The contradictions in market advice… the investments odds are against us… an AI tool to sidestep investment pitfalls… tomorrow’s big event with Keith Kaplan Have you ever noticed the contradictions in our “wisest” investment slogans? Is it… - “Let your winners run” or “Little pigs get big, but big pigs get slaughtered”?

- “Cut your losers short” or “Time in the market beats timing the market”?

- “Be greedy when others are fearful” or “Never catch a falling knife”?

- “Stick to your investment plan” or “When the facts change, I change my mind”?

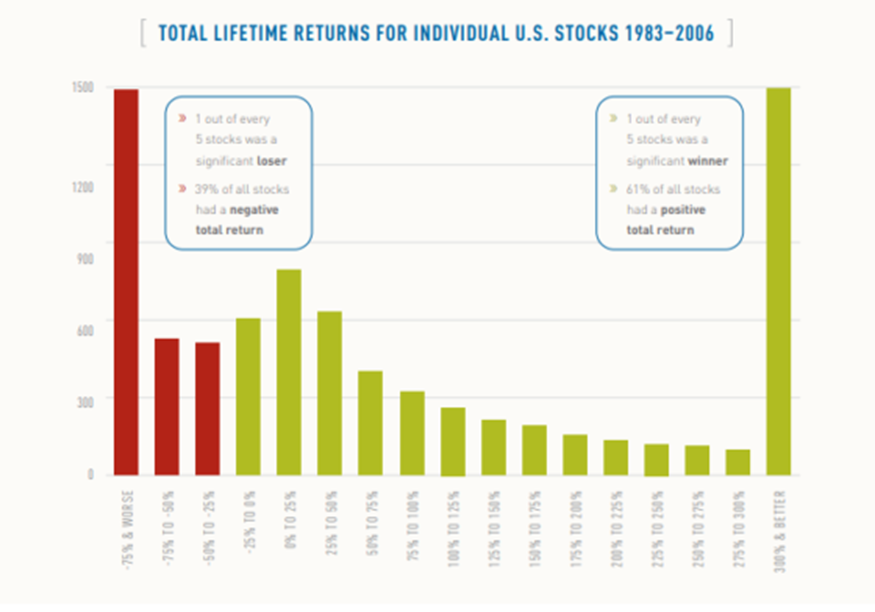

There will always be an investment maxim that, in hindsight, will have been the “wise” path you should have taken (usually quoted to you by a 23-year-old, wet-behind-the-ears recent hire at a brokerage firm). You know that stock you sold when it fell 20%, triggering your stop-loss? When it reverses and turns into a 300% winner, you should have known that… “The stock market is designed to transfer money from the active to the patient,” as Warren Buffett once said. But when you hold onto that other 20% loser in your portfolio – only for it to collapse 85% and never recover – you should have known that… “Selling your winners and holding your losers is like cutting the flowers and watering the weeds,” as Warren Buffett once wrote. (Technically, this comes from Peter Lynch, but Buffett liked the quote so much that he included it in one of his year-end reports to shareholders.) Bottom line: Investing is hard. Even if you master the emotional side of investing, the statistics of investing are brutal About a decade ago, the research shop Longboard studied the total lifetime returns for individual U.S. stocks from 1983 through 2006. They found that the worst-performing 6,000 stocks – which represented 75% of the stock-universe in the study – collectively had a total return of… 0%. The best-performing 2,000 stocks – the remaining 25% – accounted for all the gains. Here’s Longboard on the takeaway: The conclusion is that if an investor was somehow unlucky enough to miss the 25% most profitable stocks and instead invested in the other 75% his/her total gain from 1983 to 2006 would have been 0%. In other words, a minority of stocks are responsible for the majority of the market’s gains. It gets worse. The above statistic, that 75% of the stocks had a collective return of 0%, masks a darker financial reality… While it would be unfortunate to sink your money into a stock that generated no gain, the unspoken implication is that you’d at least walk away with your original investment capital. Not so much. The Longboard study found that 18.5% of stocks lost at least 75% of their value. In other words, nearly one in five stocks didn’t just return zero… they were double-digit losers that destroyed investment capital. Here’s the breakdown:

