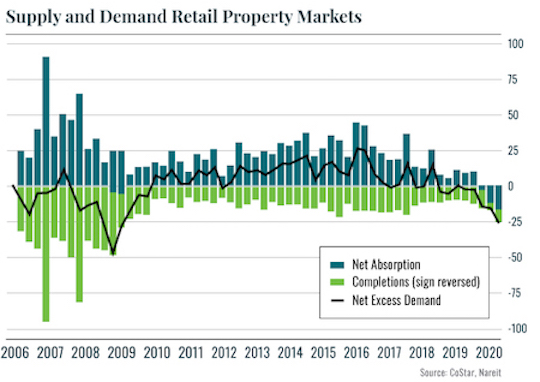

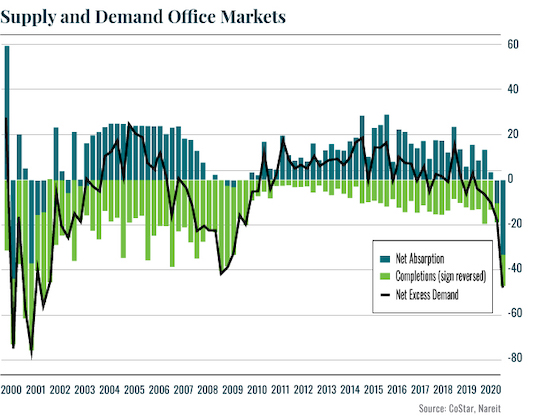

| Retail commercial real estate has experienced NEGATIVE net absorption for two consecutive quarters (the second and third quarters) this year. [Ed. Note: “Net absorption” is the net change in physically occupied space between the current measurement period and the previous measurement period.] This has led to the largest decline in net absorption since the first quarter of 2009 during the Great Recession. NAREIT’s chart shows the trend is clearly DOWN since 2019. The shutdown from this year (2020) has accelerated the drop.  Retail is not the only market suffering. The shutdowns have also resulted in a collapse in demand for office space as well, as many companies switch to “working from home” permanently. The collapse in demand here is even worse than that of the 2008-2009 bust.  The Fed can’t fix this either. Many are these companies are either too big to qualify for the Main Street lending program or their debt is too distressed to qualify for the Primary Market Corporate Credit Facility. The fallout from this sector of the economy alone has yet to be digested. If you’ll recall, large banks and financial entities gave a 60-day loan forbearance to their commercial real estate clients from late April to late June of this year. Once that period expired, everyone went into “wait and watch” mode for the Presidential election. (Management teams wanted to have an understanding of the regulatory/ policy landscape before posting their losses/ loan write-downs.) What Does This All Mean? That the U.S. economy appears to be heading towards another potential lockdown right as the banks and other “bad loan bag-holders” make a move to finally declare the damage from the FIRST lockdown. I’ve done more extensive research about the potential impact the first COVID-19 lockdown is still waiting to inflict on the economy. I’ve also put together four (what I call) “crash-proof” strategies for when it comes. To check out my full report and more (including my warning letters to President Trump, Vice-President Pence and Fed Chairman Powell) CLICK HERE… Best Regards,

Graham Summers

Editor, Money & Crisis |

Tidak ada komentar:

Posting Komentar