January 24, 2025

The Unassuming Hero of AI

Dear Subscriber,

|

| By Michael A. Robinson |

The charred remnant of Pacific Palisades tells a harrowing tale of death and destruction.

Analysts say rebuilding could cost as much as $50 billion.

Then again, as the fires swept through the picturesque Los Angeles neighborhood, homes, roads and businesses were reduced to ash.

The cost of rebuilding this vibrant community is staggering, but it underscores an overlooked cornerstone of modern life: Building materials.

Don’t scoff. Precedence Research says this global sector is worth some $1.3 trillion, a figure that stands to grow as high-tech leaders build thousands of new data centers worth up to $1 trillion over the next few years.

Concrete, steel and aggregates — the unassuming heroes of construction — are about to take center stage in a story that bridges disaster recovery with the meteoric rise of AI-centric data centers.

With that in mind, today I want to tell you about a storied leader in the field that has been doubling its earnings every 18 months …

Life in a Fire Zone

Let me be clear. We are not swooping in to take advantage of the plight of thousands of California fire victims in what could be the most expensive wildfire in U.S. history.

Indeed, I live in an East Bay Hills community in northern California where a raging wildfire destroyed hundreds of residences and killed dozens back in 1991.

To be sure, we moved in a few years later and almost no homes on our street were burned. But trust me when I say that on high wind days in the dry season, this is on everyone’s mind.

Things were so dry and windy here roughly three years ago that my wife and I had our emergency bags packed and sitting by the front door so we could flee on a moment’s notice.

In other words, I don’t believe we are profiteering from folks in a crisis. Our job here is to make the kinds of connections between major events that will be ignored by Wall Street and Big Media.

Fact is the same materials that will help rebuild Pacific Palisades are also the backbone of the digital revolution.

As AI continues its relentless march forward, data centers — the physical heart of AI operations — are proliferating at an unprecedented rate.

We’re talking about thousands of giant structures to be built all over the world. The exact number remains in a state of flux.

But here’s a data point worth keeping in mind. A Google and Microsoft alliance alone are set to spend roughly $200 billion on data centers in the next few years.

AI’s Foundation

And here’s where the story takes an intriguing twist …

Martin Marietta Materials (MLM) will play a role in rebuilding Los Angeles and providing the materials data centers will require for the AI boom.

As a leader in aggregates and building materials, the firm’s not what you’d typically think of as an AI play.

Yet, its products — crushed stone, sand and gravel — are essential for constructing the vast concrete foundations and cooling systems required by AI data centers.

These sprawling facilities consume massive amounts of energy and demand robust, fire-resistant infrastructure. Concrete, reinforced with aggregates, is the material of choice.

Companies like Nvidia and Microsoft are leading the charge in AI software and hardware. But without the physical infrastructure to house and power these systems, their growth would grind to a halt.

Martin Marietta is an under-the-radar company and is strategically positioned to supply the raw materials needed for our cutting-edge technological advancement.

Its vast network of quarries and production facilities throughout the U.S. ensures a steady supply of high-quality aggregates.

A Storied History

The firm’s history is a story of transformation and growth rooted in American industry and innovation. The company’s origins trace back to 1939 when Martin Marietta Corporation emerged from a merger of chemical and construction firms.

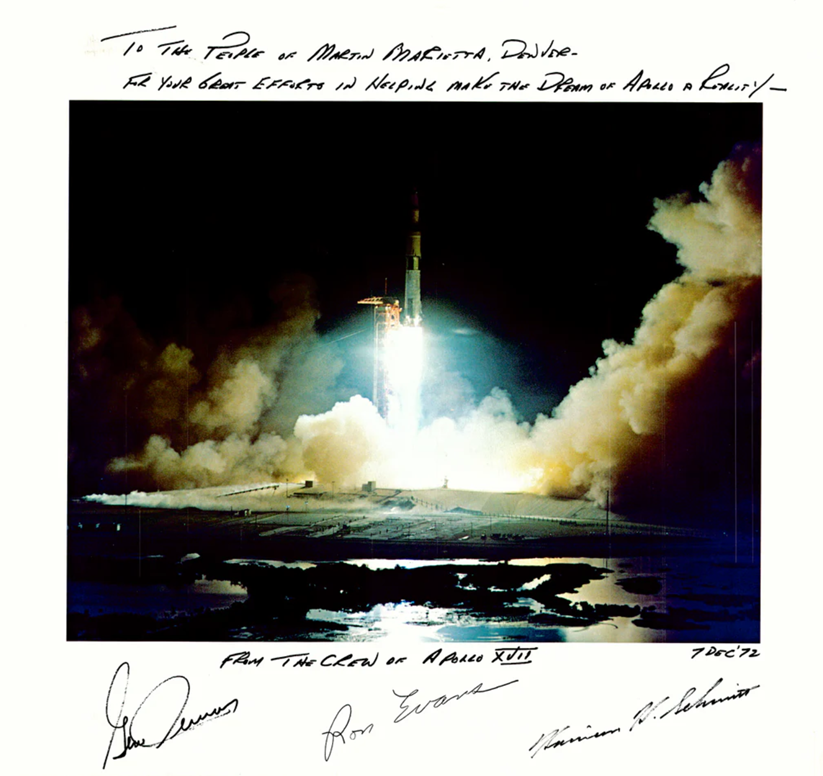

In its early years, the company played a pivotal role in the aerospace and defense sectors, providing critical materials for military applications and even contributing to the Apollo space program.

Signed picture from Apollo 17 crew to Martin Marietta employees.

Source: Old Map Gallery.

Click here to see full-sized image.

In 1993, Martin Marietta Materials was spun off as a standalone entity, focusing exclusively on aggregates, cement and other building materials.

This strategic pivot allowed it to concentrate on infrastructure and construction, becoming one of the nation’s largest suppliers of aggregates and ready-mix concrete.

Over the years, the company expanded its footprint through acquisitions, securing quarries, cement plants and distribution networks across the United States.

Today, Martin Marietta is a cornerstone of modern construction, delivering essential materials for everything from highways and bridges to residential developments.

Its journey from aerospace to aggregates underscores the power of finding the correct corporate niche — and profiting from the move.

Earnings Double Ahead

Add it all up, and you can see why I say the AI buildout, still in its early stages, is all-encompassing in scope.

Of course, we’ll need high-tech items like semiconductors, computer servers, software, cybersecurity and wireless connections, just to name a few.

But with Martin Marietta, we also can invest in the AI boom’s literal foundation.

Earnings growth in the most recent quarter was weaker than I would like to have seen.

This is why I also recommend looking at the long haul. And here is where the company scores a major win.

Over the past three years, it has averaged per-share profit growth of 47%. That puts it on pace for earnings to double in as little as 18 months.

To be conservative, let’s double that time frame to three years.

And since stock prices tend to follow earnings growth, that bodes well for the long-term investment thesis here.

Best,

Michael A. Robinson

P.S. Martin Marietta may have helped along the Apollo missions. But today’s startups are taking on modern space missions. And for a very limited time, you can claim a way to invest in one before it even IPOs. Check it out here.

Tidak ada komentar:

Posting Komentar