The Fed give Wall Street what it wanted … how many rate cuts will we get this year? … why Louis is betting on four … tomorrow’s deadline of “Q-Day” This afternoon, the Federal Reserve held interest rates steady at the current target range of 4.25% - 4.50%. This was widely expected. The uncertainty (and risk to the stock market) centered around two questions: - How would tariffs, federal layoffs, and the risk of reinflation impact projections for rate cuts, growth, and inflation in the updated “Dot Plot”?

- Would Federal Reserve Chaiman Jerome Powell sound dovish or hawkish in his press conference?

Well, we got answers – and Wall Street liked ‘em. All three major indexes jumped this afternoon, led by the Nasdaq’s 1.4% pop. We’ll circle back to this momentarily. Digging into the details of the “answers” that Wall Street liked, let’s begin with the Fed’s official policy statement and the Dot Plot. As noted a moment ago, the Fed maintained the current target rate. Perhaps more importantly, the Fed maintained its projection of two quarter-point cuts in 2025. Similarly, the Dot Plot maintained that two more quarter-point rate cuts are expected in 2026. This is the same expectation as the last Dot Plot from December. Now, there were some changes. Fed members project the economy will now grow at just a 1.7% pace this year. That’s down from the 2.1% estimate in December. And core inflation is now expected to grow 2.8%, up from 2.5%. Plus, the Fed will scale back its “quantitative tightening” program in which it reduces its bond holdings. Instead of allowing $25 billion of Treasurys to roll off its balance sheet each month, the new number is just $5 billion. Altogether, there was nothing in the updated numbers that spooked Wall Street Fortunately, neither was there anything “spooky” from Federal Reserve Chairman Jerome Powell in his live press conference. Here are the highlights (I’m paraphrasing): - The economy remains strong and long-term inflation expectations are well-anchored

- The labor market is in good shape. Though it’s a “low hiring, low firing” market, it’s sturdy

- Though it’s early, the Fed isn’t seeing the DOGE/Trump federal job cuts making a major impact on the overall labor market

- The Fed’s base case is that any price increases from tariffs will result in a one-time bump rather than be the beginning of sustained price increases. That could change, but pass-through inflation is the current expectation

- It will be challenging to isolate and measure the inflationary impact of tariffs

- While there’s always some chance of a recession, and recent recession forecasts have climbed slightly, the odds are still “not high”

- While the “soft data” (such as consumer/investor sentiment surveys) show weakening conditions, the Fed is not seeing any material weakening in the “hard data”

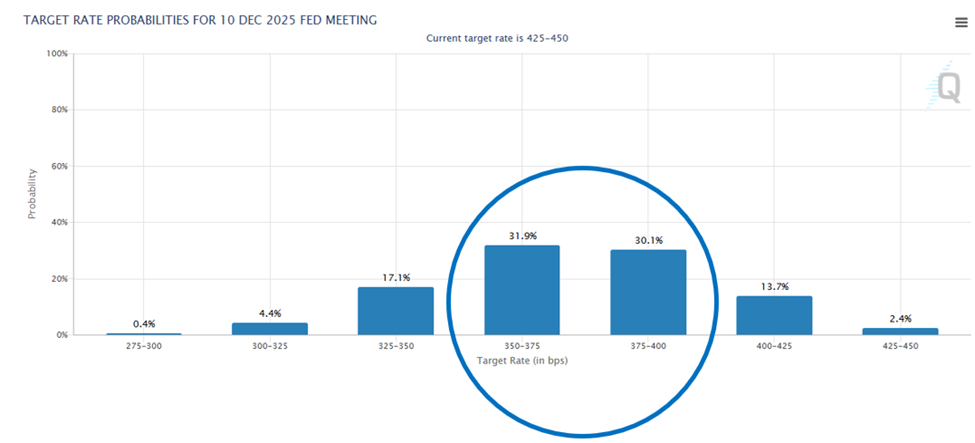

I’ll note that part of the Fed’s decision to maintain the projection of two quarter-point cuts this year (and two more next year) was due to uncertainty. Several times during the press conference, Powell noted that we’re in a highly uncertain environment, so maintaining the prior forecast was the default position. Plus, slightly rising inflation and slightly cooling growth largely cancelled each other out – resulting in a maintain-the-status-quo “inertia” for some Fed presidents. In any case, Wall Street liked what it heard, and stocks roared higher. | Recommended Link | | | | You won't believe what Elon Musk is hiding... Inside this facility in the middle of an industrial zone of Memphis, right next to a decommissioned coal plant. Click here to see what's inside... Because it could make a lot of people wealthy in America. |  | | In the wake of today’s FOMC meeting, traders can’t decide whether we’ll get two or three quarter-point cuts this year Sure, the Dot Plot projects only two cuts, but traders are going bigger. The CME Group’s FedWatch Tool shows us the probabilities that traders are assigning to various target interest rates from the Fed at different dates in the future. As you can see below, traders are now putting nearly identical odds (30%/32%) on the Fed cutting rates two and three times by December 2025.