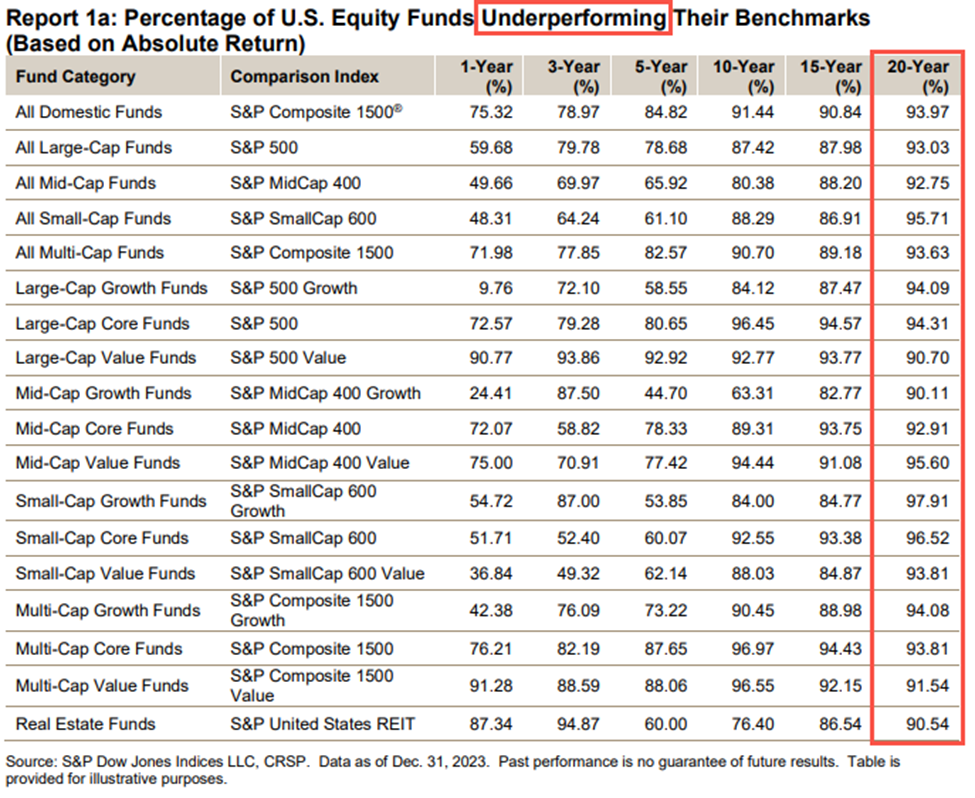

Source: Longboard Other studies have found similar results. Research from economist and academic Hendrik Bessembinder that looked at equities from 1926 to 2015 concluded that about 60% of stocks were so bad that their performance was worse than one-month U.S. Treasury notes. From Bessembinder: It is historically the norm in the U.S. and around the world that a few top-performing companies have great influence over how the market does overall. It’s the norm and I expect it to be the case in the future. While it may be “the norm,” it points toward a sobering takeaway for investors… It’s not easy finding the big winners. And if you don’t find a big winner, getting a 0% return isn’t the worst potential outcome. Instead, significant loss of your hard-earned money is a very real threat – and it happens with greater frequency than most investors realize. By the way, it’s not just you and me who struggle with underperformance. Here’s market analyst and author Charlie Bilello: Most professional money managers (>90%) underperform their benchmarks over the long run.

