| | You might have seen the news that Moderna Inc. (Nasdaq: MRNA) joined the S&P 500 this week.

This is a huge deal. Being admitted to the world’s premier blue-chip stock index is a sign that a company has “made it.”

When you’re in the S&P 500, you’re no longer an upstart. You’re officially part of the establishment. Moderna, of course, is best known for its COVID-19 vaccine, which was one of the first commercial applications of messenger RNA (mRNA) technology.

But that’s just the beginning…

This isn’t just a win for Moderna: It’s proof that the genomics revolution is here. Suggested Stories: Meme Stocks, Nutty Valuations and More (Investing With Charles)

Public Storage's Dividend Is Perfect When Market Volatility Strikes

| A prominent financial research firm has news for you. This year could be the last time you see one… Radical changes are taking place in the financial system — as we speak. According to the Federal Reserve, a new digital currency could “become systemically important, overnight.” (And it’s not Bitcoin, Ethereum, or any crypto you’ve likely heard of before.) But you can get all the details you need to prepare for this massive change — as well as profit from it… | |

Marijuana Market Update In today’s Marijuana Market Update, I take a look at 1933 Industries Inc. (OTC: TGIFF) and provide an update on the brand-new Money & Markets Cannabis Index.

Click here to stay ahead of the game in the cannabis market.  Suggested Stories: Not Your Grandpa’s Assembly Line: Buy This Automation Stock Now

Head Overseas for True Value — This ETF Is Your Ticket

| Could the technology behind this odd-looking machine really be the most transformative innovation in history?

Experts are screaming “YES”!

Elon Musk calls it “amazing…”

It’s a technology I call “Imperium.”

And it’s about to spark the biggest investment mega trend in history …Want the details? | |

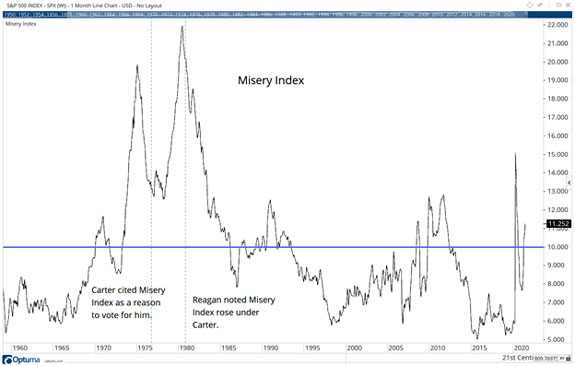

Chart of the Day It’s time for investors, and consumers, to think about the 1970s. That was a decade of turmoil.

In 1971, President Nixon severed the link between the U.S. dollar and gold. The economy suffered high unemployment and inflation, which was thought impossible.

Economists needed new theories. They named the combination of stagnant growth and high inflation “stagflation.” The new theories needed new metrics.

To describe the conditions consumers experienced for the first time, Arthur Okun created the Misery Index.

The Misery Index was high in the ‘70s and ‘80s, and it’s on the rise again. (See chart below.)

You don’t want to be blindsided by what’s coming.

Read on for what a high Misery Index means for consumers and the economy as a whole.  Suggested Stories: Bond Market Says the Next Global Crisis Is Developing

Technical Analysis Reveals Bearish Market |

2012: Facebook Inc. (Nasdaq: FB) held its IPO and began trading on the Nasdaq. It was valued at $104 billion, the largest valuation to date for a newly listed company. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Sovereign Offshore Services, LLC, Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | | |

Tidak ada komentar:

Posting Komentar