In today's Exponential Investor...- Bitcoin stolen

- MtGox coming full circle

- Days away – 24 MILLION new bitcoin investors?

|

Just over seven years ago, I was involved in a robbery.

One day in 2014, I went to log in to the crypto exchange where I'd deposited some of my bitcoin.

But instead of the usual website, I was greeted with a blank screen displaying the following message:

Dear MtGox Customers,

In the event of recent news reports and the potential repercussions on MtGox's operations and the market, a decision was taken to close all transactions for the time being in order to protect the site and our users. We will be closely monitoring the situation and will react accordingly.

Best regards,

MtGox Team

Shortly after I received that message, the exchange filed for bankruptcy. And I kissed goodbye to the idea of ever retrieving my bitcoin.

As you can tell, that crypto exchange was called MtGox.

You may have heard of it.

At the time, MtGox, based in Tokyo, was estimated to be handling 70% of the world's bitcoin purchases. That made it the largest crypto exchange in the world.

MtGox going under was the biggest shock to ever hit the crypto industry.

And it still is to this very day.

It transpired that MtGox had 850,000 bitcoins stolen. That was more than 7% of the world's supply at the time. (And around $38 BILLION worth at today's prices.)

Neither mine nor any of the other victims' bitcoins have been recovered.

(For what it's worth, I had 0.10324027 BTC in MtGox. Not loads. Still, at today's values, that's around £4,800 in bitcoin.)

But as you're about to discover, the MtGox story is finally coming full circle.

Life after MtGox

To show you, I need to talk about antifragility. A phrase coined by option trader – and acclaimed author – Nicholas Nassim Taleb.

In his book,

Antifragile: Things That Gain from Disorder, Taleb dives deep into the concept of antifragility.

Namely, that there are things that are

fragile – like a crystal glass. These things break when exposed to stress.

Then, there are things that are

robust – like a plastic cup – that stay the same when exposed to outside stressors.

And finally, there is a group of complex systems that are

antifragile. These systems thrive on outside stressors. They become stronger when exposed to stress… and weaker when deprived of it.

In Taleb's own words:

Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure , risk, and uncertainty. Yet, in spite of the ubiquity of the phenomenon, there is no word for the exact opposite of fragile. Let us call it antifragile. Antifragility is beyond resilience or robustness. The resilient resists shocks and stays the same; the antifragile gets better.

Examples of antifragility are abundant in the world around us.

Our bodies develop immunity when exposed to a harmful virus…

Our bones and muscles strengthen when we lift heavy objects...

And in his book, Taleb homes in on the existing financial system.

Taleb posits that central bankers seeking to deprive our financial system from economic shock leave it in a weakened state. And open to much larger shocks when they DO happen.

It's a theory that many – including me – would argue holds water.

But what

actually does happen when you leave a financial system to its own devices?

Well, to my eyes, the crypto-led financial system is a shining example of antifragility in action. Of a system

strengthening under the weight of chaos and disorder.

In fact, you need look no further than the MtGox scandal.

At the time, many considered the MtGox scandal an existential threat for the industry.

Bitcoin's critics professed it was a step away from the morgue for the cryptocurrency.

But in the aftermath of MtGox filing for bankruptcy, something unexpected happened.

The industry didn't crumble.

It reorganised. Reformed. And became

stronger than before.

As the Mt.Gox debacle unfolded, a group of exchanges made a statement reaffirming their commitment to the future of bitcoin and crypto. Part of the statement read:

In order to re-establish the trust squandered by the failings of Mt. Gox, responsible bitcoin exchanges are working together and are committed to the future of bitcoin and the security of all customer funds. As part of the effort to re-assure customers, the following services will be coordinating efforts over the coming days to publicly reassure customers and the general public that all funds continue to be held in a safe and secure manner.

The lead signatory on that statement was Coinbase.

As you may recall, Coinbase listed publicly in April of this year. It was the point of maximum fervour – so far – during this bull run. And coincided with bitcoin hitting its all-time high of over $63,000.

For many of the industry's veterans and true believers, it served as a vindication of the mission Coinbase set out on seven years ago, in the wake of the MtGox scandal.

Many consider it the ultimate legitimisation of bitcoin as a "mainstream" asset class.

However, I do not.

That's because there is another chapter in this story still to play out. A step from the margins to the mainstream far greater than a company simply listing on the public markets.

