yourself. Rather, I'm writing you today to tell you about something I keep getting wrong about Lucid, and that's the name. I keep calling the company by its old name, Lucid Motors. But after the company's SPAC merger closed in late July, Lucid Motors changed its name to Lucid Group. A subtle change, sure. And to most, it means nothing. After all, as the old Shakespeare saying goes: "What's in a name? That which we call a rose, by any other name, would smell as sweet." But for Lucid Group, this name change may tell us everything we need to know about Lucid's long-term strategy. The number one argument I hear against Lucid stock is that the premium electric vehicle market is simply too niche to support the company's bloated $40+ billion valuation. As a bull on the stock, I 100% agree with this statement. There aren't many folks out there who can afford a $100,000 sports car, and even if Lucid somehow dominates that entire market, the company still isn't possibly worth anything near $40 billion. But, for folks who think that's a bearish argument, I ask them to once again go through the company's SPAC investor presentation. Let me pull a quote from Slide 38 of that presentation: "Lucid plans to start with high end cars, build the brand synonymous with luxury, and then manufacture progressively more affordable vehicles in higher volumes." So, Lucid doesn't plan to begin and end with its ultra-expensive Lucid Air sportscar and Gravity SUV. That's just the starting point. Like the Model S and Model X for Tesla. And, just like Tesla leveraged success of the Model S and X to mass-manufacture the affordable Model 3 and Y models (which are now taking over the world), Lucid plans to leverage the success of the Air and Gravity to mass-manufacture affordable, mainstream models in the future (which we predict will take over the world). Throw out this idea that Lucid is a premium EV maker. They're an EV maker. Period. Still, though, that doesn't explain the name change from Lucid Motors to Lucid Group. After all, Lucid Motors could be a fine name for a company that makes all types of cars, like Lucid plans to do in the future. But Lucid swapped out "motors" for "group" because the vision here isn't for Lucid to just be a car maker at scale – rather, again much like Tesla, Lucid wants to be an energy company. Let me pull up another slide from the investor presentation. This is Slide 39.

Clearly, in the long run, Lucid doesn't just want to make cars – they want to leverage their market-leading battery technology to sell energy storage systems, too, and have their eyes on supplying technology components to the flying car (aka, eVTOL) market, too. Bold dreams, sure. But we think this is all very accomplishable. After all, the core enabling technology across all these verticals is the battery. And Lucid already has that down. The company has created the world's best battery. That battery is currently being applied to making the world's best electric vehicle – but with a little tweaking, it could easily be applied to making the world's best energy storage systems, too. In a nutshell, that's why Lucid Motors changed its name to Lucid Group – to plan for the future. Today, Lucid is a niche premium EV maker. Tomorrow, the company will be a ubiquitous energy titan with premium EVs, affordable EVs, energy storage systems, and eVTOL batteries. And so, I repeat – this is Tesla 2.0. If you missed out on Tesla, here's your second chance. Just as Tesla made Teslanairies in the 2010s, Lucid will make Lucidnaires in the 2020s. The question is – will you be one of them? I hope so. And that's why I'd like to introduce you to Innovation Investor – our flagship investment research product that is focused on investing in the world's most innovative companies, exciting megatrends, and breakthrough technologies. Of course, Lucid Group fits that bill. But so do about 50 other stocks that we think have enormous upside potential in the long run – and a handful of which we think could be millionaire maker stocks. To learn more about that millionaire maker product, click here. Sincerely,

Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. |

Tidak ada komentar:

Posting Komentar