| | For decades, seasoned investors have used gold as a means to hedge against potential market downturns and inflation.

Gold doesn’t have any credit or default risks; it holds intrinsic value because of its limited supply. If you wanted to protect your portfolio against market downside or a rise in inflation, you held gold in some form.

Today, investors have added a new asset to the list of potential hedges: cryptocurrency (more specifically, bitcoin).

But is one a better hedge asset than the other?

Click here to find out in The Bull & The Bear.  Suggested Stories: Moderna’s S&P 500 Move Puts the Spotlight on Genomics

1933 Industries Inc. (TGIFF) Breakdown + Our New Cannabis Index

| Eric Fry has 40 1,000% winners to his name. Most people are lucky if they find one in their entire lives. Now he's revealing his favorite pick for 2021 absolutely free. He's included the name and ticker symbol at the conclusion of his presentation on the secret behind the wealth gap in America. | |

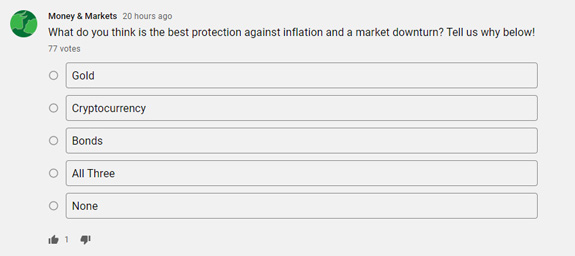

Poll of the Week Chad Stone, Assistant Managing Editor This bull market keeps hitting records. But it hasn’t been a smooth ride.

We got a scare when the Dow Jones Industrial Average lost 725 points on Monday. A drop like that can spook even the most experienced investors.

All the while, inflation looms as prices roll higher. The Consumer Price Index spiked 5.4% in June, the highest year-over-year gain since 2008.

Matt gave his take on two popular hedge assets above.

Are you worried about inflation or a market downturn? What’s your go-to hedge asset?

Click here to vote in our newest Money & Markets poll, and make your voice heard!  Suggested Stories: Meme Stocks, Nutty Valuations and More (Investing With Charles)

Public Storage's Dividend Is Perfect When Market Volatility Strikes | In July 2020, the Trump administration oversaw a RADICAL change to the tech world … one that could unleash a huge wave of disruption … prosperity … and wealth creation in the near future.

Chances are, you haven’t heard about it until today.

But according to one of America’s most respected tech forecasters, it’s set to create small fortunes right here in this country.

He recently went on camera to explain why — | |

Week Ahead Earnings season is in full swing again. I break down expectations for tech giant Apple Inc. (Nasdaq: AAPL). I also provide some insight into the much-anticipated Robinhood IPO dropping this week.

We’ll also see how consumer confidence fared in July.

Here’s more of what to watch in the week ahead on Wall Street. Suggested Stories: Not Your Grandpa’s Assembly Line: Buy This Automation Stock Now

Head Overseas for True Value — This ETF Is Your Ticket |

1969: The Apollo 11 astronauts returned to Earth, splashing down safely in the Pacific Ocean. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Sovereign Offshore Services, LLC. Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | | | | | | | |

Tidak ada komentar:

Posting Komentar