March 21, 2025

This AI Data Center Play Smoked the Market By 1,950%

Dear Subscriber,

|

| By Michael A. Robinson |

The Wall Street Journal recently scored an exclusive story about the boom in AI data centers.

Credit the Journal for scooping the rest of the financial media with a piece about a $2 billion loan for a new facility in Utah.

While that sounds like a lot of money, make no mistake. It’s less than 1% of what’s up for grabs here.

While everyone’s looking for the next hot AI stock, most are missing a great behind-the-scenes play.

The fact is, massive data centers are becoming the new gold mines of the digital economy.

And here’s the thing:

I’ve found a broad play in the AI data center boom that most investors haven’t even considered.

One investment … multiple data center players … and a single ticker that could capture the entire infrastructure revolution powering AI’s explosive growth.

If you think I’m overselling this opportunity, consider this:

Over the past six months, it’s crushed the S&P 500 by 1,950%.

Ready to learn more?

Amazon, Google, Meta — They All Want Data Centers

It was clear from WSJ’s article that we’re on to something here.

JPMorgan (JPM) and Starwood Property Trust’s (STWD) $2 billion loan for a 100-acre data center in suburban Utah was the latest sign of the market’s enormous appetite for facilities that provide the backbone of AI.

This facility will provide 175 megawatts of continuous power. That’s enough juice to power 175,000 average-sized U.S. homes.

The loan marks the second data center construction loan of more than $2 billion this year. It follows one in January for a facility in Abilene, Texas.

Now, lenders are starting to write bigger checks because data centers are getting much larger to serve AI, which consumes more advanced chips and more power.

Data centers are also increasingly getting commitments from big-name tenants before breaking ground, rather than building on a speculative basis.

Speaking of …

Tech companies like to locate their servers near large population centers, major fiber-optic networks, and other technology and telecommunications company servers.

But these markets run into power and land limitations, as well as public opposition.

Developers and “hyperscalers” including Amazon (AMZN) and Microsoft (MSFT) are now moving where they can find sufficient power, water and friendly local governments.

Meta (META), meanwhile, is planning a $10 billion data center in Louisiana. And Google (GOOGL) broke ground last year on a pair of data centers in South Carolina.

According to Goldman Sachs (GS), the AI infrastructure market is projected to reach $200 billion by next year.

Goldman also estimates that companies will need to spend more than $50 billion a year on AI-specific data center infrastructure.

And that’s just to keep pace with demand from cloud providers, tech giants and emerging AI applications.

What Kind of Infrastructure?

This term encapsulates the physical and virtual resources required to support AI workloads.

They’re designed to provide the necessary computational power, storage, networking and reliability to handle AI model training and operations.

Things like high-performance computing systems, data storage solutions, high-speed networks, graphics processing units, liquid cooling systems, machine-learning platforms, and cybersecurity programs are all examples of data center infrastructure.

And now I want to introduce you to a company that’s poised to lead the data infrastructure revolution.

The Original IT King

Founded in 1984, Cisco Systems (CSCO) began with a focus on creating routers to connect different computer networks. This helped businesses share data more effectively.

The company was a leader in the original web revolution, becoming a key player in the early days of the internet.

Today, Cisco Systems is a global leader in IT and networking solutions, serving customers across various sectors including healthcare, education and government.

And its market cap stands near $250 billion.

Funny enough, despite its prestige, this company isn’t exactly beloved on Wall Street.

It’s been flying under the radar of late and racking up big returns while building out its franchise.

In 2024, Cisco acquired cybersecurity and analytics company Splunk for $28 billion. The deal reflected Cisco’s efforts to remake its business around data and AI.

Through the deal, AI was to be woven into the combined companies and used to help customers draw correlations among intelligence coming from various vendor platforms.

That way, they could take a more predictive approach to cybersecurity.

Cisco also aimed to launch more capabilities to make use of generative AI — using AI to create content — to simplify its software and make it easier for people without technical training to operate the tools.

Crushing The S&P And NVDA

As a reminder, Cisco led the first web revolution in the early days of the internet. And apparently, it’s been written off as a relic by many an investor.

But this isn’t your dad’s Cisco.

It’s a multibillion-dollar giant that’s keeping up with the latest trends and investing heavily in the AI revolution — thanks in large part to its work with AI data centers.

The stock is running rings around the broader stock market. In fact, when big tech rolled over last month, this company powered through.

