January 30, 2025

The Two Unlikely Winners from AI's Crash

Dear Subscriber,

Editor’s note: Many people wonder what a world where AI takes jobs away will look like.

Over the weekend, the world learned about a Chinese-made AI that wants to come for AI’s U.S.-based crown.

On Monday, we saw what the investment world looked like — and it was red all around.

Your favorite AI stocks got rocked temporarily. But certain AI-related investments showed resilience. Even better, they still offer profit opportunities going forward.

Here’s Marija Matić with where to find them …

|

| By Marija Matic |

The AI world got rattled early this week by an unexpected challenger.

DeepSeek is a Chinese AI powerhouse that says it accomplished with $6 million what others have spent billions to achieve.

Its emergence has shaken global markets to challenge long-held assumptions about the costs of AI development.

In simple English, DeepSeek inspired investors to question sky-high valuations across the tech sector.

The market's reaction was swift and dramatic. As DeepSeek shot to the top of Apple's App Store rankings, tech giants felt the tremors.

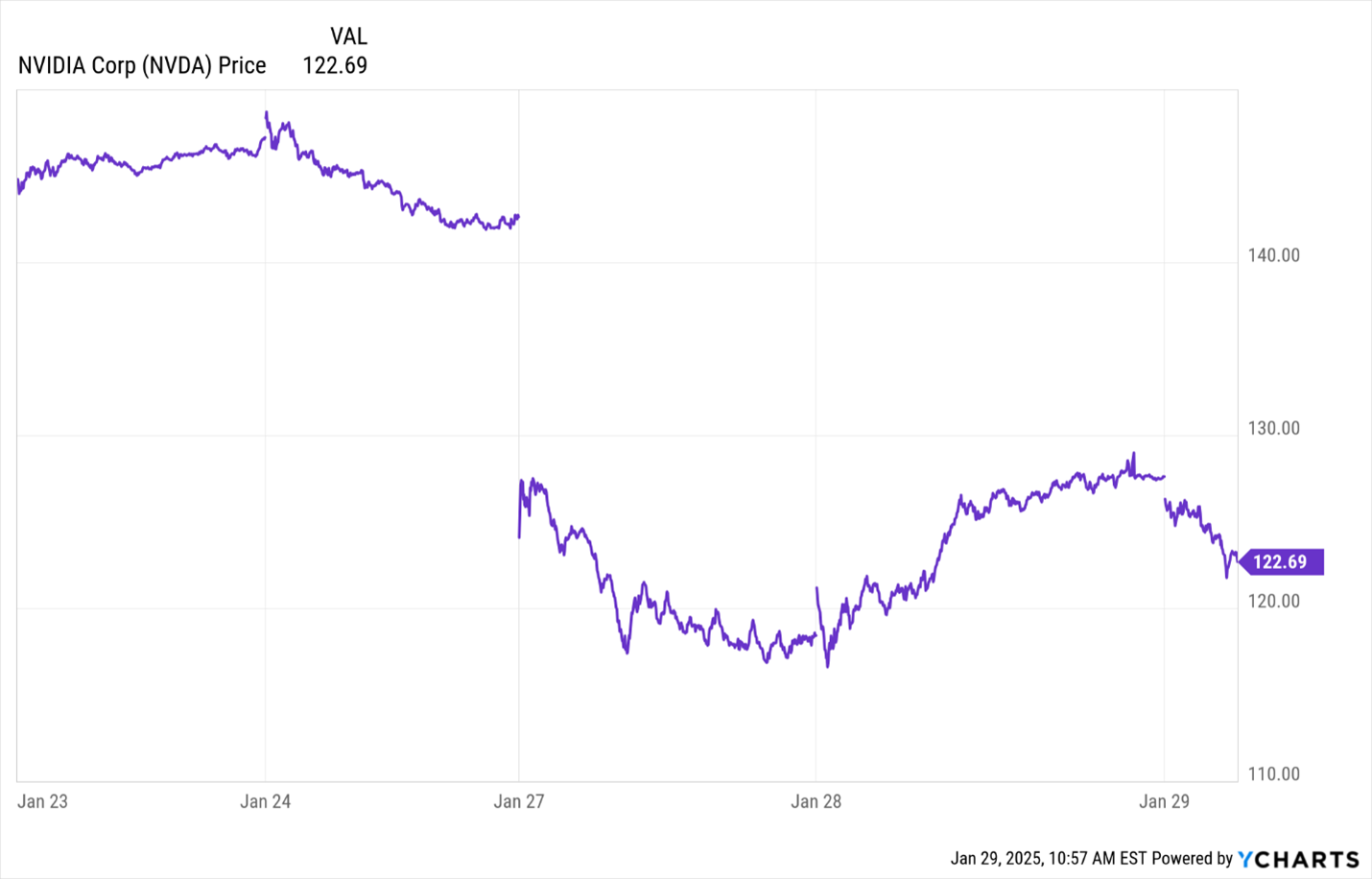

Nvidia (NVDA), the cornerstone of AI chip manufacturing, saw its stock plummet 17% in a stark reminder of how quickly the landscape can shift.

NVDA stock over the past five trading days.

Source: YCharts.

Click here to see full-sized image.

But don’t think the impact was only felt by TradFi AI.

The cryptocurrency market wasn't spared, either. AI-related tokens shed 20% of their value in a matter of hours before they could claw back roughly half of those losses.

While the start of this story is rough, there is plenty of good intel investors may want to mine for.

Silver Linings in the Storm

In short, DeepSeek is a wake-up call.

