Big Shorts Feeling The Big Squeeze | | Sponsored Content I'm Revealing Urgent Details on my Brand-New EV Battery Pre-IPO... Electric vehicles are the hottest investment trend heading into 2021. And Tesla's inclusion in the S&P 500 is sending these stocks soaring. My clients already had a shot at 317% profits with this next generation battery stock. That's why I'm thrilled to release this urgent report: BUY ALERT: Tesla Insiders Launch a Brand-New EV Battery Stock. | | | What a wild last couple of weeks in the world of what is arguably the highest-profile wave of short-squeezes ever witnessed in the history of the U.S. stock market.

Prior episodes of forcing short sellers to cover positions were typically instigated by professional market participants and viewed as more of a club sport of kings that garnered little fanfare and barely deserved mention within the financial media outlets. But oh, how the tables have turned and appear to have the makings of a great Netflix series that still could be in its first season.

On a much smaller scale, the unfolding of David hitting Goliath square in the forehead with a small smooth stone, not just once, but every day of the week the market is open for trading, is being reported around the globe. The power of social media has unleashed an army of millions of Reddit apostles and "hoodies" trading on commission-free Robinhood that has a few of the "royals" on the ropes and the peasants chanting "off with their heads!"

Robinhood has roughly 13 million accounts with an average account balance of $1,500-$5,000, translating to about $20 billion in assets under management (AUM). A crowd of 6.6 million follows the WallStreetBets section on Reddit.com, many of whom also have accounts at Robinhood. As of last week, it was being rumored that 50% of total assets at Robinhood were invested in GameStop Inc. (GME), which might prove to be one of the reasons why trading in the shares was restricted to only selling for a brief period.

Source: reddit.com | | Three 'Backdoor' Plays Pumping Out Thousands in Extra Cash Wall Street "fat cats" don't want you to know about these three"backdoor" investments that are pumping out hundreds, even thousands of dollars in extra cash. But a top income expert reveals how you can get your hands on these plays that used to be reserved only for billion-dollar hedge funds and the super-wealthy. Find out how you can tap into these rich cash streams and earn big, juicy dividends. | | | As of last Friday, Robinhood had restricted purchases of GME to only three shares, down from five shares earlier in the week. This particular short squeeze in GME has morphed into a crusade, with a new emoji combination emerging in the process -- "diamond hands" -- referring to a fearless stock trader undeterred by large swings in the price of stocks.

The hyper-active thread on WallStreetBets is packed with movie trailers from "Braveheart," "Gladiator," "300" and "Remember The Titans," urging their GME brothers and sisters to "hold the line!," "be as one!," "let 'em play, cheater!" Driving the enthusiasm is one particular torch-bearer with the handle of Deep F---ing Value (DFV) for short. The mantra for his account is YOLO (You Only Live Once) and it has set ablaze the fire among millennials who are all getting a crash course in long/short stock and options investing that has empowered millions of newbies to the market.

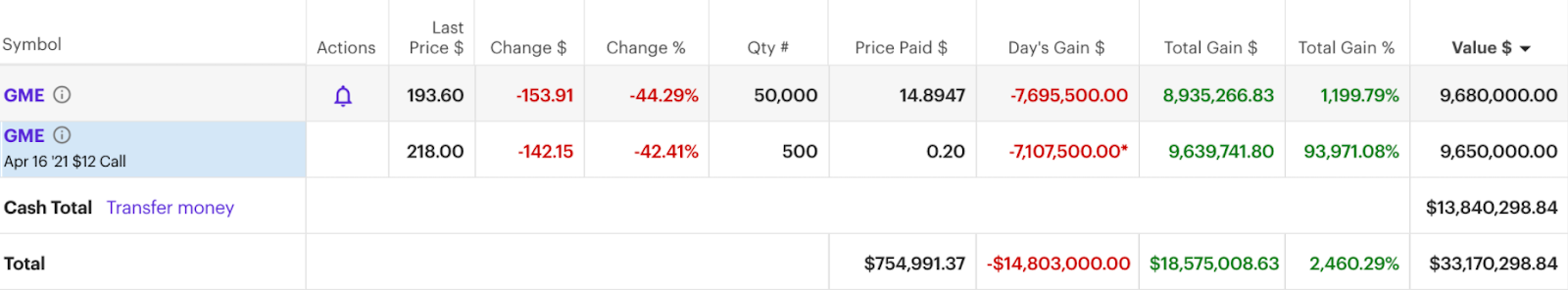

The story goes that DFV started with $55,000 back in late November 2020 when he started buying the stock and call options. He posts his account value every day and, as of Jan. 28, was sitting on a value of over $33 million, the high being over $47 million when GME was trading upwards of $480.

