Don’t Be Afraid of Mid-Term Years VIEW IN BROWSER Chances are you’ve heard – and maybe even believed – the old claim that we only use 10% of our brains. It’s catchy. It’s memorable. It’s completely wrong. But people believe it anyway, because when something gets repeated enough, it starts to feel like the truth. According to the McGovern Institute for Brain Research at MIT, humans use 100% of the brain every day — just not all at the same time. Through MRI and PET scans, neuroscientists have shown that every region of the brain has a function, even if it’s not active simultaneously. The 10% myth survives because people focus on the part that sounds simple and ignore the rest. This came to mind as I’ve been seeing articles and social media posts recently that midterm election years (the general elections held near the midpoint of a president's four-year term of office) are “bad years for the market.” Investors have been warned to brace for turbulence or pull back on risk every time a midterm year rolls around. Here is an example from Seeking Alpha…

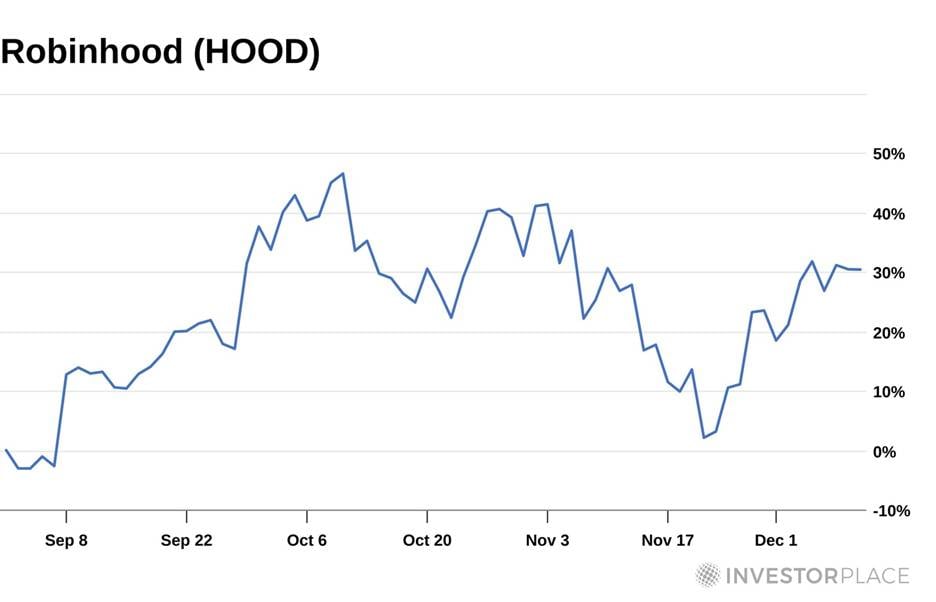

The projection has a grain of truth. You probably remember 2022, when the market was down 19%. Or 2018, when the market experienced a 6% decline. But do you also remember 2014? That’s when the market jumped 11%. Or what about 2010 when the market was up 13%? Investors often focus on the part that sounds simple. They latch onto the handful of bad years and overlook the full picture. There’s no reason to believe next year will be bearish. Today, I’ll show you why our group of expert stock analysts is still bullish, and I’ll share two picks to start the year right. Strong Earnings Set to Continue Let’s start with the fundamentals, courtesy of investing legend Louis Navellier. Regular Digest readers know Louis’ quantitative system is based on buying fundamentally superior stocks – those with positive earnings and revenue growth. How is the market doing overall? Louis summarized this for readers recently. Now that the third-quarter earnings announcement season has officially wrapped up, here is where we stand: According to FactSet, 83% of S&P 500 companies posted a positive earnings surprise and 76% achieved a positive revenue surprise. The S&P 500 reported a 6.6% average earnings surprise and a 2% average revenue surprise. I should add that the S&P 500 achieved 13.4% average earnings growth and 8.4% average revenue growth for the third quarter. So, earnings growth and earnings surprises are at the highest pace in four years, while revenue is running at its highest pace in three years. And the great news is that earnings and revenue are forecast to accelerate in 2026. Picking fundamentally superior stocks is what led Louis to choose Robinhood (HOOD) in late August. In November, the company reported third-quarter revenue more than doubled year-over-year to a record $1.27 billion, surpassing estimates for $1.22 billion. Third-quarter earnings surged 270.7% year-over-year to $556 million, or $0.61 per share, compared to $150 million, or $0.17 per share, in the same quarter a year ago. Since Louis’ pick, HOOD is up more than 30% and is still an “A” in his Stock Grader system.

