$10K Investment in Nvidia Could've Made $2.5M | Imagine investing $10K into Nvidia a decade ago—today that's $1.25M. That's the power of getting in early on the right startup. We think RAD Intel is next. They're applying AI to solve a problem every marketer faces: how to reach the right audience with the right message. Backed by Adobe, Fidelity Ventures, and already in use by Fortune 1000s - this company's valuation has soared 4900% in just 4 years*. | RAD Intel's software is built for AI 2.0: intelligent targeting that powers real ROI. They've already reserved a Nasdaq ticker symbol, $RADI and this is a rare opportunity to get in on a high-growth | | | | | AI software company at the ground floor. | The company is offering shares at just $0.85 right now. | Don't let this be another "I wish I had…" moment. The opportunity is now. | 👉 Lock in $0.85 shares today

| |

|

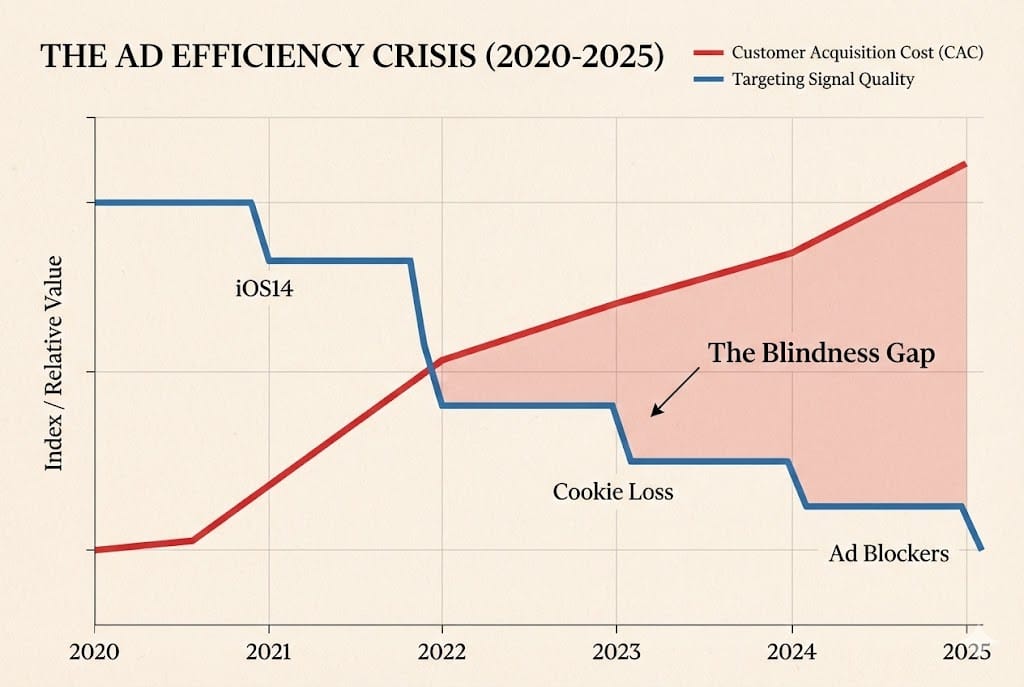

| | | Platforms like RAD Intel didn't disrupt the old model — they became necessary the moment the old model stopped working. | Why Targeting Broke | For nearly two decades, digital advertising rested on a stable assumption: if you could identify a user, you could persuade them. Retailers, SaaS companies, and global brands built entire acquisition models around that simple premise. A pixel fired, a profile updated, and the machine moved on. | In 2025, that foundation is gone. | The shift did not arrive as a dramatic regulatory shock. It unfolded slowly—browser by browser, update by update—until the underlying logic of performance marketing simply stopped functioning the way it once did. | The clearest example is Google's much-discussed decision to pause the full phase-out of third-party cookies in Chrome. Many interpreted this as a reprieve. But the industry data shows something different: even without a formal deprecation, the signal that once powered targeted advertising has already eroded beyond repair. | Safari and Firefox, representing roughly 30–40% of global traffic, block cross-site trackers by default.

Apple's App Tracking Transparency, which shifted tracking from opt-out to opt-in, reduced mobile tracking rates from 74% to just 17%.

