| | I’m not a big fan of investing in initial public offerings (IPOs) when they first hit the market.

It’s not until the lockup period ends — usually 180 days after the IPO prices, when insider shares open to the broader market — that you get a feel for the long-term performance of an IPO stock.

Because so few total shares are traded at first, there is much higher demand for supply. Thus the stock price inflates. In this episode of The Bull & The Bear, I show you why Robinhood’s IPO won’t be a buy.

Suggested Stories: Live by the Meme Stock, Die by the Meme Stock

Federal Legalization Update + 2021's Big Cannabis Deals

| Could America become the world's No. 1 manufacturing power again? Sounds unbelievable, but one overlooked technology is making it possible. It's going to create 63 million middle-class jobs … and a $100 TRILLION mega-economic boom, according to the World Economic Forum. It's also going to create a new millionaire class of investors, thanks to one little-known stock at the forefront. | |

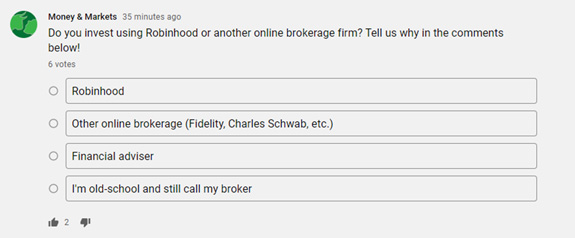

Poll of the Week Chad Stone, Assistant Managing Editor Robinhood’s user base ballooned to 18 million funded accounts during the COVID-19 bull market recovery. That’s impressive!

Robinhood makes it easy to buy and sell stocks and other assets, but it might lack some features you’re looking for.

Have you tried Robinhood, or do you prefer a different broker to execute your trades? Click here to vote in our newest weekly Money & Markets poll!

Suggested Stories: Clean Energy Arms Race Will Trigger a Solar Stock Boom

The Art of Buy and Hold: Do's and Don'ts to Maximize Gains

| Mike Huckabee has made a shocking confession… "When it comes to investing my money, I feel like I'm stumbling around in the dark." But recently, he found a way to fight back. He discovered a group of 100,000 Americans who are rising up … boldly taking control of their financial future. Using a powerful investing secret, everyday folks are going from confusion, fear and frustration with their investments … to clarity, peace and success. No wonder Governor Huckabee calls it a "Miracle on Main Street." | |

Week Ahead

Earnings season is in full swing again.

In this week’s Money & Markets Week Ahead, I break down expectations for a telecoms giant. I also take a look at an insurance IPO dropping this week, as well as existing home sales in June.

Here’s more of what to watch in the week ahead on Wall Street. Suggested Stories: Wall Street Meets Main Street With This Monthly Payout

Gains of 400% and 300%! It Pays to Follow Our Weekly Hotlist

|

1975: A U.S. Apollo and a Soviet Soyuz spacecraft linked up for the first time, beginning a new era in scientific cooperation between the two nations. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | | |

Tidak ada komentar:

Posting Komentar