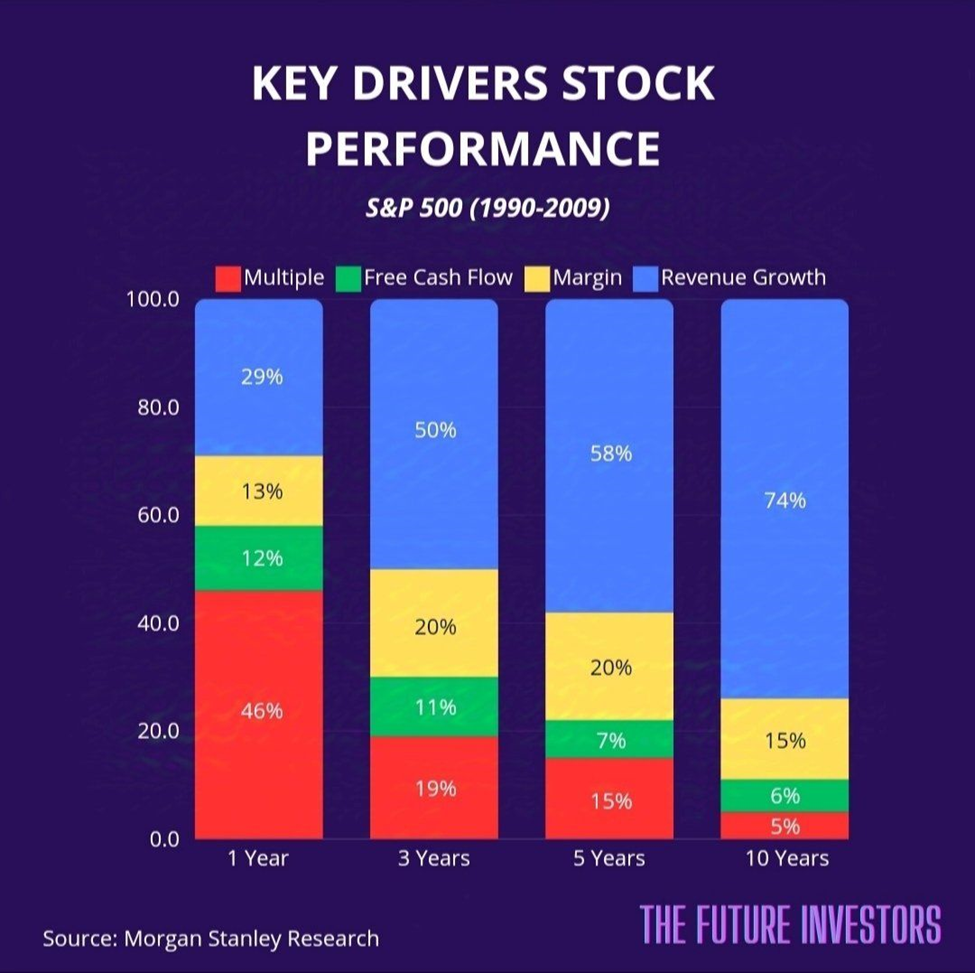

Source: CME Group But if legendary investor Louis Navellier is right, these traders should go even bigger. Here’s Louis from yesterday: It’s widely expected…that the dot plot will signal two more key interest rate cuts this year. Personally, I think this outlook may be a little conservative. I still expect four key interest rate cuts this year. The reality is that global interest rates will collapse given weak economic growth in Asia, as well as economic contractions in the U.K., Canada, France, Germany and Mexico. Global central banks like the Bank of England and the European Central Bank will need to continue cutting key interest rates to shore up their respective economies. And Treasury yields will continue to decline as global central banks slash key interest rates. Since the Fed does not fight market rates, I expect our central bank will follow suit and cut rates four times this year. Now, at face value, four quarter-point cuts would be bullish for stocks. After all, lower interest rates reduce borrowing costs for companies, boosting bottom-line profits. Plus, investors often are willing to pay higher price-to-earnings (P/E) multiples in low-rate environments. But what’s the risk that four rate cuts produces a bearish outcome? The question that will tip the market up or down Do outsized cut rates represent 1) a bearish, reactionary Fed that’s playing defense against a looming recession, or 2) a bullish, proactive Fed that’s promoting steady growth by aligning interest rates with the neutral rate? (For newer Digest readers, the neutral rate is the theoretical Fed interest rate that neither helps nor hurts the economy. It cannot be directly measured, and it changes per economic conditions.) In 1995 and 2019, the interpretation of Fed rate cuts was bullish. That led to a 34% climb for the S&P in 1995, and a 29% gain in 2019. But in 2001 and 2008, the interpretation was bearish. Investors suffered top-to-bottom intra-year losses of 30% in 2001, and 57% losses in 2008/2009. Now, we’re not expecting anything like 2001 or 2008. Corporate balance sheets and income statements are in far better shape than during those years. And Powell’s commentary today didn’t reflect any significant concern about a major downturn, much less a recession. However, as we pointed out in last Friday’s Digest, in the short-term, sentiment is the primary driver of a stock price – not earnings. See for yourself. The chart below shows that over a one-year period, investor sentiment (referenced on the chart as “multiple” in red) accounts for nearly half of a stock’s performance. Earnings (as represented by “revenue growth” in blue) accounts for just 29%.

