| Dear Reader,

Many of my recent updates have centered around President Trump and his sweeping new policy initiatives like DOGE.

Normally, you wouldn’t expect an economist like myself to stay so laser-focused on political issues.

But these aren’t normal times … and this isn’t a “normal” economy. It’s now a Trump Economy.

Jump into today’s video for the full story:  |

We’ll guarantee you’ve never seen his map before…

Because we had to dig it up from deep in the bowels of a three-letter-agency in Washington.

It shows a secretive bipartisan program to not just stop — but REVERSE the flow of illegal migrants into America.

The best part, for you: There may be a simple way for investors to profit up to 6,000% or more from this initiative in as little as three years…

To get the full details, no strings attached, click right here. | Video Transcript: Welcome to Moneyball Economics.

I'm Andrew Zatlin, and I'm going to share with you some proprietary data of mine, and I hope you agree that it's going to tell us where a really cool investment opportunity is. And that's really what I try to do. I try to share the data that's meaningful, that tells us what's going on around us and how we can take advantage of it as investors.

And along those lines, I would like to start by reading from an email from one of our subscribers.

It comes from a gentleman named Ted B. Ted, thank you for your email. And folks, I encourage you to send in emails. If it's top of mind a question, a strong thought, share it with me. It might be something that we as a team, as a community should be looking at and we should be discussing together.

So Ted, thank you for taking the time to do that, to send me an email.

I'm going to read from your email editing it a little bit in the interest of time, but hopefully I've captured your thoughts and sentiment. So Ted says:

“Less politics, more economics. I enjoy the videos, but that one seems to be a Pollyanna for the current administration. A superforecaster should be telling the whole story. How about this … DOGE doesn't find a significant amount of savings, but the administration hails it anyway and issues checks to everyone, which in turn ignites inflation, just like the Covid stimulus? Less news about Doge and administration policies, and more about our economic realities and where potential future investments lie.”

Okay, so Ted, again, thank you. Let me see if I can answer those points that you raised.

Well, first of all, I'm all about looking at our economy and where potential investments lie, but we are not in an economy anymore.

We are in a Trump economy.

Trump is not nibbling away at the margins fine tuning here or there.

He is literally overhauling our economy and he's doing it at lightning speed.

That means we face a challenge in what kind of data we can use.

First of all, remember before Trump came on board, there was a pre-Trump economy. As he came on board in January and February, people started to realize the degree to which he wanted to impact things, the number of things he's changing, the depth of things he's changing, and the markets they had to adjust. And that's why things went bearish.

Any data that looks at the economy pre-March is garbage data, because that's a pre-Trump economy … and that pre-Trump economy just doesn't matter. We've got to focus on the Trump economy, and yes, that means we've got to look at what his administration policies are.

We've got to look deeply at what DOGE is attacking, because what DOGE is attacking is stuff that you want to avoid, but you also want to look at what they're enabling.

And quite frankly, that's what I think I've been doing lately where I haven't been focused on economic data and conventional data because like I said, it's obsolete, it's outdated. As soon as it gets released, we won't get real data pretty much until we're into April, and in the meantime, we're trying to figure out what's going on and I'm using my alternative data to get there.

And so as a result, I really haven't been talking about economics so much as laying the groundwork of where is Trump going? I'm trying to be a tea leaf reader. I'm trying to be a Trump whisperer. Quite frankly, I think I've been pretty good at it the past few weeks.

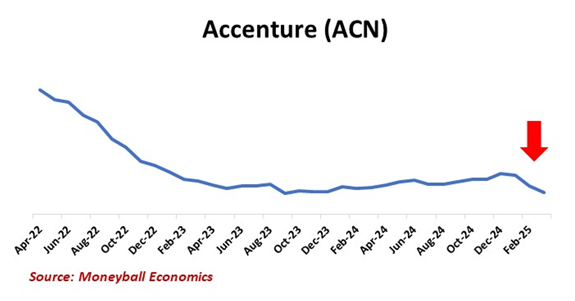

For example, I shared with you that all by diving into all the programs that DOGE is attacking, I said, get away from Accenture. They are trying to cut out a lot of the offshore IT resources. Guess what? Since I said that, Accenture's down 10-15%:  I looked at what the Trump administration is doing and they said, we're going to freeze government spending. Hey, I said, the government spends a lot on traveling. Marriott, American Airlines, Delta, those are also places you don't want to be. And guess what? Recently Delta Airlines and American Airlines have taken it on the chin. | Inside the President’s covert plan to recapture forgotten U.S. territories, seize precious resources and spark a $20 trillion wealth wave…

Stocks connected to Trump’s New Deal are already surging – discover the #1 investment to make before May 30 | So we cannot talk about the economy.

We have to talk about the Trump economy, and that's what I'm here today to talk about.

So what is Trump doing? He's throwing tariffs out there. That's one of many initiatives he has. When you think about tariffs, there are winners and there are losers.

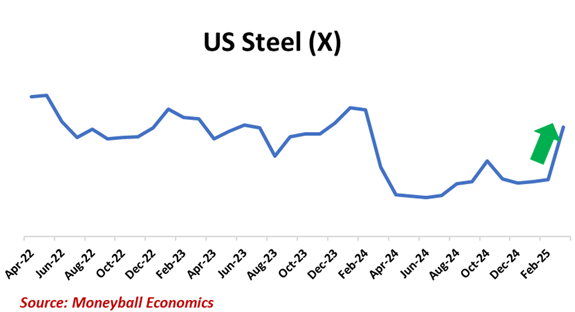

One of the groups that I think is a strong winner is American Steel and aluminum production.

Common sense, you're going to make it more expensive to import steel from Canada to import aluminum. Well, guess what? That's going to boost domestic suppliers, and that's exactly what I want to share with you today. That's what is going on.

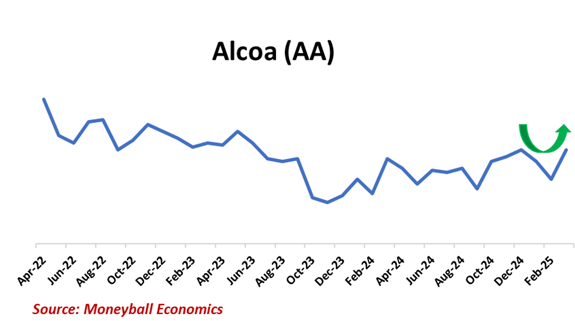

When I look at the hiring data for, let's start with Alcoa. Alcoa major US aluminum producer, and guess what? Their hiring started to go down as Trump came in, and now it's moving right back up. Why? Because there was a lot of uncertainty around where tariffs were going to take us. Demand for aluminum up down. Nobody really knew.

Now that there's a lot more clarity as we head into March, you can see that Alcoa is putting their money where their mouth is. They're hiring a lot more people suddenly:  Now, let's turn to US Steel, steel production in the us.

Remember how under Biden, Nippon Steel was about to buy US steel and Trump said, we're not going to let you do that. Guess what's happening?  Like a rocket. US Steel has resumed hiring at a level we haven't seen in years. These tariffs are going to benefit US Steel, but nobody knows this yet.

You want to get into Alcoa, you want to get into US Steel because Trump is going to force up demand for their product. He's going to force up pricing and we can piss and moan about the inflationary impact of that.

At the end of the day, these are the companies that are clearly expecting a lot more orders to flow. I'm going to continue to use this kind of alternative data until I believe that more conventional mainstream data is finally caught up.

In the meantime, folks, we're in it to win it.

Zatlin out.

Andrew Zatlin

Editor, Moneyball Economics |

Tidak ada komentar:

Posting Komentar