Dear Money & Crisis Reader, Dear Money & Crisis Reader,

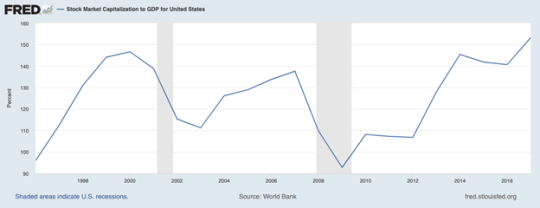

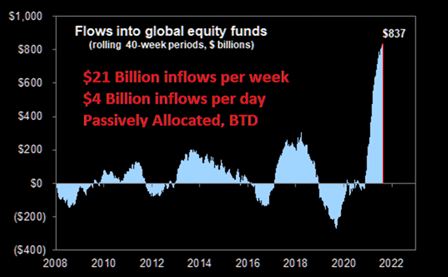

As I’ve been outlining over the last few days, stocks are in a bubble. The evidence is clear from multiple angles. One of the simplest is Warren Buffett’s favorite indicator: the Stock Market Capitalization to GDP ratio. Buffett famously used this ratio as the justification for avoiding the Tech Bubble in the late '90s. As the below chart shows, the current bubble is even larger than that!  Another means of determining whether or not the market is in a bubble is from fund inflows, which measures how much capital investors are putting into stocks. After all, in order to have a genuine bubble, we need to see mania from investors as they dump their money into stocks. Well, investors are pouring hundreds of billions of dollars into stocks today at a pace far exceeding anything like the last 12 years. Indeed, as CNBC noted earlier this year, investors have put more money into stocks in the last five months than in the prior 12 years combined.  |

Tidak ada komentar:

Posting Komentar