January 7, 2025

2 Tools to Help You Sail Into Altcoin Season

Dear Subscriber,

|

| By Bruce Ng |

Altcoin season is like the Holy Grail of crypto.

That’s because, in bull runs past, that has been when altcoins across the board outperform Bitcoin (BTC, “A”) to pump substantially each day for several days.

In short, it’s a windfall. And catching it right has spelled significant gains for investors in the past.

Naturally, the prospect of that happening again has everyone in the crypto community on the edge of their seats.

That said, a few things are different this bull run. For example …

- The number of crypto assets has boomed. There are over 16,000 coins now, far more than the 4,051 in February 2021. This many coins could mean that bull market liquidity won’t be able to flow to every single one and pump it the way it has in the past.

- Crypto’s total market cap has surged. Today, at $3.41 trillion, it is harder for it to increase by the leaps we’ve seen in past altcoin seasons.

These developments are definitely important to keep in mind, as they could radically change what this coming altcoin season looks like.

That said, they shouldn’t change your approach too much.

As I said previously, the best way to approach altcoin season is to focus your efforts.

Rather than spread yourself thin to catch the ride up on many assets, my suggestion is to target the most promising opportunities.

And the best place to start is by reviewing which sectors have done well. To that end, I have two new tools you may want to add to your crypto toolkit.

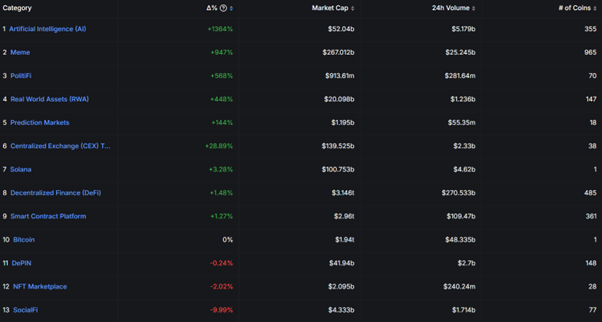

First is DeFi Llama. More specifically, it’s Narrative Tracker. Navigate to it, and you can see the yearly performance of the top sectors, as shown below:

Figure 1. Top performing sectors of the past year benchmarked against BTC.

Source: DefiLlama.

Click here to see full-sized image.

From the table above, it’s quite evident that not all sectors perform equally well, even in bull markets. Instead, there are specific sectors that outperform the entire alt market andBTC by a large margin.

If this altcoin season sees its big winners consolidated to the top sectors, resources like this narrative tracker will be a big help.

The following sectors stand out to me:

- Artificial Intelligence, which outperformed BTC by an astounding 1,364%

- Memecoins, which beat BTC by 947%

- Politifi, or political coins, have outperformed to the tune of 568%

- Real World Assets (RWA) which are up 448% more than BTC

Granted, the table above shows the past performance, with the keyword there being “past.” And that does not guarantee future results.

Still, it provides a solid starting point to help you narrow down your choices.

Next step is to use sentiment analysis — i.e., gauging the hype of particular keywords, sectors and coins on social media — to see which narratives are still hot, and which are last year’s news.

That’s where my second new tool, called dexu.ai, comes in.

Like DeFi Llama, it shows the performance of different narratives. It also gets into subnarratives and mindshare — a measure of how much engagement, attention and hype a particular sector gets on social media.

And, if you navigate to this dashboard, you can see at a glance the engagement around keywords currently trending on Crypto Twitter — the community of crypto experts on X.com (formerly Twitter).

Figure 2. Twitter Word Cloud on dexu.ai.

Source: dexu.ai.

Click here to see full-sized image.

As a general rule, the larger the keyword on the screen, the more hype it has generated. You can also search for the most hyped keywords for the past day, seven days and 30 days.

Scroll further down, and you can see the latest viral tweets, too.

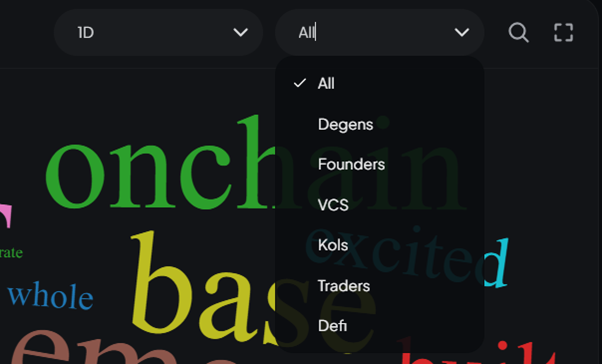

For both the tweets and dashboard, you can narrow your search even further to target specific categories of posters, such as VCs, key opinion leaders or traders. Just click on the dropdown menu that defaults to All and play around.

Figure 3. Customize dexu’s Twitter Word Cloud.

Source: dexu.ai.

Click here to see full-sized image.

Using dexu.ai this way allows you to identify what is trending within the active crypto community and gauge what the sentiment is in order to spot the most promising narratives.

With these two tools, you’ll be better positioned to improve your chances of picking a bull market darling to ride higher. Even if this altcoin season looks different than those in the past.

Best,

Dr. Bruce Ng

P.S. Targeting capital gains isn’t the only crypto strategy you should be aware of. Liquidity providing can unlock opportunities for yield you won’t see anywhere else.

Our DeFi expert Marija Matić has successfully targeted yields as high as 101%, 912% and 1,168%. It’s no wonder the BBC, MarketWatch and MSN have relied on her for expert analysis!

And that was under an administration that was notoriously anti-crypto. With a first-ever pro-crypto administration set to take over, these exceptional yields could get even better.

That’s why Marija is hosting her Supersized Income Summit this coming Tuesday, Jan. 14 at 2 p.m. Eastern.

This landmark event is one you don’t want to miss. Even better, it’s completely FREE! Just be sure to save your seat here.

Tidak ada komentar:

Posting Komentar