A Good Time to Buy Bonds That Are Tied to Stock Market Performance | | Sponsored Content The 'Set and Forget' Dividend Portfolio for Retirement The easiest way to self-manage your dividend income portfolio without losing a ton of money is following my advice below. Dividend stocks I personally recommend and buy myself are meant to held for a long time. One of my current dividend payers to 'set and forget' for now is paying over 25% yields. There's a process I follow to build this dividend portfolio that grows and ends up paying your bills for life. See how easy it is to follow. Click here to see how this 'set and forget' dividend portfolio works. | | | I'm not sure about the last time such a divide over the direction of interest rates and bond yields existed, but the present situation is one for the monetary history books. In what was looking like a scenario where lower commodity prices were taking hold, about the only commodity that has really retreated heavily from its recent high was lumber.

Most of the prices of the goods that consumers use the most, energy and food, are trading higher following a broad pullback earlier this month. However, coming into the month of August, the price of corn, soybeans, wheat, cattle, lean hogs, coffee, sugar and orange juice are trending back up near their 2021 highs. Light sweet crude has turned higher this past week, following a minor correction, and natural gas is trading at a new yearly high.

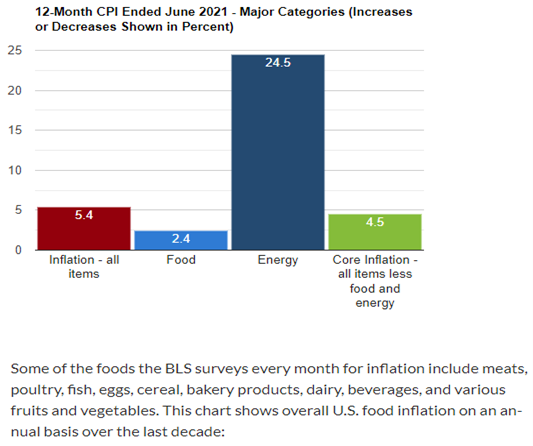

I think it drives us all a little crazy when the government reports core inflation, ex-food and energy, because of the volatile nature of the two. But for a family of four, where both parents are working and commuting by car to put food on the table, pay the rent/mortgage, cover health care and pay for all the services that are needed to function week after week, there would be no argument that inflation is having a deep impact on their way of life.

Source: www.usinflationcalendar.com

The Consumer Price Index (CPI), which is calculated by the Bureau of Labor Statistics (BLS), measures more than 200 categories of items arranged into eight major groups, including: food and beverages, housing, apparel, transportation, medical care, recreation, education and communication and other goods and services.

Most recently, the BLS reported that "the CPI for June rose by 0.9%, after rising 0.6 percent in May, and was the largest 1-month change since June 2008 when the index rose 1.0 percent. Over the last 12 months, the all-items index increased 5.4 percent before seasonal adjustment; this was the largest 12-month increase since a 5.4-percent increase for the period ending August 2008."

The July 2021 CPI data are scheduled to be released on Aug. 11. As a result, they will provide some key insight as to whether the Fed transitory stance will be further tested. | | Biden's $10 Trillion Tidal Wave of Federal Spending Five key sectors will get the lion's share of this government mandated windfall. This newly released dossier details the #1 play in each sector, and how each could make up to 200% or more on their money in the next 12 months alone. Click here now to tap into this government gold rush. | | | At present, both the stock and bond markets have voted with the Fed, and as long as U.S. Treasury yields are higher than the yields from other AAA-rated sovereign bonds from around the globe, the massive liquidity that has been created seems to be a force that will keep soaking up whatever amount of quantitative easing hits the market via Treasury auctions.

That, as well as the ongoing threat of the spread of new COVID-19 variants, have yet to rattle the stock market, save for July 19. The same forces are also providing a strong bid under U.S. Treasuries.

It's a real tale of two trajectories at work, higher inflation and higher bond prices, that defy historical patterns. And for some very savvy inflation pundits like Wharton finance professor Jeremy Seigel and DoubleLine's Jeffrey Gundlach, who believe that the Fed is behind the curve, it presents a quandary for investors who are seeking bond-related income.

Convertible bonds can present a smart alternative, as the market is affected by the forces of Fed policy, inflation and rising gross domestic product (GDP). It makes sense to be flexible and willing to move into the right asset classes, as the investing landscape characteristics are going to change due to the fact that we are coming out of a pandemic in such an uneven manner.

For the uninitiated, convertible debt is either a convertible bond or a convertible preferred stock. On their own, pure convertibles serve as a low-yielding class of income security that would normally not satisfy the yield-hungry income investor. The way in which we can exploit this sector and still maintain a high yield is to invest in closed-end funds that combine convertible securities with high-yield bonds and some leverage, thereby capturing some juicy yields and taking full advantage of the stock market's upside.

Very simply, a convertible bond can be converted into the company's common stock at a given strike price. That means you can exchange the bond for a predetermined number of shares. The conversion ratio will vary from bond to bond, but you'll find the terms of the convertible (such as the exact number of shares or the method of determining how many shares the bond is converted into) in the bond's indenture.

For example, a conversion ratio of 50 to 1 means that every bond (with a $1,000 par value) you hold can be exchanged for 50 shares of stock. If a $1,000 convertible bond is convertible into 50 shares of stock, the parity price of the stock is $20. If the stock moves up to $25, then for the stock and bonds to remain at parity, the bonds would have to be trading at $1,250. A convertible bond provides the performance attributes of common stock and the long-term safety of a bond with a fixed maturity. | | Five Ways to Save Your Account BEFORE the Market Gets Ugly Again Do you know how to tell before the bottom drops out of the market? In this brand new, FREE, e-book, you'll learn five tips, tools, and strategies that can keep you from costly losses during dips and corrections... and save your account before a meltdown.

Get the full story by downloading Five Tips for Overcoming Market Volatility. Because not only will these strategies let you sleep soundly at night... they will keep your money growing while they're protecting it! | | | One risk associated with convertibles is that most are "callable" at the company's discretion, which can limit upside opportunity. When a bond is converted to common stock, the corporate debt is reduced. What was formerly debt is now converted to equity. Of course, converting debt into stock has the effect of diluting the company's equity.

The upside of the convertible bond comes from its common stock component. Meanwhile, downside protection comes from the cash coupon, fixed maturity and status in the capital structure.

I like the convertible securities market because it addresses the desires of both bond and equity investors. For equity-oriented investors, convertibles can be viewed as a stock with a put option.

The downside protection of the convertible comes from its higher-yield, fixed-maturity value and status in the capital structure, all of which combine to give the security some real advantages.

Investors may want to consider looking into closed-end convertible funds with monthly payouts at www.cefconnect.com for more information. A few sample funds include:

Calamos Dynamic Convertible & Income Fund (CCD), currently yielding 7.75%

Gabelli Convertible & Income Securities Fund (GCV), currently yielding 7.51%

Advent Convertible & Income Fund (AVK), currently yielding 7.47%

Virtus AllianzGI Diversified Income & Convertible Fund (ACV), currently yielding 5.89%

Ellsworth Growth & Income Fund (ECF), currently yielding 3.49% | | Sincerely,

Bryan Perry

Editor, Cash Machine

Editor, Premium Income

Editor, Quick Income Trader

Editor, Breakout Profits Alert

| | About Bryan Perry:

Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. | | | | | |

Tidak ada komentar:

Posting Komentar