January 29, 2025

Benefit from the DeFi Project Backed by Trump

Dear Subscriber,

World Liberty Financial (WLFI) has gained significant attention in the past year due to its association with Donald Trump and his family.

The project aims to reinforce the dominance of the U.S. dollar within the DeFi ecosystem through the promotion of dollar-backed stablecoins.

With that lofty goal and obvious support from the White House, the project has sparked curiosity and debate.

But for investors, there really is only one question that matters: Is it a good investment?

So, let’s dive in.

What is World Liberty Financial?

As I said, World Liberty Financial’s primary goal is to cement the U.S. dollar as the cornerstone of DeFi.

The vision aligns with the idea that the dollar has been central to international finance for decades, and so it should retain that position as DeFi adoption expands.

The project’s Gold Paper outlines an ambitious strategy to meet this goal.

It starts by promoting dollar-backed stablecoins as the future of finance.

By creating a future where stablecoins dominate global transactions, World Liberty Financial can work to ensure the U.S. dollar remains central to international trade.

To do that, World Liberty Financial plans to integrate DeFi capabilities.

That’s why it plans to launch on Aave V3. With that, World Liberty can utilize Aave’s (AAVE, “C+”) existing — and tested — infrastructure and share protocol revenue with Aave’s decentralized autonomous organization, or DAO.

And this is where the support of President Trump and his family comes into play.

World Liberty Financial makes clear on its website that the president and his family are not on the board. Rather, they function as advisers.

This means, as advisers, they can ensure World Liberty will remain compliant with all regulatory frameworks.

This is a huge benefit.

Regulatory uncertainty has stifled U.S. crypto development for years and prevented large-scale institutional adoption.

With an emphasis on regulatory compliance, World Liberty Financial has the potential to attract financial institutions that want to access DeFi services but haven’t been able to due to regulation.

This model suggests a hybrid approach between an independent DeFi initiative and an extension of established protocols to promise a robust and efficient financial ecosystem.

With the clear appeal for institutional investment and support from the First Family, World Liberty Financial could become a key player in the DeFi space when it launches.

That said, sustaining such an initiative would require long-term policy support beyond a single administration.

Near-Term Token Concerns

WLFI serves as the governance token for the World Liberty Financial ecosystem. And that is how you, as a retail investor, can gain exposure to the project.

As a governance token, it allows holders to vote on proposals related to the platform’s governance.

But it differs from traditional governance tokens in three controversial ways:

- No Economic Rights: Usually, a governance token shares the economic success of the platform with its holders. But WLFI does not provide dividends or exposure to potential value appreciation.

- Non-transferable: WLFI tokens cannot be traded or sold. That means buyers will be limited to those who want to invest in World Liberty Financial or those who want to vote on its governance. Traders looking for capital gains are unlikely to join the community.

- Accredited Investors Only: In the U.S., investment in WLFI is restricted to accredited investors, limiting retail investor participation. Additionally, potential buyers need to go through “know-your-customer” protocols, which is against the DeFi ethos.

These constraints make WLFI an unconventional DeFi token. And it has raised concerns among DeFi purists and crypto enthusiasts about WLFI’s broader appeal and utility.

Performance So Far

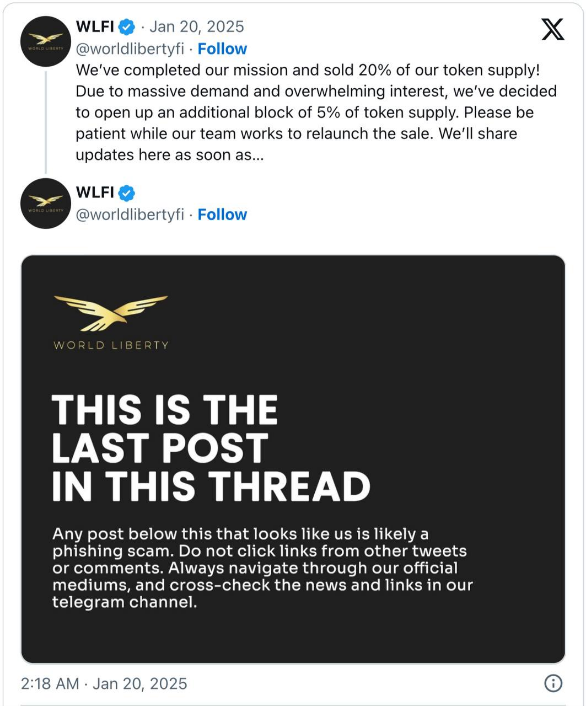

WLFI’s public sale ran from October 2024 to January 2025.

