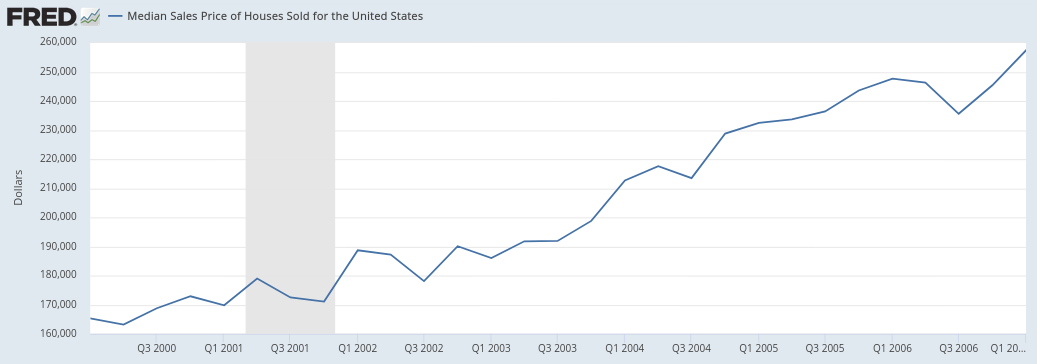

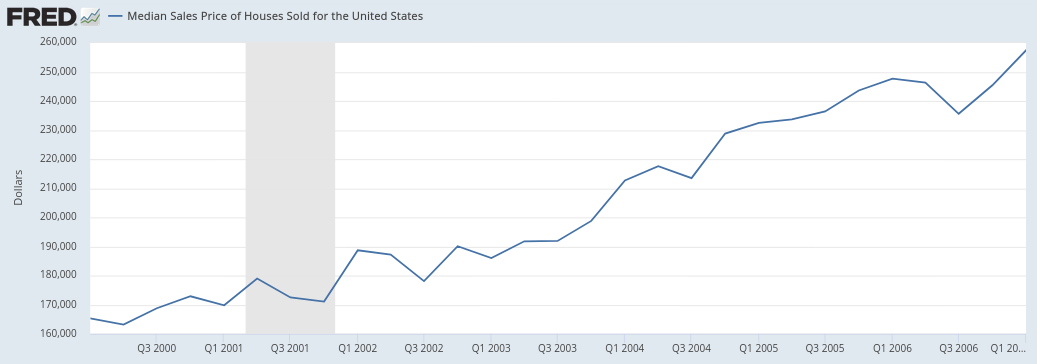

When we emerged from the throes of the pandemic, a lot of people were drawing comparisons to the Roaring '20s, certain that pent-up demand and government largesse would fuel an exuberant economic boom. But that's not what I saw. And it's not what I'm looking at right now. No, what I'm seeing right now reminds me a lot more of the early 2000s — the period defined by a red-hot housing bubble and soaring commodities prices. Those are the eerie parallels I've been seeing around every corner. For example, here's a look at housing prices from 2001 to 2007...

| The Next AMC? This is the short squeeze story nobody is talking about. Our own Jimmy Mengel is already showing readers massive profits on this... Gains of up to 492% in only months. And the biggest potential is still ahead. Potentially bigger than GME or AMC. Don’t miss out on this one. Click here for the full story. |

