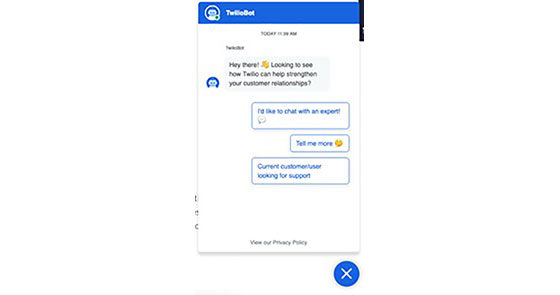

Dear Reader, If we needed more evidence that the pandemic is coming to a rapid end in the U.S., we need not look any further than what is happening in the theme park industry. After all, what could be worse during a pandemic than thousands of children in a crowded space yelling and screaming in happiness and joy? As it turns out, the risks of children having a good time were nothing at all to be concerned about. As we now know, there is not a single documented case of a child transmitting COVID-19 to a teacher. And research has also shown that children have extremely low transmission rates – they just aren’t the spreaders that some had us falsely believe. Children were never at risk, nor were they a risk to adults. So it is great news that Disneyland is already testing its rides in California in preparation for its April 30 reopening. That’s just weeks away. And it’s not just Disneyland. Universal Studios Hollywood announced that it is opening up on April 16. Six Flags Magic Mountain opens its gates tomorrow. Even Legoland in Carlsbad opens on April 15. Yet in a stark contrast, Disneyworld in Florida reopened last July and stayed open the whole time. Incredible! Was it a disaster? Not even close. How were they able to do it? Well, the radically different policies between California and Florida couldn’t be more obvious. California adopted strict lockdown policies, shut down its schools, enforced curfews, and maintained mask mandates. Florida, on the other hand, based its policies on scientific research. Although city and county-level mandates exist, the state never issued a mandate for masks. And it worked hard to keep both its schools and economy open for business. Which state fared better with regards to managing COVID-19? Florida came out on top. It had significantly less COVID-19-related deaths per 1 million population. It even had less hospitalizations. And all of this despite the fact that it has a much higher percent of its population 65 years and older… the most at risk part of the population. California’s heavy-handed mandates and restrictions made things worse – not better. Yet the long-term negative impact will be even more dramatic. The damage done to children in California by keeping the schools closed for so long will have irreparable lifelong repercussions. That won’t be the case in Florida. Florida’s economy is thriving, with more people flocking to the state. And the opposite is happening right now in California. Children come first. California’s policies failed, and I hope that we’ll all learn a lesson from best and worst practices as all this comes to an end. As for me, I’m cheering for the kids. I can’t wait to hear their shouts, hollers, and screams of joy in parks of all kinds. Better yet, Legoland and Disneyworld are on my list. I can’t wait to get down to Orlando to enjoy the Star Wars: Galaxy’s Edge attraction. It’s for my boys, of course… and maybe I’ll have a little fun too… And while the pandemic has had lots of terrible effects on society, there's one good thing that's come out of all of this. The pandemic has finally allowed one $11.9 trillion industry to cut through all the red tape that's been holding it back... and begin its digital leap. In fact, I think this might be the last digital leap to occur... which means investors definitely don't want to miss it. To find out all the details... and the best way to play this leap, go right here to sign up for my event. It's airing next Wednesday, April 7, at 8 p.m. ET. I hope to see you there! Spring is here! Now let’s turn to today’s insights… | Recommended Link | Jeff Brown's SHOCKING Confession For three decades, Jeff Brown has been both a highly respected angel investor and a high-level tech executive. Recently, as part of his work, Jeff received some shocking news. Instead of wallowing in despair… He considers himself lucky, and he wants to share why. Jeff believes the technology that revealed this startling information is set for a decade-long bull run. And he wants to show you how you can profit from that wave. | | | | | -- | 5G is coming to more rural areas… The Federal Communications Commission (FCC) just voted to move forward with another spectrum auction to support the fifth-generation (5G) wireless network build-out. This comes on the back of the largest spectrum auction in history last December. All wireless networks are deployed over radio spectrum, and each wireless carrier must strategically acquire that spectrum over time. These auctions are the primary way that is done. The auctioning of spectrum is a managed process in order to ensure that radio frequencies are dedicated for specific uses. This is done to avoid any interference of two different wireless services using the same frequency. And for each new generation of wireless technology, it typically takes a few years for wireless carriers to patch together spectrum across the country, enabling them to build their nationwide networks. Elites Moving to Desolate Islands – Why? That’s why the previous spectrum auction was the largest in history. The wireless carriers are scrambling to cobble together spectrum to build their 5G networks. Collectively, they bid $80.9 billion – more than doubling many analyst estimates. And as we might expect, Verizon and AT&T dominated the auction. Verizon bought $45 billion worth of spectrum. And AT&T shelled out $23 billion. That means these two giants scooped up 84% of all the spectrum that was auctioned off. To prevent this from happening again, the FCC’s next auction will follow different rules. For one, there will be an aggregation limit. Companies will only be able to bid on a limited amount of spectrum in any given geographical area. That will give the regional wireless companies a shot at acquiring spectrum in their coverage areas. The other rule is that any entity that wins spectrum must begin building a 5G network within a strict time frame. That’s the catch. If you bid and win, you must build. This was done to discourage investment companies and private equity firms from buying spectrum to take it off the market. We’ve seen that happen before. Investors win spectrum and sit on it for a few years. Then they sell it to AT&T or another wireless service provider at a profit. That’s a win-lose game – and consumers are on the losing end. Together, these two new rules ensure that smaller wireless carriers will finally have a shot at acquiring spectrum to build out regional or even rural 5G networks. That’s right – 5G will be coming to rural areas soon. I think this is a smart approach to the upcoming auction, which is set for October. This will go a long way toward making 5G truly nationwide. And this is something that I’ve written about before. The large wireless carriers always start by focusing their network build-out in dense urban areas because that is where the majority of the customer base is located. In time, they extend their construction to smaller cities and towns to extend the new wireless networks. This coming October auction, however, is the kind that typically happens toward the end of the process. This signals to us that the available spectrum for 5G is almost entirely allocated. Wireless network operators have what they need to build out their networks. There is always a bit of horse trading that goes on in the secondary markets after that. But in general, most companies get down to business on building their infrastructure. That’s exciting. While 5G networks have been launched around the world already, it will still take another two or three years of record investment to build out the core 5G networks. And 5G network construction around the world will continue for at least another five years. In other words, we’re still in the thick of it right now. And that means the companies supplying the key infrastructure components still have plenty of room to run. We’ve made big gains on these companies in The Near Future Report and Exponential Tech Investor, and we’re not done yet. If new readers want to find out the best ways to profit from this trend, go right here to learn more. AI chat bots are disrupting the customer service industry… I recently came across an interesting report on artificial intelligence (AI)-enabled chat bots that caught my eye. It turns out that AI chat bots have skyrocketed in popularity over the past 12 months. This is more evidence that the COVID-19 pandemic has reshaped our world. AI chat bots use natural language processing to learn how to answer common customer service and sales questions. They are deployed through a text window on a customer-facing website. Tech Expert: "S.A.V. Will Be Huge" This is something that I’m sure many readers have encountered before. Sometimes the AI chat bot will even pop up on a site and invite us to ask it a question by typing into the text box. It is usually located in the lower right hand corner of our screen, and it appears to be someone with a human name… Here’s an example of what a chat bot looks like: Twilio Chat Bot

