| That pattern was: - An asset class becomes disconnected from reality, soaring to levels far exceeding its historical relationship to underlying fundamentals.

- The Fed ignores the bubble, claiming it’s impossible to predict bubbles.

- The Fed begins to tighten monetary conditions by raising interest rates.

- The bubble bursts, the asset class collapses back to more appropriate levels, and the Fed is forced to employ extraordinary monetary policies to stop the financial system from entering debt deflation.

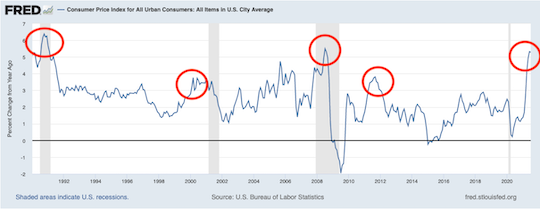

We typically see an inflationary burst between #1 and #2… which prompts the Fed to act in #3. This was the case prior to the 20% drop in 1992, the Tech Bubble bursting in 2000, the Great Financial Crisis in 2008, the 20% market drop in 2011, and…now.  In every single instance, inflation spiked, the system couldn’t handle it, and stocks rolled over and dropped 20%-50%. This time will be no different. It’s now just a matter of time. Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar