Three Stocks Insiders Are Selling in Droves VIEW IN BROWSER Tom Yeung here with your Sunday Digest. In my home state of Massachusetts, there are a group of houses on Cape Cod that are tumbling into the ocean. Every major nor’easter washes away a tiny bit more of the famous sandbar. And once in a while, another home gets swept away.

Source: AP News Of course, that doesn’t stop some homebuyers from rolling the dice. These homes have stunning views of the Atlantic Ocean… not to mention easy access to the beach. In fact, the luxury house pictured above was sold in 2021 for a lofty $5.5 million – an eightfold increase from its original 1999 land sale price. But sooner or later, the ocean always wins. The Cape Cod home pictured above was demolished in 2025. The same is true for stocks trading at high valuations. Shares of eye-wateringly expensive companies might keep going up for a while. In fact, we know they do. Eventually, these highfliers will tumble back down. Like a house sitting on a sandy cliffside during a storm, no company in history has ever maintained ultrahigh prices forever. And when that happens, everyone looks at the bag-holders and wonders, “What were they thinking?” Now here’s the thing… You don’t have to be a part of that selloff. And you don’t have to watch your house slide into the ocean. Instead, for every buyer of a risky asset, there’s also a seller. So, you could be like Mark and Barbara Blasch, the couple who sold that Cape Cod house above for $5.5 million and walked away. They’re the ones who saw the edge of the ocean creep closer to their home and say, “Something’s wrong. Maybe it’s time to get out.” That’s why I want to introduce you to Marc Chaikin, a Wall Street legend best known for creating the Chaikin Money Flow indicator, a tool that’s now built into trading platforms and used by investors worldwide. Marc has spent the past five decades navigating bull markets and crashes. He even recently predicted the 2023 bank runs that briefly threatened the entire U.S. financial system. On Tuesday, February 17, at 10 a.m. Eastern, Marc will be hosting a free live broadcast where he outlines his new predictions going into a volatile March-April period. He believes markets are sitting on a figurative sandbar, and that a rupture in tech companies could send a large chunk of the market crashing into the sea while sparing a tiny portion: 1.8% of companies, to be precise. Now, you’ll have to attend Marc’s event to see for yourself which 1.8% of stocks he’s talking about. But what I can tell you is that many of the remaining 98.2% firms have their own Mark and Barbara Blaschs who are selling their stakes in droves. So, in this update, I’d like to highlight three notable companies where insiders have been moving out of the market as our current market melt-up begins to stall. And in the meantime, be sure to sign up for Marc’s upcoming presentation, which you can do so here. Recommended Link | | | | It's a strategy which follows a rule so straightforward, anyone can understand it. In this new presentation from Wall Street veteran and investing legend, Louis Navellier, he reveals the simple ABC’s of this strategy and shows how it has outperformed the market, year after year. Watch Louis’ exclusive new presentation today. |  | |

Two Data Center Heavyweights The first noteworthy sales involve insiders at data center firms. Here, two companies stand out: Oracle Corp. (ORCL) and CoreWeave Inc. (CRWV) In addition to regular, preapproved 10b5-1 sales in the past quarter, Oracle’s management has: - CEO: Sold 10,000 shares in the open market

- Director: Sold 2,223 shares

- President: Sold 15,000 shares and gifted another 5,000

Meanwhile, CoreWeave’s sales have all been the 10b5-1 type, but their pace of selling has been astonishing. Many sales happen as soon as the shares are awarded, a historically bearish sign: - Chief Development Officer: Sold almost 1 million shares