Source: Twilio On a retail consumer website, examples of some common questions are: -

“What’s your return policy?” -

“What does the size chart look like?” -

“Where do I find my bill?” AI chat bots are perfectly suited to handle basic questions like these. And unlike a human representative, the AI can respond instantly. Before the COVID-19 pandemic, consumers used AI chat bots less than 10% of the time. They preferred to speak with a customer service agent over the phone or send an email. Fast forward to today, and consumers are using AI chat bots about 25% of the time. And analysts predict that this will rise to around 35% by year-end. We are witnessing a clear and dramatic shift in consumer preferences. People have become much more willing to use a chat window to get their questions answered than they were just a year ago. To me, this suggests that we have become much more comfortable interacting and doing commerce from behind a keyboard. And many have realized that this is faster, easier, and even results in a better outcome in most cases. We can resolve things more quickly through a chat window than with a phone call. This is a trend that will definitely continue. I have watched this industry closely over the last three years. At first, the AI chat bots weren’t very good. They had a hard time providing relevant answers. But the technology has improved exponentially since then. I wouldn’t be surprised if AI chat bots handle half of all customer service inquiries by the end of next year. And that means we are going to see a drastic shift in the customer service industry going forward. | Recommended Link | | Huge Monetary Shift Happening Now Under Biden Some of America’s biggest companies like American Airlines use an elite-controlled “world money”… instead of U.S. dollars. Also the U.S. House of Representative passed a new bill that could circulate this new currency ASAP. If this major monetary shift goes through, it could cut your retirement account, your savings, and property value immensely… And potentially erase your way of life in one fell swoop. It would be another failed fiat currency pushed by elites. | | | -- | Visa is expanding its plans for cryptocurrency… In a recent interview, Visa CEO Alfred Kelly revealed some interesting details about the company’s plans for cryptocurrency. In short, Visa is going to allow customers to buy bitcoin directly. And it will allow all merchants who accept Visa to also accept bitcoin payments. We’ve talked before about how Square was the first to enable its customers to buy, sell, and hold bitcoin. Square rolled out this functionality to the Cash App several years ago. Then PayPal and MasterCard got into the mix. Both companies announced last month that they would enable merchants on their network to accept bitcoin payments. Now Visa is catching up. It is building out the infrastructure to enable custodial wallets for its customers. We can think of these as accounts that are secured and managed by Visa. We don’t know all the details around this yet, but I’m sure the system will include high transaction fees from Visa. The company already makes a fortune on credit card fees by taking a 1.4–2.4% cut of every credit card transaction made. It’s a given that Visa will try to impose this model on the cryptocurrency space as well. I suspect it will likely be even higher given that the company will have to work with a digital asset exchange to enable this functionality. And here’s what’s most interesting about Kelly’s comments – Visa is also working with 35 different “fiat-backed cryptocurrencies.” What he’s referring to are stablecoins. These are digital assets backed one-to-one with a state-issued currency like the U.S. dollar. Or they could potentially be tied to a basket of national currencies, which is what Facebook had originally envisioned with its own plans for a digital currency. So it’s not just bitcoin. Visa is also building out the infrastructure to support stablecoins. There’s an underlying motive here… All this infrastructure can be used to support the inevitable launch of the Federal Reserve’s central bank digital currency (CBDC). This will be a blockchain-enabled representation of the U.S. dollar. Except it will be 100% controlled and managed by the Federal Reserve, unlike other cryptocurrencies. And all this activity around payment infrastructure is an obvious sign to me that the private markets are actively preparing for this eventuality. It is also a not-so-subtle sign that the Fed’s CBDC is coming faster than people think. Moves like these are why I see state-backed digital currencies as inevitable. That said, we shouldn’t miss the bigger picture. The rise of digital currencies will also raise the profile of blockchain technology. And investors positioned in a handful of blockchain stocks could see triple-digit returns in the years ahead. I’ve outlined my favorite blockchain investments in a free presentation. You can watch it right here. Regards, Jeff Brown