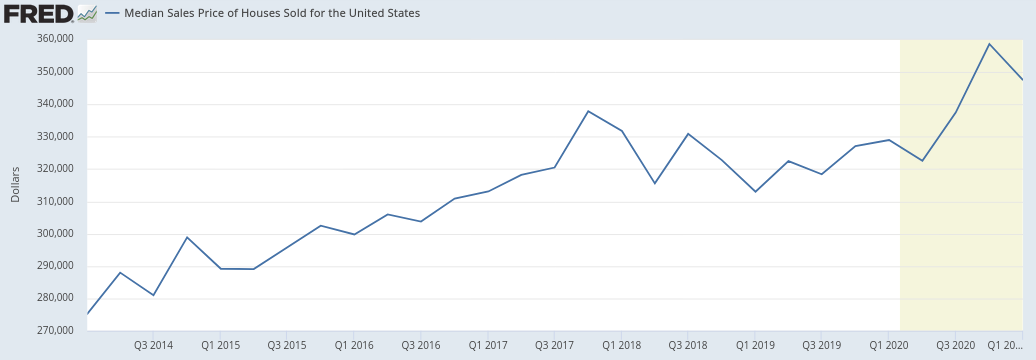

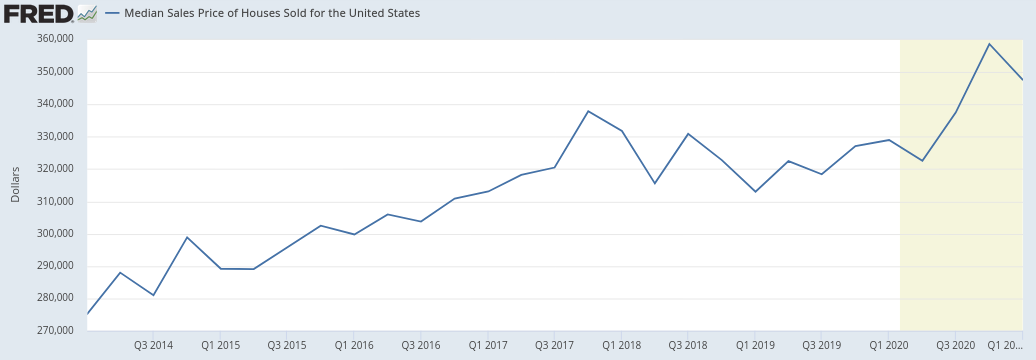

And here's how housing prices have performed since 2015, a similar range...

You can see substantial increases over both periods. And while the 2000–2007 surge was bigger on a percentage basis, our current bull market has yet to conclude. Indeed, we know what happened to the housing market after it peaked in 2007. But with today's market, there's no telling when the insanity will stop. All we have right now is a suspicion that the rise in home prices will moderate, but with inventory lacking and demand on the rise, no one is suggesting they'll regress. Now let's look at gold prices where we can draw a similar comparison. Here's a snapshot of the past two decades in gold prices...  | Dr. Fauci Backs New COVID Technology (20-cent stock to soar) Incredibly enough, Dr. Anthony Fauci is backing a new COVID-fighting technology. He says it merits “serious consideration” and even uses it himself. It’s not a vaccine, but that hasn’t stopped other experts from getting behind it... The Centers for Disease Control (CDC) just greenlighted this device for reopening schools and businesses. And the FDA is on board too, lifting regulatory restrictions to deploy this everywhere. One tiny tech stock owns all of the patents on this technology. For a brief window, you can buy it for $0.20 per share. Click here for the full story. |

The most obvious spike here is the one that occurred from 2009 to 2011, when prices were at roughly the same level they are today. But that's not actually where I think we are. I think the current period is actually more like the first leg up we saw in 2006. That's when loose monetary policy and spurious economic growth were driving prices higher rather than the financial collapse that later sent investors rushing to safe havens. So in this scenario, gold is due for a second leg up, surging to unprecedented highs when the bubbles in housing and stocks burst. And speaking of stock bubbles, here's how the stock market has performed over the past five years...

And here's how things looked from 2002–2007...

| The U.S. Government May Have Just Accelerated the EV Revolution Thanks to a $1.7 trillion government-proposed clean energy plan, electric vehicles could soon replace gas-powered cars on U.S roads. And one tiny EV company is perfectly positioned to piggyback off that plan to trigger the EV revolution and offer early investors the chance at astronomical gains. Click here to get the full story. |

The first chart (today's) shows a 97% gain while the 2002–2007 period is closer to 70%, but as we've seen in the previous two cases, history doesn't always repeat — sometimes it just rhymes. And there's a lot rhyming today. The scorching real estate bubble that seems like it should correct but continues to inflate... Gold making a steady climb, punctuated by chaotic spikes... Stocks shooting higher and higher... And all of this underpinned not by fundamentals, but by loose monetary policy and excessive government spending — policies that keep rates artificially low and hand trillions of dollars off to financial institutions, corporate interests, and rich individuals that, in turn, use these handouts to speculate. This is how bubbles are created. It's the same thing that happened in the early 2000s when Alan Greenspan rushed in to gas the market with rate cuts in the wake of the dot-com collapse, slashing the federal funds rate all the way to 1.75% from 6.5% just two years earlier. Around that same time, you might remember George W. Bush rolled out a series of tax cuts that freed up even more money for elite institutions and high-rolling investors. Well, here we are today, and the federal funds rate has dropped from 2.5% in 2019 to 0% today. And Fed Chairman Jerome Powell has made it clear it's going to stay there for the foreseeable future. Similarly, like George W. Bush before him, President Donald Trump and his Republican colleagues issued a massive tax cut to corporations and wealthy individuals in 2017. And now, President Biden is adding still more fuel to the fire with multi-trillion-dollar spending packages. No wonder I'm experiencing so much deja vu. Of course, none of this is to say the market will crash tomorrow. We could go on like this for months or even years. It's impossible to tell. But if what happened in 2008/2009 tells us anything, it's that eventually the music stops. And in that sense I guess this is like the Roaring '20s. Fight on,

Jason Simpkins  @OCSimpkins on Twitter @OCSimpkins on Twitter

Jason Simpkins is Assistant Managing Editor of the Outsider Club and Investment Director of Wall Street's Proving Ground, a financial advisory focused on security companies and defense contractors. For more on Jason, check out his editor's page. *Follow Outsider Club on Facebook and Twitter.

|

Tidak ada komentar:

Posting Komentar