Market News: |

Gold hit an all-time high of $5130 Salesforce wins $5.6B U.S. Army 10-year Indefinite Delivery Indefinite Quantity (IDIQ) contract Micron invests $24B in Singapore to expand its manufacturing capability Insurers sink as Trump proposed roughly flat rates for Medicare insurers next year Apple is developing a wearable AI "pin," Apple Link, that could arrive as soon as 2027 Missed silver's boom? Here's what's next (ad)

|

|

Precious metals reached historic all-time highs.

Gold surges past $5,130 per ounce. |

Silver just did something it hasn't done in over 40 years: it hit $117 per ounce, smashing through every previous record. |

Retail investors are celebrating. |

Mining stocks are up 400%. |

Bank of America is talking about $309 targets. |

But one of the most respected strategists on Wall Street just predicted an "almost guaranteed" 50% drop. |

This is the story |

|

The Numbers Tell Two Different Stories |

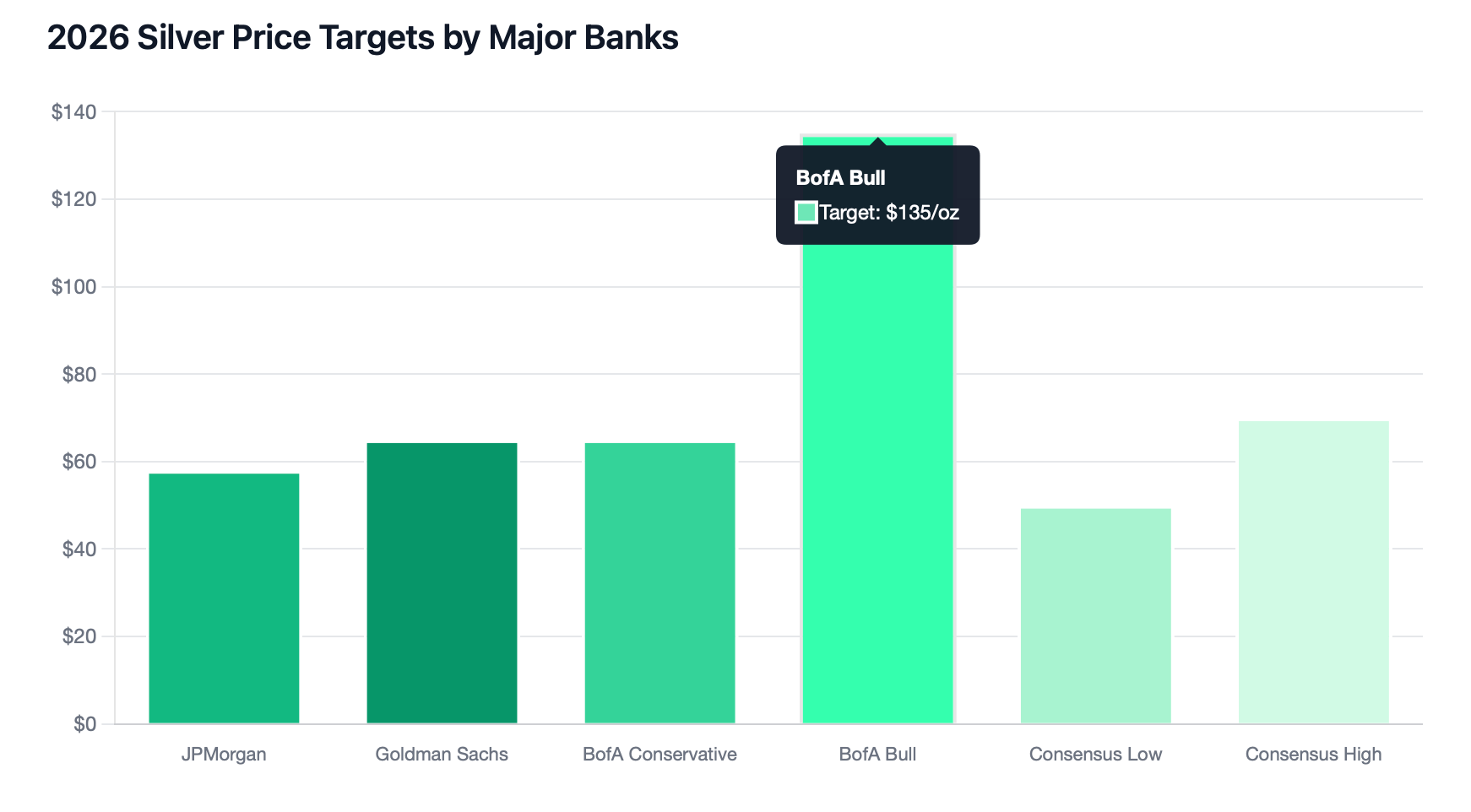

Let's look at what the major banks are actually saying about silver right now. |

Major Bank Silver Price Targets for 2026 |

| Bank research reports, January 2026 |

|

Those are the official forecasts. But Kolanovic's warning cuts through all of it. He's betting on mean reversion, hard and fast. |