One that tells both TradFi and crypto AI that adaptability will be key in the future of this sector.

As China demonstrates its growing capabilities in AI, the ripple effects can reshape how investors view the intersection of AI and blockchain technologies.

To keep up, AI projects will need to adapt to that yet-defined vision.

TradFi AI seems to be in good hands on that account.

In a bold move that's turning heads, the Trump administration has thrown its weight behind AI with a jaw-dropping $500 billion investment proposal.

This isn't just another government spending plan. It’s a clear signal that the USA is betting big on the future of transformative technologies despite the recent shake-up.

While market jitters might persist in the short term, this unprecedented level of governmental backing suggests a seismic shift in how these sectors are viewed at the highest levels of power.

And it makes sense.

DeepSeek’s success represents a significant milestone in the global AI race. In particular, it highlights China's growing capabilities in the field.

The cost-effective development model demonstrated by DeepSeek could also shift future funding focus from capital-intensive approaches to more efficient, targeted development strategies.

AI Winners’ Resilience

I believe we will see this shift in AI crypto projects, as well.

In fact, we can see glimpses in existing crypto AI projects.

Bittensor (TAO), for example, was one of a few AI tokens that managed to buck the trend. In fact, it posted gains in defiance of the broad sector’s downward spiral.

TAO price action over the past seven days. Note the large spike on the right of the chart. As other AI plays tanked, TAO soared.

Source: Coingecko.

Click here to see full-sized image.

Of course, there were winners in the world of traditional finance, too.

