| Robinhood — the stockbroker that drove stock commissions to zero — is going public. It’s somewhat ironic that you will soon be able to buy and sell shares of the company responsible for breaking the Wall Street model. But that is the case, and it has some implications for all of us as investors. Robinhood owes its popularity to its user-friendly design. And the company deserves credit for that. Almost 9 million Robinhood users are on the app daily. These users are checking their accounts seven times per day on average. Talk about engagement! But more trading is not always better trading. In fact, it’s almost always worse. P.S. My colleague and chief investment strategist Adam O’Dell is known as one of the best stock-pickers and investment analysts in the world. He’s spotted three market catalysts that could send the market to brand new heights … catalysts that will help “mint more new millionaires in the next 12 months than in the last 15 years.” To find out more about these events, and learn about Adam’s No. 1 “market breaker” stock of 2021, click here for the details in Adam’s Millionaire Market Summit. Suggested Stories: Follow Your Gut? No Way! Play “Moneyball” With Stocks Midyear Financial Report Card: One Tip to Win in 2021

| "Old school" folks might be skeptical of listening to financial advice from someone half their age, but this stock whiz beat out 15,000 experts to claim No. 1 title. | |

Marijuana Market Update Matt Clark, Research Analyst

This week, I answer a reader question about Village Farms International, a Canadian company known for producing greenhouse-grown vegetables. Its subsidiary, Pure Sunfarms, has now developed into a significant player in the Canadian cannabis market — specifically in British Columbia. In today’s Marijuana Market Update, I tell you whether it’s a good time to buy VFF.

Suggested Stories: A Pipeline to Dividend Growth — Buy ONEOK's 6.5% Yield Now Tragedy Spurs Action: 3 Ways to Shore Up Your Financial Risk

| It gives me no pleasure to give you this stark warning ... but I have to do it nonetheless. Anything else would be grossly irresponsible... Put simply, Joe Biden's widely touted post-pandemic "bailout" is doomed. In fact, I've uncovered three ticking financial time bombs that could derail America's "recovery." | |

Chart of the Day

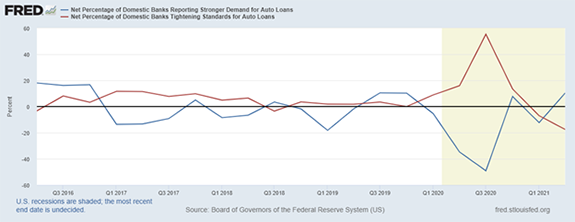

History shows that credit market crises all start the same way. Lenders loosen their standards and increase risk. The subprime mortgage crisis that led to the Great Recession in 2008 is a recent example. Banks and other lenders ignored risks because they assumed home prices always went up. This meant anyone qualified for a mortgage, and that led to disaster. We are in the early days of the next crisis. Lenders have lowered standards for auto loans as demand for the loans increases. (See chart below.) Let’s take a look at the numbers.

Suggested Stories: Seasonals Highlight a Bullish Opportunity for QQQ in July Earnings Season to Be Better Than Ever

|

1872: John Blondel patented the donut cutter. | |

Privacy Policy

The Money & Markets, P.O. Box 8378, Delray Beach, FL 33482.

To ensure that you receive future issues of Money & Markets, please add info@mb.moneyandmarkets.com to your address book or whitelist within your spam settings. For customer service questions or issues, please contact us for assistance.

The mailbox associated with this email address is not monitored, so please do not reply. Your feedback is very important to us so if you would like to contact us with a question or comment, please click here: https://moneyandmarkets.com/contact-us/

Legal Notice: This work is based on what we've learned as financial journalists. It may contain errors and you should not base investment decisions solely on what you read here. It's your money and your responsibility. Nothing herein should be considered personalized investment advice. Although our employees may answer general customer service questions, they are not licensed to address your particular investment situation. Our track record is based on hypothetical results and may not reflect the same results as actual trades. Likewise, past performance is no guarantee of future returns. Certain investments carry large potential rewards but also large potential risk. Don't trade in these markets with money you can't afford to lose. Money & Markets expressly forbids its writers from having a financial interest in their own securities or commodities recommendations to readers. Such recommendations may be traded, however, by other editors, Money & Markets, its affiliated entities, employees, and agents, but only after waiting 24 hours after an internet broadcast or 72 hours after a publication only circulated through the mail.

(c) 2021 Money & Markets. All Rights Reserved. Protected by copyright laws of the United States and treaties. This Newsletter may only be used pursuant to the subscription agreement. Any reproduction, copying, or redistribution, (electronic or otherwise) in whole or in part, is strictly prohibited without the express written permission of Money & Markets. P.O. Box 8378, Delray Beach, FL 33482. (TEL: 800-684-8471)

Remove your email from this list: Click here to Unsubscribe | | |

Tidak ada komentar:

Posting Komentar