| | | | What breaks first in silver? | |

| |

| | |

|

| | Tesla Proved AI Can Move Cars. This Company Proves It Can Move Markets. | Missed Nvidia? Missed OpenAI? This is your chance to get in early, and well before the crowd. RAD Intel is redefining how brands use AI to target customers—with technology so sharp, it's already trusted by Fortune 1000 brands with recurring seven-figure partnerships in place. | Their secret? AI that finds the exact audience and message that converts. That's why Adobe and Meta insiders are already in. The company has reserved its Nasdaq ticker and shares are available now for just $0.85. | When RAD Intel goes public or gets acquired, it won't be available at this price again. Time's ticking -- the share price changes soon. | $0.85 won't last. | Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai. |

| | |

|

|

Why Silver Went Parabolic |

To understand where we're going, you need to know how we got here. |

Silver started 2025 around $29 an ounce. By year-end, it was trading near $81. That's a 180% gain. Then January 2026 hit, and things got wild. The metal smashed through $100, then $110, setting new all-time highs almost daily. |

Three big forces are pushing it up. |

First, industrial demand. Solar panels eat up silver. AI chips need it. Electric vehicles use it. More than half of global silver demand now comes from industry, not investment. |

Second, there's a supply problem. The Silver Institute projects a fifth straight year of structural deficits. Mines can't keep up. London vaults are running low. Physical outflows have been constant. |

Third, the macro picture. When investors don't trust currencies, they buy hard assets. With Trump talking tariffs, the Fed's independence questioned, and fiscal spending out of control, precious metals look safer than bonds or cash. |

Silver's current rally reflects intense safe-haven and investment demand, as well as a prolonged tightness in the physical market. |

|

The Silver Mining Stocks |

If you want to play silver without buying bars, the mining stocks are where the action is. Here's what the top names look like right now. |

Silver Mining Stocks Performance Overview |

|

Pan American Silver $PAAS ( ▲ 0.5% ) is the steady hand here. It's the world's premier silver producer, with operations across North and South America. The company just closed a $2.1 billion deal for MAG Silver, adding the high-grade Juanipio mine to its portfolio. |

First Majestic $AG ( ▲ 1.1% ) is the momentum play. The stock's up more than 380% in a year, but it's also trading at 209 times earnings. The company completed its Gatos Silver acquisition in early 2025, which boosted production by 39% year-over-year. |

Wheaton Precious Metals $WPM ( ▲ 1.16% ) takes a different approach. It doesn't mine anything. Instead, it buys streaming contracts, giving miners cash upfront in exchange for future silver deliveries at fixed prices. When silver prices surge, Wheaton's profits explode. |

|

The Bull Case |

|

The bulls have real arguments. |

Start with supply and demand. The Silver Institute forecasts continued deficits. Mining output is flat. New projects take years to develop. Meanwhile, solar panel installations are accelerating globally. Every AI server uses silver. EVs need it in batteries and electronics. |

Bank of America's most bullish case sees silver hitting $309 if the gold-to-silver ratio returns to historical norms. Right now, it takes about 50 ounces of silver to buy one ounce of gold. Historically, that ratio has been closer to 40 or even 30. |

If gold hits $6,000 and the ratio tightens, the math gets wild fast. |

Then there's the monetary angle. Central banks have been buying gold by the ton, trying to reduce dollar exposure. Some analysts think silver is next. It's cheaper, more liquid for smaller transactions, and has that same "hard money" appeal. |

Bull Case Key Points: |

Fifth consecutive year of supply deficits expected in 2026 Industrial demand from solar, AI, and EVs continues growing U.S. Department of Interior designated silver as a critical mineral Gold-to-silver ratio suggests potential for significant upside Safe-haven demand accelerating amid currency concerns

|

|

The Bear Case |

Now let's talk about why Kolanovic thinks this ends badly. |

His argument is simple. Speculative manias don't end gently. They pop. And silver has all the warning signs. |

Look at the positioning. Retail investors are flooding into silver ETFs. The iShares Silver Trust has seen massive inflows. So has the Sprott Physical Silver ETF. When everyone's on the same side of the boat, that's usually when it tips over. |

Kolanovic points to history. In the 1970s, gold rallied from $40 to $200. Everyone thought it would go to the moon. Instead, it crashed back near $100. Many investors who bought the top got wiped out. Only later did gold eventually reach $800. |