The AI Megatrend continues Tech investing expert Luke Lango noted that a lot of investor sentiment is driven by mainstream media headlines that lately have tried to cast doubt on the AI megatrend. From NPR…

From The Wall Street Journal…

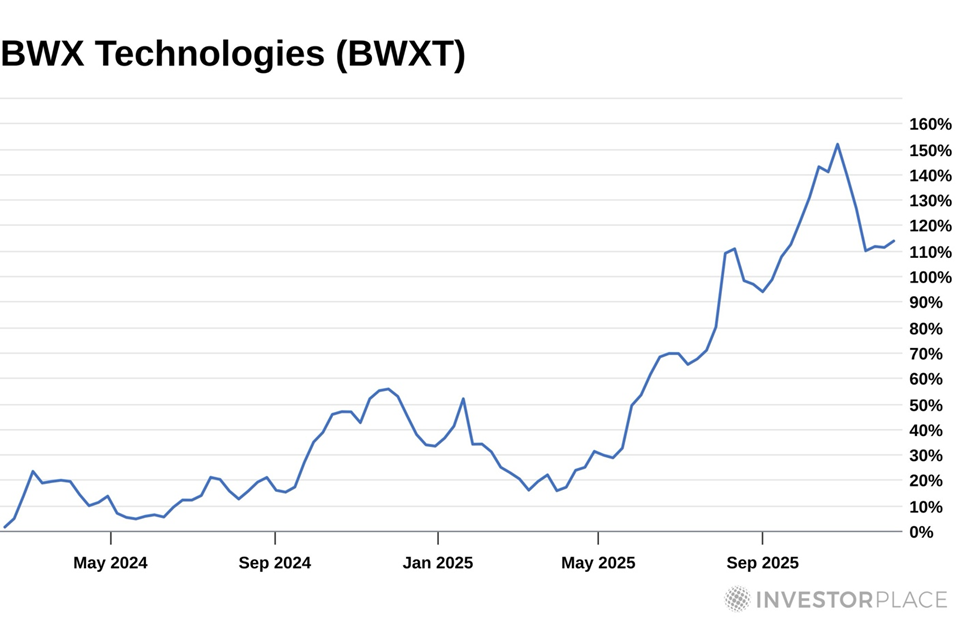

However, any meaningful examination of the data reveals positive signs. Here is what Luke wrote to his subscribers about the market action last week. While investors fixated on the noise, the real story played out under the surface: AI fundamentals accelerated across every layer of the stack. Bloomberg raised its AI power forecast by 36%. Nvidia locked in a $2 billion design deal. Credo posted 270%+ revenue growth. Salesforce’s AI ARR surged 330%. CrowdStrike, Guidewire, Rubrik, Samsara — all confirming the same trend of real contracts and real demand. By Friday, the tape caught on. Inflation stayed stable, rate-cut odds firmed, hardware orders accelerated, and global AI infrastructure plans expanded. The fear trade broke, and the market pushed to new highs. The takeaway is simple: this rally isn’t holiday magic. It’s being powered by soaring AI infrastructure demand, surging software revenue, a friendlier macro backdrop, and a government increasingly picking winners. One of Luke’s picks to benefit is a stock he called “America’s Nuclear Backbone.” All new data centers and chip fabrication plants will require a lot of new energy to power them, and we know that: 1) Sam Altman, the CEO of OpenAI, is heavily invested in and bullish on nuclear energy, and 2) Microsoft wants to power its data centers with nuclear energy. BWX Technologies (BWXT) is the primary supplier of components to the nuclear energy industry, and since Luke’s recommendation, the stock has doubled.

New Winners on the Horizon Economist Ed Yardeni made news this week. The long-time big tech bull announced that he was shifting away from the Magnificent 7 tech companies and projecting bigger gains for the broader market. Yardeni was quoted by Bloomberg: “We see more competitors coming for the juicy profit margins of the Magnificent 7,” and expect that the productivity and profit margins of the rest of the S&P 500 will be boosted by tech. I wondered if he had been reading Eric Fry, who has already steered his readers into this rotation. Eric believes that every investment needs to be seen through an “AI Lens.” I’ve identified four distinct AI investment categories, each of which offers different levels of risk and reward. From this day forward, every stock you consider should fall into one of these four categories… - AI Builders

- AI Enablers

- AI Appliers

- AI Survivors

Eric brought that “AI Lens” to his annual team-up with Louis and Luke for the Power Portfolio that debuted Monday. If you’re new to the Digest, Power Portfolio is the annual 12-month portfolio chosen by Louis, Luke and Eric. They all work together to build a portfolio to outperform the market over one calendar year. In 2025, the Power Portfolio gained 31.6%, far outpacing the Nasdaq’s 18.5% gain, and more than doubling the gains for the S&P 500 index and the Dow over the same period. Power Portfolio has delivered gains of more than 30% in each of the last two years, resulting in a compound return of 74%, compared to a two-year return of 49% for the S&P. We believe 2026 will bring even more opportunities, provided you know where to look. Tech companies are investing billions of dollars in artificial intelligence infrastructure, and the U.S. government is set to allocate trillions to support critical industries. When It Comes To Investing, Consider the Entire Picture Don’t rely on old market saws about midterm years when the reality of 2026 is being shaped by AI, earnings growth, and one of the strongest secular trends in a generation. Science shows we use our whole brain — the 10% myth was never true. And it’s time investors stopped using 10% of their thinking when it comes to midterm election years. Everything about 2026 points to a continuing bull market in 2026. It could be a massive opportunity for investors who stay the course. You can still view a recording of the latest Power Portfolio 2026 presentation to get a head start on that year ahead by clicking here. Enjoy your weekend, Luis Hernandez

Editor in Chief, InvestorPlace |

Tidak ada komentar:

Posting Komentar