Good thing you only pay them 1% of your entire portfolio! (Do the quick math on that, and then imagine carrying a briefcase of cash with that amount into their office each January to pay them. Are they worth it?) Again: Investing is hard. Let’s consider an alternative approach How about one that sidesteps emotions and zeroes in on fundamental strength? Maybe one that leverages artificial intelligence to analyze volumes of historical data and millions of data points to help investors make wiser decisions? Last week in the Digest, we highlighted “An-E,” which is short for analytical engine. This is an AI-based investment product from our corporate partner, TradeSmith. If you’re not familiar with TradeSmith, they’re one of the most respected quant shops in our industry. They’ve spent over $19 million and over 11,000 man-hours developing their market analysis algorithms with a staff of 36 people working on developing and maintaining their software and data systems. Here’s Keith Kaplan, CEO of TradeSmith, with more on An-E: A lot of today’s chatter about artificial intelligence is about “the future” – about AI’s potential, and the great things this technology can achieve. But at TradeSmith, we don’t have to visualize too far into the future. For us, that “future” is already here. We’ve figured out how AI can deliver market-beating wealth – and not just on the easy, good days. What we’ve created can help you thrive even in the worst market conditions. And that means recognizing opportunities, yes, but also sidestepping danger. That’s where TradeSmith’s proprietary AI trading algorithm – An-E, short for analytical engine – comes in. What sets An-E apart from the crowd is that it can forecast stock prices one month into the future… and many of these forecasts are incredibly accurate. And it’s not just useful for stocks that are set to go up… An-E also zeroes in on the losers, too. Over the last few days in the Digest, we’ve highlighted case studies illustrating An-E’s predictive power. Let’s look at another bearish example (An-E is equally effective in bear markets as it is in bull markets). Back on March 6, An-E predicted that Dolby Laboratories Inc. (DLB) would suffer a 12.91% drop after 21 trading days. The AI’s conviction level on its prediction was 63%. After 21 trading days, DLB closed at $72.49, just above An-E’s prediction of $71.85. This put the loss at -12.13%, nearly identical to the forecasted -12.91% decline. He’ll walk you through how An-E forecasts stock prices one month in advance with remarkable accuracy – and how you can use it to find high-probability trades that unlock short-term profits. By the way, just for joining automatically, Keith will give you five of An-E’s most bearish forecasts – stocks it’s projecting to drop hard in the coming weeks. Back to Keith: We’re in the midst of one of the most radical economic shifts we’ve ever seen. Global trade is being rewritten, markets are in flux, and many investors are scrambling to make sense of it all. But this is exactly the moment AI like An-E was designed for. With markets more unpredictable than ever, “buy and hold” simply won’t cut it anymore. The smart money is learning how to move with the market’s rhythm – and AI is the key to making it possible. If this isn’t for you, at least recognize what you’re up against American publisher and author William Feather once wrote, “One of the funny things about the stock market is that every time one person buys, another sells, and both think they are astute.” Do you know who’s on the other end of your “astute” stock transactions? Increasingly, it’s AI (or at least high-powered quantitative algorithms), which surpasses humans in its analytical/predictive powers by orders of magnitude. Here’s Business Insider with how Wall Street is cannonballing into AI. Welcome to Wall Street's AI era… Quant hedge funds are beginning to rely on the latest AI chips, like Nvidia's popular GPUs, to test some of their most advanced models. Google Cloud is helping quantitative investment firms like Two Sigma and Hudson River Trading innovate around a shortage of sought-after Nvidia AI chips. The article goes on to highlight a long list of companies that are turning to AI in one way or another. Can the average investor compete? Perhaps the better question is: “Will the average investor even try to compete?” The answer appears to be “no.” In 2018, the Bureau of Labor Statistics surveyed how Americans spend their time. After “sleeping” and “working,” what was the most time-intensive activity for survey respondents? Watching TV. That clocked in at 2.84 hours per day. And how much time, on average, was allocated to personal financial management? 0.03 hours per days… which is less than two minutes. If you’d like to learn more about investing alongside AI rather than against AI, tomorrow’s event is for you Here’s Keith again: Not every chunk of bad news means doom for your portfolio. In fact, volatility like we’ve seen presents a massive opportunity. This is AI’s time to shine. With An-E on your side, the odds of you finding more winners and avoiding more losers is higher than before. Join me tomorrow at 8 p.m. Eastern at The AI Predictive Power Event by signing up here automatically… and you’ll discover how. Whether you’re playing offense by targeting winners or defense by avoiding losers, An-E gives you the clarity you need when it matters most. To reserve your seat, just click here to instantly reserve your spot and we’ll see you there. So, what’s the best way to end today’s Digest? Clearly, with yet another investing quote – but this one might be the wisest of all. From author, asset manager, and trader Andreas Clenow: Beware of trading quotes. Have a good evening, Jeff Remsburg |

Tidak ada komentar:

Posting Komentar