The same pattern played out in 2011. Silver hit $48.70, then collapsed by more than 60% over the next few years. The industrial demand story was real then too. It didn't stop the crash. |

"Silver is not gold. It's gold with beta—and beta cuts both ways. When positioning unwinds, it unwinds violently." |

Kevin Muir, a contrarian trader, recently said silver may have already peaked. His argument: silver stalled while gold kept rallying. That's often how tops form. |

|

Key Historic Silver Surges |

1979–1980 (The Hunt Brothers Squeeze): Silver rose from roughly $6 to nearly $50 an ounce (an over 700% increase) in less than two years, driven by the Hunt brothers' attempt to corner the market. 2011 (Post-Financial Crisis): Following the 2008 crash, silver prices soared, nearing the $50 mark again, driven by inflation fears and investment demand.

|

| | Musk + Huang Agree: This Will Change Everything | Investors rarely get moments like this. | Elon Musk didn't hint. He didn't tease. He recently said it outright: robots will be the biggest industry on Earth. | Bigger than phones. Bigger than cars. Bigger than the internet boom. | Jensen Huang is backing him up, calling accelerated computing the new backbone of civilization. Tens of millions of robots. Massive AI factories. Self-driving trucks. A total reshaping of global power. | And one company is positioned right at the epicenter of this shockwave. | Before this erupts—see why early investors are already sprinting in. | *ad |

| | |

|

|

What About Gold? |

You can't talk about silver without looking at gold. And gold's story right now is just as dramatic. |

Gold surged roughly 65% in 2025. That's the biggest annual gain since 1979. And most major banks think it's going higher. |

Goldman Sachs just raised its target to $5,400, up from $4,900. The bank says this isn't a short-term fear trade anymore. Investors are treating gold as insurance against long-term risks like debt levels, policy uncertainty, and central bank independence concerns. |

Central banks are the big story. Emerging market central banks bought nearly 1,000 tonnes per quarter in 2025. That's 50% higher than the previous four-quarter average. China, India, Turkey, and Poland have been the biggest buyers. They're diversifying away from the dollar, and gold is where they're going. |

JPMorgan forecasts central banks will buy around 585 tonnes per quarter in 2026. Western gold ETFs added 500 tonnes in early 2025 alone. Record inflows of nearly $89 billion pushed holdings to all-time highs. |

| ❝ | | | "We continue to lean on the relationship between tonnes of quarterly investor and central bank demand and prices to derive our gold price forecast. Around 350 tonnes or more of quarterly net demand is needed for gold prices to rise each quarter. Every 100 tonnes above 350 is worth around a 2% quarter-on-quarter rise in the price of gold." | | | | Gregory Shearer, Head of Base and Precious Metals Strategy, J.P. Morgan |

|

|

|

So What Should Investors Do? |

This is the tough part. Both sides have credible arguments. |

If you're bullish on silver, the industrial demand story is real. The supply deficit is real. The safe-haven flows are real. But you have to accept that volatility comes with the territory. Silver can drop 20% in a week and nobody blinks. |

If you're worried about Kolanovic's warning, history is on your side. Mean reversion is powerful. But timing it is nearly impossible. He's calling for a 50% drop "within a year or so." That's a wide window. |

The middle path might make the most sense for most investors. If you don't own any silver, maybe don't chase it at $117. Wait for a pullback. If you already own it and you're sitting on huge gains, consider taking some profits. Lock in the win. |

|

The Bottom Line |

Silver just hit $117. That's historic. But whether it's the start of something bigger or the top of a bubble, nobody knows for sure. |

Wall Street is split. JPMorgan's official research team sees $58 by year-end. |

Bank of America sees a path to $135 or even higher. |

But Marko Kolanovic, one of the most respected strategists of the past decade, says it's headed for a 50% crash. |

Gold's probably heading higher. The central bank buying is structural, not cyclical. The debt concerns aren't going away. The geopolitical risks aren't fading. Most targets cluster around $5,500 to $6,000 for late 2026, with some models going higher. |

But silver is different. It's more volatile. It's more industrial. It's more tied to economic cycles. And it's more loved by retail speculators. |

Maybe this time really is different. Maybe the industrial deficit and AI demand push silver to $150. Maybe the gold-to-silver ratio closes and we see $200. |

Or maybe Kolanovic is right. Maybe this is 1980 all over again. Maybe everyone piling in at $117 ends up learning a painful lesson about momentum trades. |

Either way, the next six months should be wild. |

|

| | | | Quick ratingHow was this one? | |

| |

| | |

|

Disclaimer: This analysis is for educational purposes only and should not be considered investment advice. Always do your own research before making investment decisions. |

Items marked with an asterisk (*) are promotional and help support this newsletter at no cost to readers. |

Tidak ada komentar:

Posting Komentar