| | Once in a while, you stumble across a question that you were thinking but hadn’t asked. I found this one on Twitter recently: Why buy bonds when their yield is less than the rate of inflation? Who in their right mind would tie up perfectly good capital at a yield that low? At 1.5%, the “risk-free return” of government bonds turns into return-free risk when taking inflation into account. I have an answer to that question. And it isn't just a percentages game.

Suggested Stories: PAVE ETF X-Ray: Target the Best Infrastructure Buys Should You Buy Enphase Energy Stock After Its 750% Surge?

| It's a confusing time for investors. Today, you'll get the clarity you've been looking for. The very man who's already guided over 100,000 Americans with his investment insights shows you where the market is headed over the next 10 years … and which stocks will lead the way. He personally sent out a warning a week before the coronavirus crash. And his firm has predicted a number of booms and busts with stunning accuracy. So you'll want to pay very close attention. | |

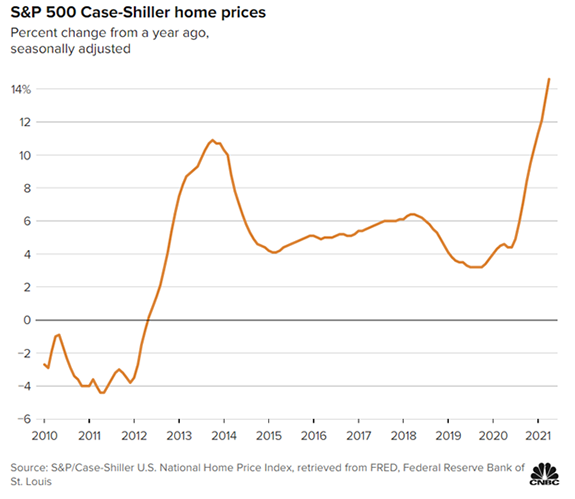

Chart of the Day

Potential homebuyers don’t need to wait for data releases to see the bad news. They already know the housing market is increasingly unaffordable. Data only deepens their despair. The latest report showed the trend in home prices is intact. According to CNBC: "[Home prices] saw an annual gain of 14.6% in April, up from a 13.3% increase in March, according to the S&P CoreLogic Case-Shiller National Home Price Index.” This was the largest one-year change in the index, as you can see in the chart below. Click here to see how this “wealth effect” may be a boon for the economy and markets.

Suggested Stories: Japan Provides a Peek Into America's High-Debt Future The Economic Rally Is in Trouble

| If you own stocks, you may want to cash out immediately. And if you hold dollars, you need to see this chart. Because, according to one of America's most respected economists, the data in this chart signals a possible COLLAPSE ahead for the dollar. What he revealed is not pretty. | |

|

1964: President Johnson signed the Civil Rights Act into law. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | | |

Tidak ada komentar:

Posting Komentar