It offered 20 billion tokens, or roughly 20% of the total supply.

The project has raised approximately $350 million, with a portion of the tokens sold in stablecoins like USD Coin (USDC) and Tether (USDT) and in Ethereum (ETH, “A-”).

In January 2025, an additional 5 billion tokens (5% of supply) were made available.

Source: X.com.

Click here to see full-sized image.

Despite WLFI's lack of liquidity, as it cannot be sold or transferred, investor interest remains high, fuelled by Trump's involvement and the project's long-term vision.

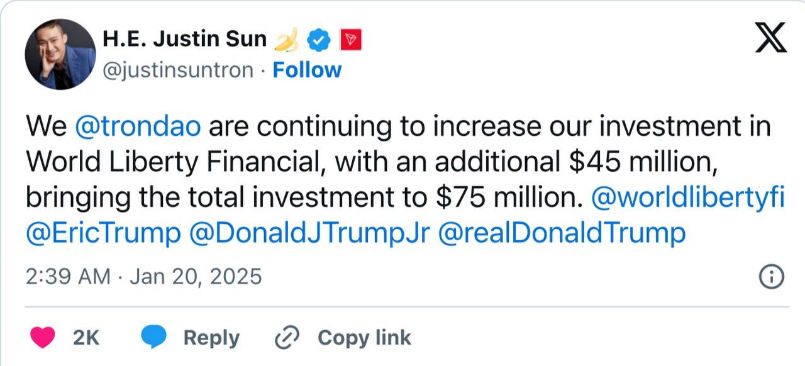

Justin Sun and Tron DAO have been the largest investors in WLFI, contributing $75 million to the project.

Source: X.com.

Click here to see full-sized image.

My Verdict: Is WLFI a Good Investment?

World Liberty Financial presents an ambitious vision for integrating the U.S. dollar into DeFi.

And there is a lot of upside promise if it can fulfill that vision.

However, its restrictive token mechanics, investor limitations and political ties make it a controversial and polarizing project.

One with a murky long-term outlook as it has yet to prove itself.

So, for now, I would say WLFI is crypto to keep on your watchlist.

Even though the time is not right to jump in, I believe investors should still pay attention.

That’s because there is a lot you can learn from World Liberty Financial’s wallet activity and associated crypto purchases.

If Trump’s affiliated wallets begin accumulating specific assets, for example, those tokens may experience increased demand as the market reacts.

As an investor, this could create a unique perspective on potential investment opportunities.

Ones that are more liquid and easier to access.

Tools like Arkham Intelligence or Dropstab.com can help you track these wallet movements in real time.

So, we will have to wait to see if World Liberty Financial can live up to its promise and potential. But in the meantime, it will undoubtedly be a key project to watch in 2025 … and beyond.

Whether the project succeeds in reshaping DeFi remains to be seen, but it is undoubtedly one to watch in 2025 and beyond.

Best,

Mark Gough

P.S. Crypto isn’t the only sector that has caught the president’s interest. President Trump is committed to winning the AI race against China. And that means more AI development domestically.

That doesn’t mean all tech stocks can expect to soar. But the right ones are poised to benefit. That’s why I urge you to attend a special tech summit next week.

It’s called “The $35 Trillion Trump/Musk Tech Alliance Summit.” And it’s free to Weiss Ratings Daily readers as long as you register today.

Save your seat here, then mark your calendar for this coming Tuesday, Feb. 4 at 2 p.m. Eastern.

Tidak ada komentar:

Posting Komentar