January 13, 2025

A New No-Risk Way to Play Bitcoin?

Dear Subscriber,

|

| By Nilus Mattive |

I’m all about safety and avoiding hype … especially right now with a stock market at extremely high valuations based on historical measures.

And given the fact that the so-called “Magnificent Seven” stocks accounted for more than half of the S&P 500’s return in 2024 — which is worrisome in and of itself — you might think my bearishness on those names had a wildly detrimental effect on the model portfolio I offer to my members of Safe Money Report.

That hasn’t been the case at all.

All told, the average total return on my open recommendations through the end of 2024 was 38.4%.

That number, which includes any dividends received but not reinvested, is quite good considering I’ve only been running the newsletter for the last two years.

Heck, many of the recommendations have only been on the books for a matter of months!

Of course, a big part of our success has been the outsized benefit we’ve gained from several different crypto-related positions.

Making the decision to initiate an allocation to crypto within a month of taking over Safe Money Report was an extremely bold — and productive — decision.

To be clear, crypto is really just a minor focus and most of my recommendations are still in traditional assets like stocks and bonds.

Nevertheless, our healthy diversification across ALL asset classes — coupled with good timing — is why we’ve been able to achieve very healthy gains with what I believe is far less overall risk.

Whether my readers followed all the different crypto-related recommendations to the letter, or merely just bought one or two at any point, it’s almost certain that they have already made extremely large returns in a very short amount of time.

Let’s start with cumulative gains of roughly 400% since my initial Bitcoin recommendation went to press less than two years ago.

That is absolutely huge. A single 400% winner can bring an entire portfolio’s performance up by leaps and bounds!

But even if a reader simply acted on a Bitwise 10 Crypto Index Fund recommendation I sent out this past April, the tracked open gain on that was currently sitting above 75% by the end of 2024.

This fund holds both Bitcoin and Ethereum. But it also holds eight more cornerstone cryptos.

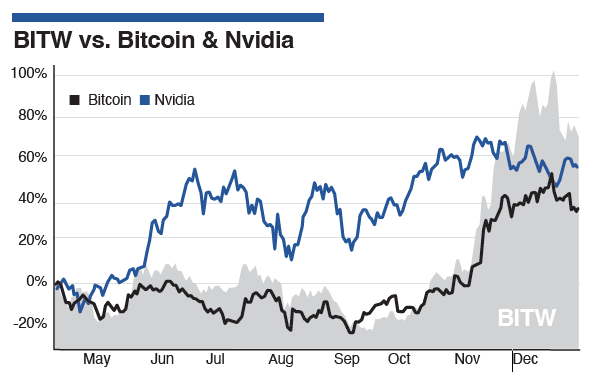

Take a look at how that fund compares with Bitcoin and Nvidia from my original recommendation date through the end of 2024 …

Bitwise 10 is in gray, Nvidia in blue and Bitcoin in black.

Click here to see full-sized image.

As you can see, that recommendation has absolutely crushed both the bellwether crypto as well as the poster child for the Magnificent Seven.

Because I’m so conservative and focused on safety, I actually just told subscribers to take half of that position off the table and lock in some of the profits.

Indeed, at this point, ALL the crypto positions we have left in the Safe Money Report model portfolio are basically “free” because they are just a portion of the leftover profits that past recommendations originally generated.

Let me repeat that: At this point, members should have already gotten back all of their original capital … plus heaps of profits … and yet they still have allocations to all the biggest cryptos going forward.

Talk about a riskless situation!

Of course, you might be wondering where that leaves someone who has yet to dip their toes into the crypto waters or hasn’t yet had the kind of success we’ve had.

Well, if you also want a stake in Bitcoin with the promise of zero downside, then you should take a hard look at a new exchange-traded fund from Calamos that is currently set to launch on Jan. 22.

It’s the first crypto-focused fund of its type — a structured protection ETF designed to give its investors some of Bitcoin’s future upside without any downside.

How will it attempt to accomplish this? Through a mix of options on the CBOE Bitcoin U.S. ETF index and Treasury holdings.

The company says the fund is designed to be held for a full year. It will release the specific upside potential on the day trading begins. The ticker symbol will be CBOJ.

Other companies — including Innovator and First Trust — are looking to launch similar funds in the future.

Meanwhile, Grayscale and Roundhill are working on ETFs that will combine crypto holdings with my favorite advanced income strategy — options selling.

Of course, if you really want to get the most income out of the crypto market — and make sure you’re positioned for any future upside — then I also strongly recommend you attend tomorrow’s Weiss Ratings event on “Supersized Crypto Royalties.”

Whatever way you decide to go, the most important takeaway is this: Using a wide range of assets and strategies is the very best way to make sure you stay safe, and your wealth keeps growing.

Our results in Safe Money Report are proving that unequivocally.

Best wishes,

Nilus Mattive

Tidak ada komentar:

Posting Komentar