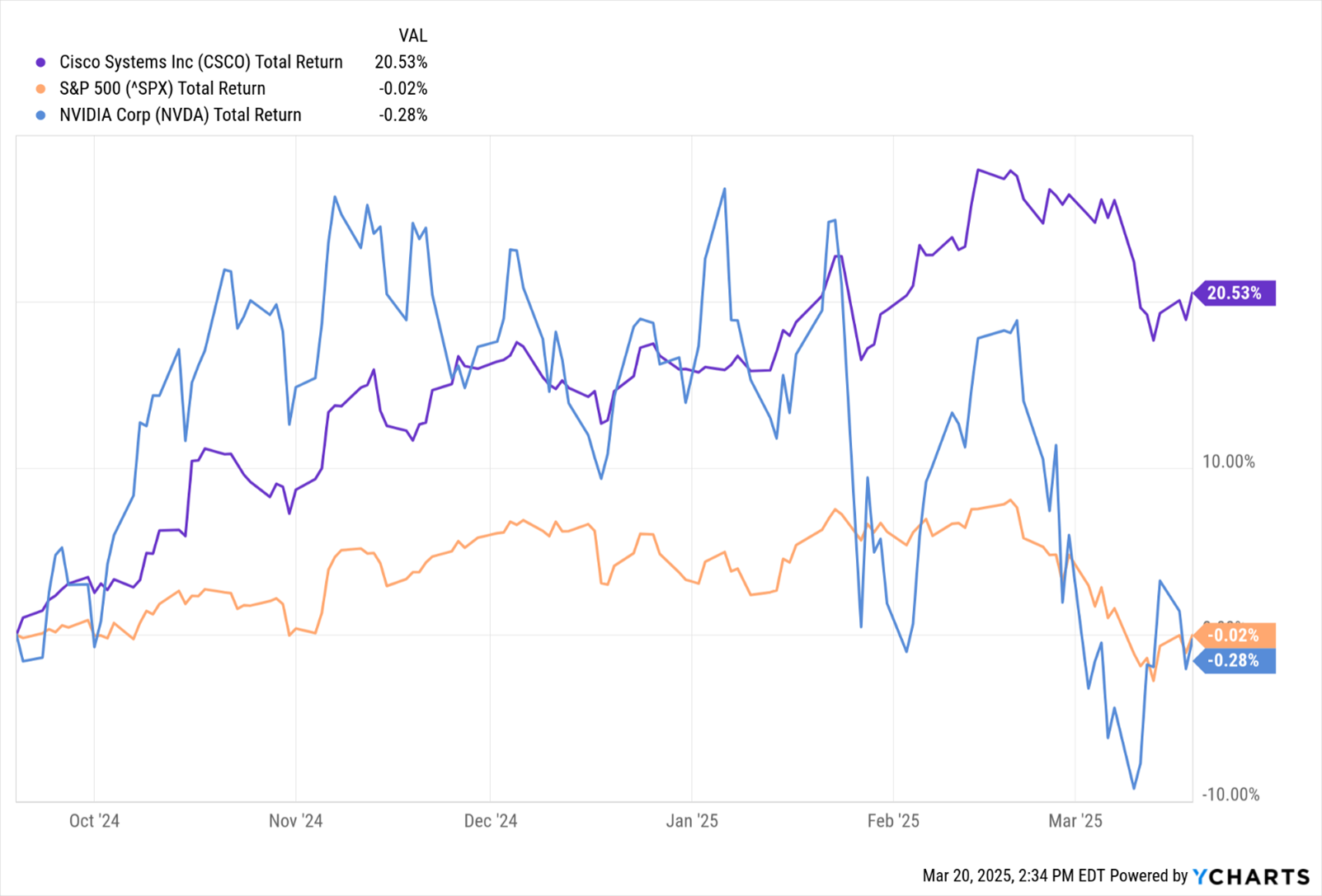

CSCO is up 20% while the S&P and NVDA are lower than where they were six months ago.

Source: YCharts.

Click here to see full-sized image.

In February, it increased its full-year revenue outlook as sales surpassed expectations in its fiscal Q2.

And for the three months ended Jan. 25, Cisco posted a profit of $2.4 billion. Revenue, meanwhile, increased almost 10% to $14 billion.

This success has translated to its share price, too. Over the past six months, Cisco’s stock is up more than 20%.

That’s nearly 20 times the returns of the S&P 500 and nearly five times that of AI leader Nvidia.

It’s like I keep saying.

The road to wealth is paved with tech.

And it’s stocks like this that can speed up your journey to financial freedom.

Best,

Michael A. Robinson

P.S. Just yesterday, Chris Graebe showed his subscribers how they can play AI’s insatiable energy appetite. He released the name of a startup company that could help address a critical supply chain vulnerability at the heart of America’s $1.1T Nuclear Renaissance. This deal is filling up FAST. So click on this link as soon as you can to get the details.

Tidak ada komentar:

Posting Komentar