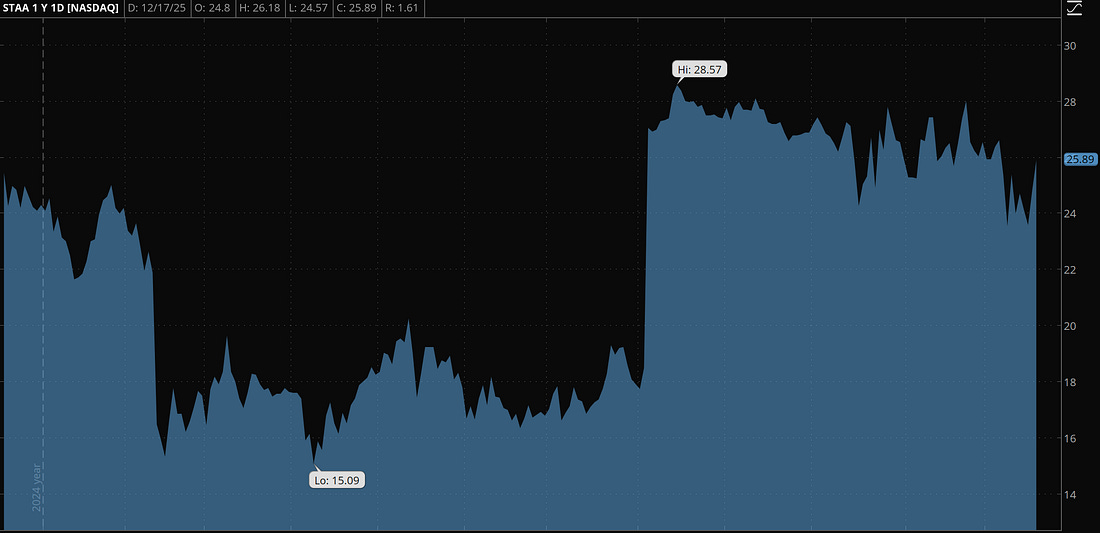

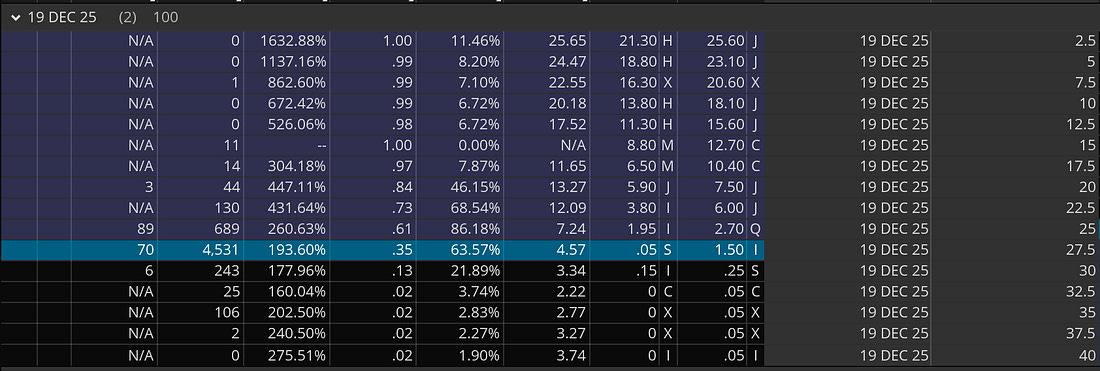

Wed, Dec 17 - 6:30 PM I must be missing something. Scanner flagged STAA today for 48-Hour Cashflow. Ideal setup with OTM puts expensive relative to realized. Had to look it up. Staar Surgical. Pending takeover, special situation. Alcon offered $30.75 per share. I used to know every ticker. This one didn’t come to mind. Must be getting old. But explains why the put premium is elevated. Stock’s at $25.05. Offer’s $30.75. That’s $5.70 if shareholders say yes Friday. I don’t remember seeing a special opportunity like this in a while. That much upside sitting there. Last one that comes to mind was Twitter. So I started digging. There’s a fight. Broadwood Partners owns 10%, thinks it’s worth more. Okay. So that’s why the spread’s wide. Market thinks Broadwood tanks the deal. But Broadwood’s been buying shares??? As recent as a few weeks ago? Had to think this through all scenarios. If they thought this deal was dying... why accumulate at $25? Stock without a deal could sink to what, $18? $15? I just don’t see the play. They have to be talking their book. Of course they think it should be more. But who the hell would want to watch their investment drop 50% first? And then wait how long for it to come back? And to what? No white knight’s shown up. No competing bid. Just press releases. Then there’s ISS who just said FOR the deal. Either I’m not seeing the blind spot or this is a screaming opportunity. But I’m not sure -- been sitting all day in front of the terminal. ISS says yes. Broadwood’s buying, not selling. And the market’s still pricing this like Friday’s a funeral. Started looking at the $27.50/$30 call spread. Costs around 30-50 cents. If deal passes, $27.50 calls go ITM by $2.50. Spread pays $2.20ish. 30 cents to make $2.20. In 24 hours. This seems like a screaming opportunity. Worst case, Broadwood flips before Friday? But with their position size they’d have to disclose within two business days. Nothing filed. Checked Twitter. Found the merger arb accounts. Went through SEC filings again. Nothing. Maybe everyone scared already sold. That’s why there’s $5.70 sitting there. Or I’m the idiot and there’s something obvious I’m not seeing. Last time I stared at something like this was Elon trying to back out of Twitter. All that noise about bots. I kept looking for the catch. The contract was the contract. I watched that one. Didn’t take it. Tomorrow I’ll look at it with fresh eyes again. About This Journal: Every entry documents what really happens at my desk. The losses, wins, and everything between. Josh Belanger's results are not typical and are not a guarantee of your success. Josh is an experienced investor and your results will vary depending on education, work experience, and background. Josh does not personally participate in every investment alert he provides. Due to sensitivity of financial information, we do not know or track the typical results of our students. Josh’ strategies may not always be accurate, and his investments may not always be profitable. They could result in a loss of an entire investment. We cannot guarantee that you will make money or that you will be successful if you employ his trading strategies specifically or generally. Consequently, your results may significantly vary from his. We do not give investment, tax, or other professional advice. Reference to specific securities should not be construed as a recommendation to buy, sell or hold that security. Specific securities are mentioned for informational purposes only. All investments involve risk, and the past performance of a security, industry, sector, market, financial product, investment strategy, or individual’s investment does not guarantee future results or returns. Investors are fully responsible for any investment decisions they make. Such decisions should be based solely on an evaluation of their financial circumstances, investment objectives, risk tolerance, and liquidity needs. |

Rabu, 17 Desember 2025

Either I'm Blind or This is a Layup

Langganan:

Posting Komentar (Atom)

Tidak ada komentar:

Posting Komentar