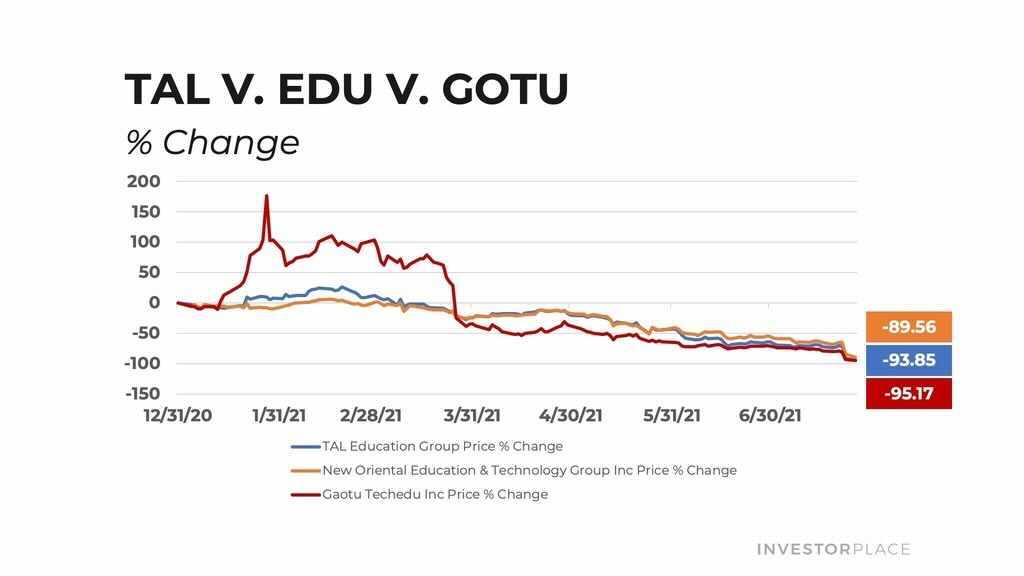

The China Crackdown Is Real, But These 3 Chinese Tech Stocks Will Survive  | | Luke Lango | Imagine owning a stock at $90 per share in February 2021, and then seeing that share price collapse to $4 over the next five months… Sounds like a nightmare, right? Well, that's exactly what happened to shares of Chinese education technology firm TAL Education Group (TAL). This was a $90 stock in February 2021. It's now a $4 stock. A once $60 billion Chinese tech giant has crumbled into a $2 billion afterthought… Similar collapses happened at New Oriental (EDU) and at Gaotu Technology (GOTU):

What happened? China. Over the past weekend, China basically annihilated its entire education technology (ed tech) industry, by banning companies teaching the school curriculum from making a profit, raising capital, or going public. Now… why would China do this? It's a roundabout way of accomplishing one of the Chinese government's biggest goals: Reversing the country's declining birth rate. The logic is essentially as follows: - China's multi-decade stretch of robust economic expansion is slowing rapidly.

- China blames a big part of this slowdown on a declining birth rate, which weighs on population growth and total economic output.

- To stem the declining birth rate, China replaced its one-child-per-family policy with a two-child policy in 2015.

- That didn't work. So, China moved to a three-child policy in early 2021.

- But the Chinese government fears the impact of this policy change on economic output may not materialize for decades, and therefore, they are looking for an immediate solution.

- Chinese officials reason that Asian students pursuing for-profit education services are more likely to be career oriented and less likely to start families in the near future (yes, a big jump in logic, but one that China is making).

- Therefore, China believes that eliminating for-profit education services will increase the number of family-oriented high school graduates in the near future, and boost the country-wide birth rate.

Regardless of the logic, this is no small move. We're talking a $100 billion industry that China's biggest tech titans like Alibaba, Tencent, and ByteDance had poured money into… and which was growing like wildfire thanks to a growing desire among the Asian populous to gain an edge through higher education. It also follows similar regulatory crackdowns from the Chinese government on Alibaba and ride-sharing giant Didi – which China actually removed from app stores. These are serious actions. China has threatened regulatory action against its tech sector for what feels like over 10 years now. But it's always been "all talk, no walk". Now, the walk is showing up… and in a big way! It's becoming clearer by the day that, for the first time in modern history, China wants to aggressively reel in its tech sector. Many investors feel this action makes Chinese stocks "un-investable." CNBC personality and former hedge fund manager Jim Cramer recently said on his Mad Money show: "You can't own these stocks." We don't share that viewpoint. We do believe more caution is required across the entire Chinese tech sector, but simultaneously think that a blanket assessment of calling all Chinese tech stocks "un-investable" is actually just lazy. The reality is that China needs its tech sector to succeed, and therefore, will only exercise regulatory crackdowns on companies that can handle such a crackdown – i.e. the country's tech giants, like Alibaba, Baidu, and Tencent. We would avoid those Chinese tech giants for the foreseeable future. China could bring down the regulatory hammer on these multi-hundred-billion-dollar giants very soon. But what about NIO (NIO)? No. China needs NIO to succeed if the country wants to compete in the global EV market, and not have its auto market dominated by Tesla. Plus, NIO is just a $70 billion company – it's not big enough to be regulated yet. Or Bilbili (BILI)? No. China isn't worried about the monopolistic power of a niche, ACG-focused $36 billion social media platform. This company will go unscathed amid these regulatory crackdowns. Or how about Luckin Coffee (LKNCY)? Again, nope. Luckin Coffee is too small to attract any regulatory attention from the Chinese government, and again, China likely wants Luckin to succeed to keep its domestic coffee market from being dominated by Starbucks. These Chinese stocks will survive the recent wave of government crackdowns – and so, if you see them continue to drop on ephemeral headline risks, you should consider buying them on the dip. But they aren't the only Chinese tech stocks that look attractive amid the recent wipeout… And that's why I want to point you to my ultra-exclusive research advisory, The Daily 10X Stock Report. For readers who are unaware, The Daily 10X Stock Report is a super-unique service where I do the unthinkable: Every single day the market is open, I give away one small hypergrowth stock pick with the potential to soar 10X in value. Many of those picks have been Chinese tech stocks. NIO is a great example that has scored Daily 10X subs gains of 1,570%. But it's only one of a handful of Chinese tech stocks I've highlighted in that service that has scored subs triple-digit gains or more. In fact, The Daily 10X Stock Report is just over a year old, and in that short time, it has already scored readers nearly 100 triple-digit winners and 6 different stocks that have soared 10X or more in value. So… what are you waiting for? Click here, and find out the best Chinese tech stocks to buy amid the recent wipeout (look for a fresh pick in this sector coming next week). Sincerely,

Luke Lango

Editor, Hypergrowth Investing On the date of publication, Luke Lango did not have (either directly or indirectly) any positions in the securities mentioned in this article. By uncovering early investments in hypergrowth industries, Luke Lango puts you on the ground-floor of world-changing megatrends. It's how his Daily 10X Report has averaged up to a ridiculous 100% return across all recommendations since launching last May. Click here to see how he does it. |

Tidak ada komentar:

Posting Komentar