- Chief Strategy Officer: Sold roughly 770,000 shares

- CEO: Sold roughly 300,000 shares

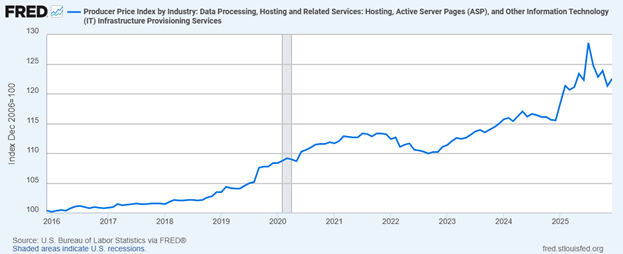

Our analysts have been warning about the sector for months. Eric Fry sold Oracle from Fry’s Investment Report last November (subscription required) when prices were still in the $200 range, and Luke Lango specifically cautioned about CoreWeave in a December Hypergrowth Investing article. “Don’t get trapped in yesterday’s trade,” he wrote. “Crowded AI leaders can still run – but the risk/reward is changing as the market starts to look past the current bottlenecks. Trim your exposure to… CoreWeave.” There could be further room for these companies to fall. You see, insatiable demand for AI chips has forced data center companies to buy AI chips years in advance. Nvidia Corp. (NVDA) currently has a $500 billion backlog (22 months of sales), so anyone in line (or that wants to join the queue) must commit to a specific chip price. A DGX B200 server rack of Nvidia’s flagship GPUs costs roughly $500,000. It’s like paying half a million dollars for a luxury car that won’t get delivered until the end of next year. However, the value of these future chips is uncertain. Oracle might have agreed with OpenAI last October to provide 4.5 gigawatts of computing power for $300 billion starting in 2027… but there’s no guarantee that OpenAI will be around to pay that bill. And even if OpenAI has the cash in 2027, it will almost certainly negotiate prices lower if a different supplier can offer services for less. After all, cloud computing is a largely commoditized product once you strip away the buzzwords. In fact, we’re already seeing some price compression among traditional data center providers. According to the U.S. Bureau of Labor Statistics, producer prices in the broader cloud computing sector began slipping from their peak last summer.

The same might be happening with AI computing prices. In January, Microsoft Corp. (MSFT) revealed that costs of its Intelligent Cloud (AI-focused computing) rose 10.1% sequentially, compared to just a 6.5% increase in revenues. Amazon.com Inc. (AMZN) reported a similar margin compression in its Amazon Web Services (AWS) segment. That suggests AI computing is also beginning to face pricing pressures – an extremely negative sign for companies like Oracle and CoreWeave that have made big bets on AI data centers. So, though there are one-off reports that everything is fine with AI computing, there’s probably good reason to follow these executives out of data center stocks. Hedging a Consumer Slowdown One thing I love about airlines is that they often serve as an early warning signal of sagging demand. If consumers are worried about their wallets, then next summer’s trip to Disney World is often the first thing to vanish from the “to do” list. (What about a short drive to Cape Cod instead?) That’s why it’s particularly notable that insiders at Delta Airlines Inc. (DAL) have recently unloaded an unusual amount of stock. In the past week alone, we’ve seen: - EVP of Global Sales: Sold 38,600 shares

- President: Sold 302,000 shares

- Chief External Affairs Officer: Sold 27,000 shares

- EVP of International: Sold 35,000 shares

It’s easy to see their caution from a valuation standpoint. Delta’s shares have surged 84% since the depths of last April’s “Liberation Day” selloff and now trade at the upper end of their historic averages. The last time shares traded at 10X forward earnings was in April 2022. Shares fell 20% over the following year. But there’s also growing evidence that American consumers are finally pulling back. On Thursday, the National Association of Realtors said that existing home sales crashed 8.4% in January. Inventory of unsold homes rose to 3.7 months, up from 3.5 months in December, and the median time for properties on the market rose to 46 days, up from 39. U.S. retail sales also slowed unexpectedly in December, according to a Commerce Department report released last week. Eight out of 13 retail categories posted decreases, and sales of big-ticket items like autos and furniture saw declines. “The weaker-than-expected retail sales data for December won’t be enough to spoil the fourth quarter,” said Thomas Ryan, North America economist at Capital Economics. “But, together with the likely weakness of spending in January amid extreme winter weather in most of the country, it leaves consumption growth on track to slow sharply this quarter.” That’s why a 7.5% selloff this week in DAL might only be the start. Insiders at the airline company have a long history of correctly timing the market. This includes a cluster of sales in April 2024 (before an almost 20% decline) and a well-timed exit by CEO Edward Bastian in 2019 before demand started noticeably sagging in the months leading up to the Covid-19 pandemic. When Delta’s insiders start selling, it’s often time to get out too. Suspicious Selling in Suspiciously Pricey Markets Not every insider sale means that prices will go down. Often, executives simply need the money or want to diversify. Tech companies routinely reward insiders with stock options instead of annual bonuses. So, while insider buying is almost always positive, insider selling can send weaker signals. But some sales are more suspicious than others. These include industrywide cluster selling (where executives from multiple related companies exit all at once), and sales by insiders working at bellwether businesses. There’s also the insider buy/sell ratio – a record of all insider trading by American executives. Since November, this figure has crashed from its long-term average of 0.40 to just 0.24 – one of the lowest levels on record. (That means insiders are only buying $0.24 of stock for every $1 they sell.) In other words, these “in the know” executives are exiting the market right as we’re hitting new peaks. That’s why Marc Chaikin’s warning comes at a perfect time. He’s concerned that markets are about to rupture, and he’s convinced that it’s going to happen at a moment’s notice. So, be sure to tune into his special presentation on Tuesday, February 17, at 10 a.m. Eastern, where he’ll outline what’s changing beneath the surface of the market… why not all stocks will be hit the same… and how a small group of companies could emerge stronger — and far more profitable — if you know what to look for. Marc will also be sharing a brand-new tool to identify these opportunities, which you’ll be able to try out for free after you sign up, along with two free stock recommendations during the event. Click here to reserve your seat for this free broadcast. Until next week, Thomas Yeung, CFA

Market analyst, InvestorPlace P.S. Please note that the InvestorPlace offices will be closed on Monday in observance of Presidents’ Day. We will be back on Tuesday. |

Tidak ada komentar:

Posting Komentar