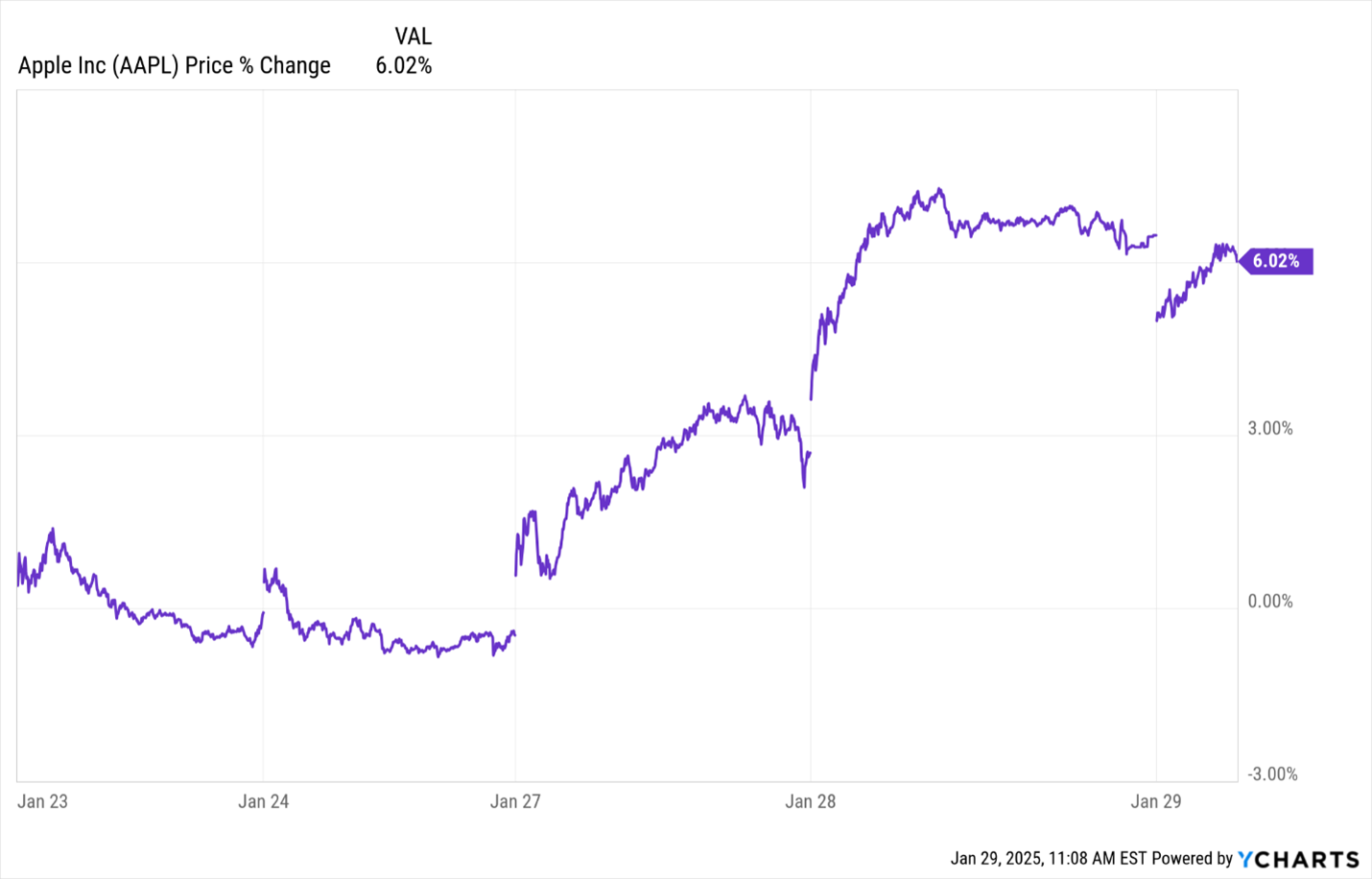

In fact, you just have to look at Apple (AAPL) — one of the Mag 7 and a company deeply involved in AI — to see a tech giant skate through Monday’s freefall.

AAPL price action over the past 5 days.

Source: YCharts.

Click here to see full-sized image.

TAO and projects like it have demonstrated it is possible to create value in a decentralized AI ecosystem.

And Apple, with its wide range of other revenue streams in addition to AI, demonstrated that tech can still win even on the worst days.

The resilience of tokens like TAO and stocks like AAPL in this shake up isn’t only to show traders which projects are or will likely outperform going forward.

It is also a sign that suggests that investors are beginning to differentiate between speculative plays and projects with genuine technological merit.

While that may end with many projects falling by the wayside, it would mean ones with real promise can rise above the crowd.

In fact, this evolution could lead to a more mature market. One where value is driven by genuine technological advancement rather than speculation.

So, as you review your AI positions, stop and think about their longevity.

Are you investing in a project with the technology, adaptability and creativity to go the distance in this competitive sector?

Or could you be left holding the bag if you HODL too long?

Better to know now. After all, as long as the bull is still running, you can rotate to a more promising opportunity.

Best,

Marija Matić

P.S. To help with that, Weiss Ratings is going to host a special virtual event on Tuesday, Feb. 4, at 2 p.m. Eastern. It’s called the “$35 Trillion Trump/Musk Tech Alliance Summit.”

As you can imagine, there will be a lot to cover. So, be sure to grab your free virtual seat here.

Tidak ada komentar:

Posting Komentar