Source: www.reddit.com/wallstreetbets

This advertising of one's meteoric path to extreme wealth has captured the fancy of the investing world, if not for entertainment value alone. Over the weekend, Zero Hedge, which publishes the Durden Dispatch, posted a story titled "Goldman Warns If Short Squeeze Continues, The Entire Market Could Crash." Now, that's an extreme headline and it really is overhyping the situation by a factor of about 10. The U.S. stock market has a current total market capitalization of $50 trillion.

Tyler Durden, of zerohedge.com, put it well: "This is a big deal to the shorting community, but to the other 99% of the financial world, nobody gives a …" | | Explosive Profits in 2021 and Beyond – Even in Volatile Markets My "5 Tips for Overcoming Market Volatility" can make you great returns in both good -- and volatile markets. No tricks or gimmicks. Just life-saving information you can use to protect and grow your money, regardless of market conditions.

Click here now and I'll send you my "5 Tips for Overcoming Market Volatility" eBook and reserve a seat for you at my LIVE online training, so you can learn how to skyrocket your profits. | | | Durden continued, "As much as young people on the internet like to imagine this as an epic, David vs. Goliath, Wall Street vs. Main Street showdown for the history books; from a bird's eye view it's actually just a brief dumpster fire where a couple hedge funds lost their shirts betting on one little small-cap stock. It has happened before, and it will happen again."

GameStop has a current inflated value of about $22 billion. www.fananchill.com lists all the stocks with the biggest percentage of short interest against the outstanding floats. It's where all the action is and where the micro dumpster fires are lit. In the big picture, it is a crash course for the uninitiated that will be caught at the top when the music stops.

The torchbearers like DFV hopefully will post a timely message when to sell and not let the thrill of the moment become an emotional sword to fall on. Robinhood CEO Vlad Tenev can only be hoping for the same. He already tapped his credit lines for hundreds of millions of dollars to maintain liquidity with the clearinghouses and counter parties. A 50% drop in GME will zero out thousands of accounts that have GME on margin, and Robinhood had been planning on an initial public offering (IPO), according to media reports.

As this story continues to fascinate and captivate the world of the small guy taking on the man, the short-selling community should be watchful. If this crusade takes on a larger life of its own that includes investors with real buying power, then we could see one GameStop "gamma squeeze" after another. What's going on in GameStop, AMC Entertainment (AMC), Ligand Pharmaceuticals (LGND), Bed Bath & Beyond (BBBY), Macy's (M), Tanger Factory Outlet Centers (SKT) and others on page one of the most heavily shorted stocks list could last for months. It is kind of the new blood sport.

But just to be clear, not all short sellers reside in Darth Vader's Death Star. Professional investors short stock for a number of reasons. Certainly, one reason is to bet on lower valuations to materialize when CEOs overly tout their companies, but also "shorting against the box" to freeze a position at a current price. This is when they short as much stock as they are long. Another strategy is to engage in arbitrage with an announced mergers and acquisitions (M&A) transaction, since there is price discrepancy in all-stock deals.

The pandemic has produced an array of experiences, but seeing millions of young investors, most of whom are online gamers, embrace a stock like Blockbuster Video that was going away, and take part in a real-time phenomenon such as this is better than watching any sports venue with an empty stadium right now. Those shorting GME are living by the old Wall Street maxim "we can remain irrational longer than they can remain solvent." When a guy can turn $55,000 into $33 million, then the shouts of "Game On" will continue to be heard around the world. | | Sincerely,

Bryan Perry

Editor, Cash Machine

Editor, Premium Income

Editor, Quick Income Trader

Editor, Breakout Profits Alert

| | About Bryan Perry:

Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. Bryan Perry specializes in high dividend paying investments. This weekly e-letter combines his decades-long experience in income investing with a simple, easy-to-read format that investors of all stripes can work into their portfolios. | | | | | |

Tidak ada komentar:

Posting Komentar