It will happen any day now. And I believe it has been vastly under-reported in the mainstream press.

I've waited seven years for this

Because in the coming months – perhaps weeks – as many as 24 million people in the United States are going to wake up and check their bank accounts.

And when they do, they're going to see something different.

By that time, I'd wager bitcoin could be well north of the $63,000 all-time high it hit back in April.

| Forecasts are not a reliable indicator of future results |

|

|

After all, after months of consolidation, bitcoin is once again flying.

Bitcoin itself is up around 50% in three weeks. And we've seen some smaller crypto make outrageous climbs in price. One crypto, Cardano, is up over 7,310% since governments and central banks went into overdrive as they created new money from March of last year.

Another crypto, Celsius, is up over 8,00%.

(Figures taken from 14 March 2020 – 17 August 2021. Past performance is not a reliable indicator of future results.)

And with a significant tailwind once again behind it…

What millions of people are going to see on their online bank account could send the market into unchartered territory.

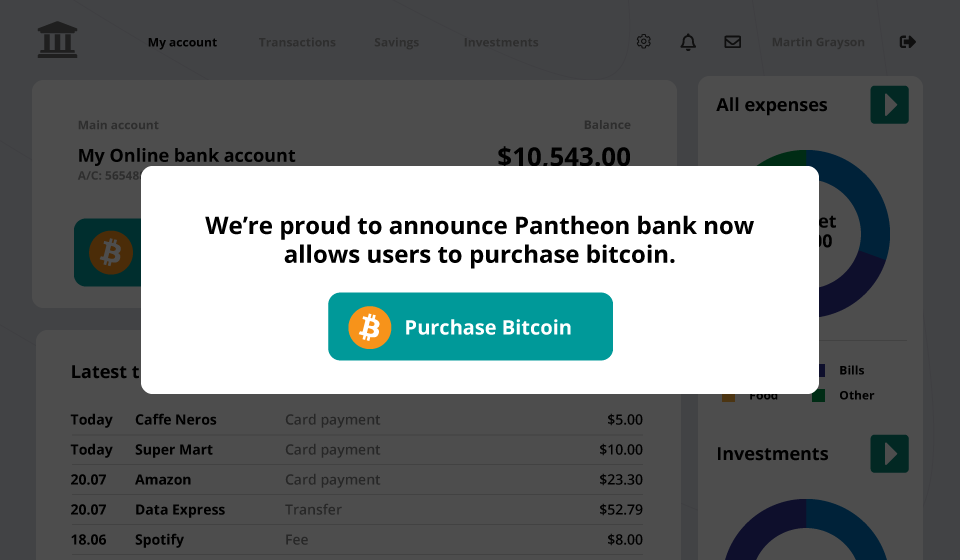

Because they're going to be presented with a screen that may resemble something like this:

In short, bitcoin will soon be offered to up to 24 MILLION savers in the United States – directly – via their online bank account.

Yes, you read that right.

Weeks ago, a deal was inked involving one of the oldest financial firms in history.

And it means the most mainstream financial institution of all – the traditional "high street" bank – is about to offer bitcoin to the everyday person.

This, in my view, really shows that rapid speed at which the industry has matured since the dark days of the MtGox scandal...

… and the truest acknowledgement of bitcoin as a mainstream asset class thus far.

This is a shift that could see MILLIONS of brand-new investors purchase bitcoin for the very first time…

Flooding the market with a new wave of capital…

And igniting what could be a NEW bitcoin super-surge that puts everything before it to shame.

If you're yet to dip your toe in this market, I believe there's never better time to do so.

In my special crypto presentation, I detail what I believe is coming next for crypto…And give away my #1 way to take advantage of the crypto boom – completely free of charge.You can watch it here. What we're seeing here is a landmark moment the crypto market has been waiting for, for over a decade.

When I saw the MtGox story unfold right before my eyes, it would have been hard to imagine happening.

But it IS here. And it is perhaps the ultimate nod to bitcoin as a mainstream asset.

And a catalyst, I believe, will send bitcoin to even higher – stratospheric – heights.

| Forecasts are not a reliable indicator of future results |

|

|

Click here – and we'll raid this market together.

Sam Volkering

Editor,

Exponential Investor

Tidak ada komentar:

Posting Komentar