Editor, The Bleeding Edge P.S. Don’t forget to reserve your spot for our investment summit next week. It’s taking place on April 7 at 8 p.m. ET. As regular readers know, our world has increasingly moved from “analog” to “digital.” I’m sure most readers can remember the days when we watched movies at home by popping a “tape” into the VCR. And we made phone calls by dialing the numbers on our old rotary phone, waiting for it to spin around before picking the next number. Some may even remember the old ticker tape that tracked stock market activity on little strips of paper. The old stock quotes in the newspaper came directly from this tape. Of course, today we stream movies directly to our TVs, phones, and tablets through services like Netflix. We make phone calls by tapping a digital keyboard on our smartphone’s touchscreen. And stock market activity is streamed directly to a host of websites and smartphone apps for everyone to see every minute of every trading day. What happened in each of these instances was what I call a “digital leap.” That’s when an industry jumps from analog to digital. It transitions to the newest technology available. This process dramatically improves the industry and its products, all while improving the consumer experience. That in turn leads to higher profits for companies in the industry. And that results in fantastic returns for investors. Everybody wins. What I want to talk about next week is the last major industry that’s still largely operating in analog mode today. We’re going to talk about an $11.9 trillion industry that hasn’t taken its digital leap… yet. That’s because this industry has been chained down by red tape, bureaucracy, and manual processes. However, the COVID-19 pandemic has broken those chains almost entirely. And that means this industry is finally ready to make the leap. This could very well be the last major industry to undergo a digital leap in our lifetimes. While the efficiencies gained here will improve our lives in so many ways, what we are going to focus on next week is this incredible investment opportunity. To illustrate this, think about what would have happened if we had recognized the movie rental industry’s digital leap ahead of time. Blockbuster Video went bust in 2010. Had we seen the industry’s digital leap coming, we could have purchased Netflix (NFLX) for around $7.30 per share at the start of that year. Fast forward to today, and NFLX trades around $508 per share. That’s a 6,859% gain – enough to turn every $5,000 invested into $347,945. And these gains were available to investors who just got on board in 2010. Anyone who invested in Netflix when it went public in 2002 has made more than 43,000%. That’s the kind of opportunity we’re talking about here. That’s what investing early in a digital leap can do. So please mark your calendar for our investor summit on Wednesday, April 7. That night, I’ll pull back the curtain on what I see happening,and how we need to position ourselves for it. We’ll get started at 8 p.m. ET sharp. As always, the summit is free to readers of The Bleeding Edge. I just ask that you reserve your spot right here.

Like what you’re reading? Send your thoughts to feedback@brownstoneresearch.com.

In Case You Missed It… Welcome to an empire of debt Our credit system is currently sitting at $68 trillion. It's the largest debt ceiling in the history of the world – in fact, it's more than twice the value of every single home in America put together. It's the most crucial part of our economy. And despite stagnant wages and rising costs, America still appears to be getting richer and richer (at least on paper). And there's the problem… This massive credit system is about to collapse. But this system has a dark secret about where it’s going to get money to pay off this massive debt. This will affect EVERY American citizen! Click here before it's too late.

|

Tidak ada komentar:

Posting Komentar