This "Moron Risk" Is Costing Investors  | | Robert Ross

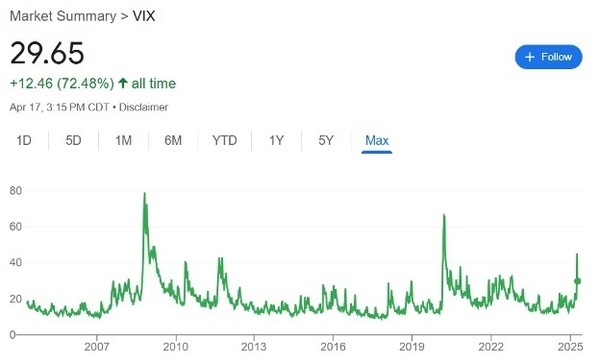

Speculative Assets Specialist | Investors often talk about premiums... A risk premium... A growth premium... A liquidity premium... Now, the U.S. faces something entirely new: a moron premium. | SPONSORED | | CHAOS CASH TRADING SUMMIT Discover Pro Trader Bryan Bottarelli's #1 Way to Trade the Market Volatility Tomorrow, April 23rd @ 2 p.m. ET! | | | That's not my term. That comes straight from the Financial Times. The publication said this "moron risk" weighs heavily on U.S. markets. Chaotic top-down decision-making is forcing global investors to reassess their exposure to America. That's a big deal. For decades, the U.S. enjoyed a stability premium. Investors paid more for U.S. stocks and bonds because they were "safer." Deep, liquid markets, strong institutions, rule of law, and a relatively predictable policy environment formed a backstop. Capital poured into the U.S. during times of instability. While the U.S. has always had its problems, there was a saying invoked: TINA, which means "There Is No Alternative." Now, we export uncertainty. A Departure From Trump 1.0 Let's rewind to Trump's first term. Say what you will about the man's rhetoric or Twitter presence, but Trump 1.0 was largely pro-growth in market terms. He delivered a massive corporate tax cut, rolled back regulations, and appointed business-friendly judges while keeping Wall Street on his side. His 2018 tariff skirmish sparked volatility, but it was measured, iterative, and ultimately resolved with a Phase One deal that calmed markets. The strategy worked so well that even the Biden administration kept the tariffs in place. After Trump's election in November 2024, investors, including me, expected a similar playbook from Trump 2.0: more tax cuts, deregulatory pushes, and a friendly Fed. That's why stocks and crypto soared after his election win. Since then, everything has changed. Instead of a business-friendly policy pivot, we got "Liberation Day" - a 10% across-the-board tariff (with China now at 245%). The announcement triggered one of the fastest 20% corrections in history. And it wasn't just equities. Treasury yields spiked. The dollar sold off. Volatility (as measured by the VIX) hit levels that have not been seen since the COVID crash.

View larger image Why? Because this time, the chaos isn't a side effect - it's the strategy. The working theory behind the "controlled demolition" approach is the administration wanted to engineer an economic slowdown to force the Fed to cut rates early. That would lower borrowing costs and lay the groundwork for a pro-growth pivot with tax cuts and deregulation later in the year. Except markets aren't buying it. Unlike 2018, there's no clear negotiation framework, roadmap, or trusted voices calming investors behind the scenes. All we have are U-turns, contradictions, and chaos. For example, investors didn't see the 90-day tariff pause announced just days after Liberation Day as strategic. The pause screamed panic, triggered by a bond market revolt and foreign selling of U.S. Treasurys. That's not strength. That's weakness.

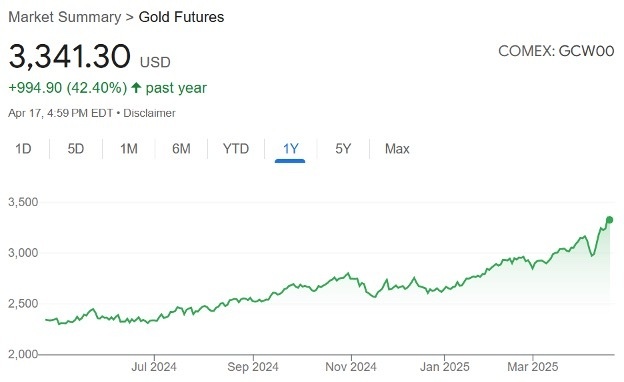

View larger image And investors have noticed. The "Moron Premium" Is Here Foreign capital now demands a discount to hold U.S. assets. That's the moron premium in action. It's why U.S. equities are trading at lower multiples despite resilient earnings. It's why the bond market is tightening even as the Fed stays on hold. It's why even gold, an asset with no yield, keeps outperforming the S&P 500 in 2025. That's positive for the small gold mining stock we bought a few months ago in Breakout Fortunes. But it's a net negative for U.S. markets as a whole.

View larger image What's more troubling is that the structure of U.S. markets is shifting. Foreign central banks are selling Treasurys and U.S. dollars. That's a rare and ominous signal. Usually, when yields rise, the dollar strengthens. Lately, we've seen the opposite: yields rising and the dollar falling. That suggests investors aren't rotating out of bonds into U.S. equities or cash - they're exiting the entire system. The safety premium America once enjoyed is eroding. The "moron premium" is replacing it. There's Still Time to Right the Ship Let me be clear: This doesn't mean the U.S. is finished. It doesn't mean you should dump your portfolio and move to Switzerland. But it does mean investors should be more selective, more tactical, and more skeptical of blindly buying every dip. It also means that market and policy volatility is likely to stay elevated. That's fine for disciplined investors with a long-term view. But it's a brutal setup for passive players or soon-to-be retirees expecting smooth sailing or quick recoveries. If the administration wants to reverse this, it will take more than stimulus promises. It will require real, sustained credibility. It means clear communication, consistent policy, and cooperation with the Fed and U.S. allies - not just blunt-force tweets and press releases. Until then, U.S. markets will remain discounted, not because our companies are bad, but because our leadership looks unhinged. And that's the essence of the moron premium. Stay safe out there, Robert Editor's Note: Is the "moron premium" actually a genius discount? We've just released new research on "Trump's Trade War Master Plan" that explains why this isn't policy failure but deliberate strategy creating the buying opportunity of a decade. And Chief Investment Strategist Shah Gilani shares details on three specific American companies trading at 25% to 75% discounts right now. Get positioned before an expected May 6 Federal Reserve announcement sends stocks soaring. Learn more here. Want more content like this? | | | | | |

Tidak ada komentar:

Posting Komentar