Ad blockers strip away another quarter of what remains. | Blend these forces and a stark picture emerges: for much of the open web, advertisers can no longer reliably identify more than half of their potential audience. The system still delivers impressions, but the informational scaffolding behind them has collapsed. | This is how 2025 rewrote the rules — not through legislation, but through disappearing visibility. | The Economic Consequence | When identification fails, efficiency follows it. | Customer Acquisition Costs (CAC) have risen sharply—60% over the last five years by several industry estimates. The inflation is not limited to any one channel: social CPMs in key video segments are up 40–60% year-over-year, while search and shopping ads show similar pressure. Companies are not spending more because they want to, but because blind bidding is replacing targeted reach. | A growing number of CFOs now acknowledge that their most reliable models no longer hold. The familiar ratios—"spend $1 to generate $3"—are struggling to survive in an ecosystem where each incremental unit of spend buys less certainty. | This is the first major advertising cycle in which businesses must solve for performance without the visibility they once depended on. And it is pushing capital toward an entirely new class of tools. | |  | As signal quality drops due to privacy changes, the cost to acquire a customer (CAC) has spiked by 60%. |

| | The Rise of Contextual Intelligence | If you cannot identify the person, you must understand the moment. | This is the premise behind the rapid investment into Contextual AI—a shift from looking at "who the user is" to analyzing "what the user is doing right now." | The technology is not speculative. It combines modern natural-language processing, sentiment detection, and visual recognition to interpret what appears on the screen at the exact instant the ad is delivered. | A generational shift is underway: | Old model: target the person through behavioral history.

New model: target the moment through contextual alignment and predicted attention. | Contextual intelligence has moved from a fallback strategy to a primary growth driver. Studies across large publishers now show that well-trained contextual engines can match or exceed behavioral approaches—while remaining immune to privacy restrictions. | This shift is playing out across Fortune 500 budgets. Companies are increasingly valuing "durable signals"—context, attention, sentiment—not because they prefer them, but because these signals still exist. | And they scale. |

|

|  | | | Presented by Rad Intel | |

|

|

|

|

|

|

|

| The Attention Turn | If the early 2020s were about removing identifiers, 2025 is about replacing them with a more stable form of prediction: attention. | Major studies from 2024–2025 indicate that high-attention inventory produces materially better outcomes across brand lift, recall, and downstream conversion. One multinational beverage campaign using predictive eye-tracking achieved 5× higher attention and more than doubled recall compared to standard benchmarks. | Attention is becoming a currency—measured, forecasted, and priced. | This is not just an agency trend. Platforms themselves are reorganizing around predictive systems: | Meta's automation suite now accounts for tens of billions in annual ad delivery. Google's Performance Max captured over 80% of shopping ad budgets in some segments. Retail media networks are using proprietary data to train predictive rankers that outperform manual bidding.

| Underneath these systems lies the same structural truth: the algorithms now see more than human planners can, even in a world with less data. What they lack in identity, they regain through pattern recognition. | The result is a marketing landscape where creativity, context, and prediction converge—and where efficiency depends on the engine rather than the audience list. | |  | AT THE NASDAQ, JEREMY BARNETT, CEO OF RAD INTEL, SHARES HOW 14 YEARS OF AI INNOVATION HELPS BRANDS AND AGENCIES "GUESS LESS AND WIN MORE" |

| The New Moat | A decade ago, the best-performing advertisers were those with the largest budgets and deepest behavioral datasets. | In 2025, advantage comes from something different: the ability to interpret incomplete signals with intelligent models. | This is the shift driving investment into AI-native marketing companies like RAD Intel—platforms built not on surveillance, but on prediction. Their value does not depend on tracking individuals. It comes from understanding patterns that remain stable even when identity disappears. | For investors and operators alike, the lesson is increasingly clear: the companies positioned for the next decade are not those trying to rebuild the old targeting infrastructure, but those designing tools that thrive without it. | As identity fades and predictive systems take over, the companies shaping this new layer of intelligence won't stay under the radar for long. The window between "early" and "visible" is often short. With a planned Nasdaq listing and the current $0.85 allocation, the asymmetry here is hard to ignore. | | 👉 Lock in $0.85 shares today |

|

| Did you find today's report useful? | |

|

| Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. Brand references reflect factual platform use, not endorsement. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai. | |

|

| | Written by Deniss Slinkins

Global Financial Journal |

|

|

|

Tidak ada komentar:

Posting Komentar