So, even though we just finished a strong earnings season – and earnings are expected to remain strong – negative sentiment can do a lot of damage in the short-term. Has recent, dour sentiment set up an amazing buying opportunity? Let’s follow the breadcrumbs… As we noted last Friday, sourcing data from FactSet, for Q2 2025 through Q4 2025, analysts forecast earnings growth rates of 9.7%, 12.1%, and 11.6%, respectively. And for calendar year 2025, analysts predict earnings growth of 11.6%. Those are robust forecasts, supportive of continued bullishness. But in the meantime, we’ve been grappling with downbeat sentiment. And what if this recent negative sentiment becomes self-fulfilling (especially if trade wars intensify)? That potential has us facing two potential scenarios… - Recent bearish sentiment proves to be justified as trade wars escalate, eventually hitting earnings (the true market driver). In that case, investors who have been selling are wisely sidestepping a more painful drawdown to come.

- Recent bearish sentiment proves to be unwarranted as the threat of a recession disappears when trade wars and recession fears fade away. In this case, investors who buy today are wisely taking advantage of the temporary “sale” on great stocks thanks to recent bearish sentiment.

Which will it be? Circling back to Louis, he just outlined why he’s betting on the bullish scenario Let’s jump to Louis’ Flash Alert in Breakthrough Stocks yesterday: Scott Bessett, our Treasury Secretary, was on Maria [Bartiromo]’s show [yesterday] morning and made it clear that we are probably not going to have a recession, and that’s true. ISM Manufacturing has been growing, so has services. Retail sales were disappointing, but they were heavily impacted by weather again – spending at bars and restaurants were down 1.5% but online shopping was up 2.4%. So, it wasn’t a bad retail sales report when you look at what we call core spending. Moving to Louis’ thoughts on tariffs, he added: All this tariff talk that was jerking Wall Street around has died. Mark Carney, the new Canadian Prime Minister, said that there’s only so much Canada can do. They really don’t have the ability to do retaliatory tariffs, even though they were threatened, because Canda is a tenth of the size of America which means that America doesn’t care… All the tariff talk has gone behind the scenes, behind closed doors. I know [Secretary of Commerce] Howard Lutnick personally. I think he is a phenomenal Commerce Secretary and he will do a great job. This leaves Louis doing what he always does – overlooking fleeting, shifting sentiment and focusing on earnings strength: I am not worried about all these gyrations and the things distracting people… As we get closer to the end of earnings announcement season, the crème de la crème rises, which are the stocks with strong sales and earnings… We have a lot to be excited about. As we’ve been highlighting in the Digest since last week, one thing that Louis is especially excited about is tomorrow’s “Quantum Day” from Nvidia If you’re new to the Digest, tomorrow, Nvidia will hold the first ever “Quantum Day” (or what Louis has been calling “Q-Day”) during its annual AI conference this week. It’s going to bring together industry leaders, developers, and partners to explore the future of quantum computing. Last week, Louis held a live event where he detailed his belief that Nvidia will announce a big move into quantum computing tomorrow. He also highlighted a tiny, small-cap stock that could be a major beneficiary of any Nvidia quantum initiative. Here’s Louis: I believe NVIDIA is about to stake its claim in the quantum computing space. And when it does, a little-known top pick could erupt overnight. This is a small-cap stock protected by 102 patents with close ties to NVIDIA. It already works closely with NVIDIA, Microsoft, Amazon, and NASA. Don’t wait until the market fully catches on after tomorrow’s event. Watch the replay of my Next 50X NVIDIA Call now for all the details – before it’s taken down. As I highlighted in the Digest last week, history shows that partnerships with Nvidia can be lucrative for investors who own the smaller stock that partners with Nvidia. Sometimes, the gains are great but not lifechanging. For example, Nvidia’s investment in Applied Digital (APLD) led to a 100%+ increase. And after SoundHound AI (SOUN) partnered with Nvidia, its stock price nearly tripled. But on certain occasions, the partnerships produce lifechanging wealth. Quanta Services (PWR) surged 1,000% following its NVIDIA deal. And Super Micro Computer (SMCI) shot up 2,460% after the two companies got into bed. Louis believes that if Nvidia announces a partnership with his favorite small-cap quantum play, 50X returns are on the table. For more details, click here for the replay of last week’s event. Tomorrow is Q-Day, so we’re cutting it close to the wire. We’ll keep you updated on all these stories here in the Digest. Have a good evening, Jeff Remsburg |

Tidak ada komentar:

Posting Komentar