Hey there! You're reading The Budget Analyst — a calm space in the noise of markets.

Here we collect signals, patterns, and quiet insights that help you see the bigger picture.

No rush, no hype — just clarity for your financial journey. | | | | In partnership with Porter & Co, Brownstone Research, ALTIMETRY. |

|

|

|

| | | | | It happens slowly at first. Then all at once. | The markets keep climbing. Every headline screams AI boom, record earnings, the Next Big Thing. Retail investors are buying the narrative. But if you watch closely—if you look at the SEC filings, the quiet transactions, the pattern of who is actually leaving—you see something else entirely. A drift. A silent exodus. The people with the most to lose, the ones who built these empires, are stepping toward the exits with a peculiar urgency. | It is eerie because it is silent. No announcements. No explanations. Just steady, methodical selling. The kind of selling that does not make noise. The kind that whispers. | The Strange Silence Around Big Tech's Biggest Exit | Start with the numbers. In 2025, insider selling across tech has reached levels not seen since the peak of the last cycle. | Jeff Bezos unloaded $1.5 billion in Amazon shares in the first half of the year—his first major sale since 2021. Jensen Huang, the visionary CEO of Nvidia , has sold $152 million worth of stock. Tim Cook , the steady custodian of Apple , cashed out $50.4 million. Mark Zuckerberg extended his sales into 2025, moving over $300 million in a single month. Oracle 's Safra Catz sold $1.83 billion. | That is not rebalancing. That is not diversification. That is exit velocity. | Meanwhile, retail investors are still buying. The narrative is still strong. The earnings are still beating. And yet the men who know these companies better than anyone on Earth are liquidating positions they have held for decades. | The question is no longer if they are leaving. The question is: what do they see that you do not? |  | Insider Selling Timeline & Volume |

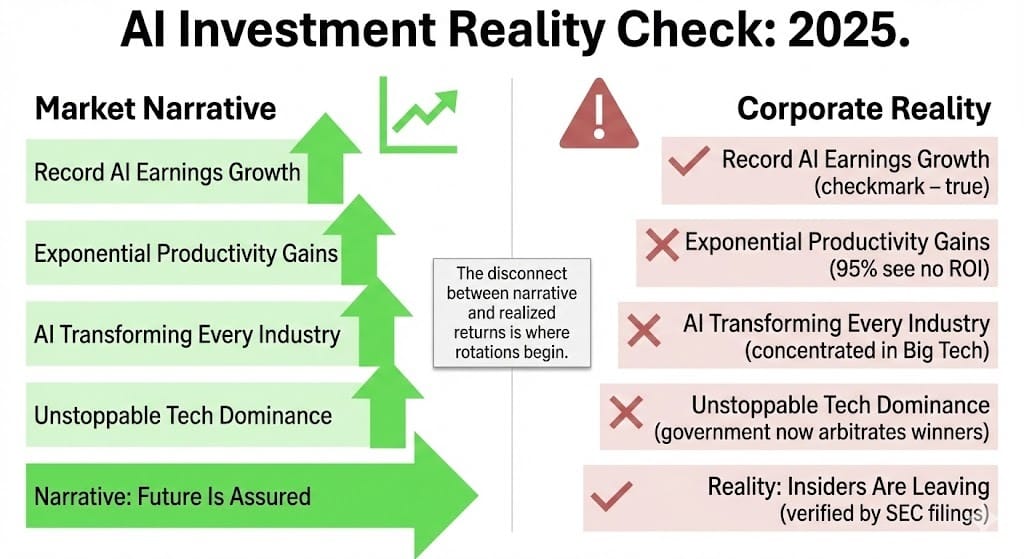

| The Narrative That Doesn't Add Up | The official story goes like this: AI is booming. Tech is transforming everything. The cloud is growing at 25% per year. Generative AI is embedding itself into every product. The future is so bright you need sunglasses. | All of this is technically true. Earnings are solid. Guidance remains resilient. The fundamentals, on paper, look strong. | But then comes the contradiction that breaks the spell. | The MIT Nanda Initiative released research in August 2025 showing that 95% of corporations surveyed reported no measurable return on their generative AI investments to date. OpenAI CEO Sam Altman, the man most responsible for the AI hype cycle, publicly warned investors that some are "overexcited" about artificial intelligence. Not a suggestion to be cautious. A direct statement that the market is pricing in too much, too fast. |  | The AI ROI Gap – Narrative vs. Reality |

| Here is the crux: the earnings are real, but the returns on future investment are mythical. The machine is grinding forward on momentum, not on productivity gains. And the people who built the machine are stepping away before the mathematics catches up with the narrative. | The stock prices are still at records. But the people inside the machine are walking away. |

| |

| | |

| | | | | The "Final Frontier" Exposé | A new documentary called "The Final Frontier" has begun circulating in policy and investment circles. It is not widely known. It is not mainstream. But it is revealing something that the consensus narrative has missed entirely: the mechanics of why insiders are rotating out of legacy tech, and which small, early-stage players are positioned to capture value on the other side of the shift. | The documentary examines how government policy, geopolitical necessity, and the limits of traditional Big Tech economics are colliding in real time. It is not about predicting. It is about documenting what is already happening. | If you own tech stocks, it's time to rethink your portfolio. | Because everyone who's anyone in the tech world is jumping ship. | Bezos has sold nearly $17 billion of Amazon shares this year… | Nvidia's CEO just sold $713 million… | Zuckerberg just sold $1.3 billion of Meta… | Buffett has sold 605 million shares of Apple since last year (~70% of his total holdings)… | Why is it — when everyone else is funneling all their money into companies like Nvidia and Apple – that these billionaires are dumping all their tech shares? | Well, the reason has just been exposed… | The financial establishment doesn't want you to know about this… but a controversial new documentary just pulled back the curtain and revealed what's really going on. | It's called The Final Frontier. | And a lot of powerful investors would rather this exposé never saw the light of day. I suspect they'll attempt to discredit it, tar and feather it, and convince you not to watch it. | That's because it tells the shocking truth about the current AI mania… and why investors in big tech companies like Nvidia, Meta, Alphabet, and Microsoft could be about to destroy investors. | | | This is not an announcement of doom. It is a piece of the puzzle that helps explain why sophisticated money is moving the way it is. When you understand the structural forces—when you see the pattern, not just the volatility—the insider selling stops looking like random noise. It starts looking like navigation. Like the first wave of something larger moving into motion. |

| |

| | |

| | | | | The Political-Tech Axis Shifting Behind the Scenes | Another layer is shifting in the background, and it is not being told as a macro story—it is being told as gossip. | Elon Musk has moved from a politically independent tech entrepreneur to a core figure inside Trump's inner circle. He has spent $277 million supporting Trump and Republican causes. He is now heading the Department of Government Efficiency (DOGE). He has the president's ear. And he is using that access to reshape how tech relates to government power. | This is often framed as a Trump-Musk alliance, as if it is a personal relationship or a power play. But beneath the surface, something deeper is happening: a reconfiguration of which tech companies get favored by government policy, which get audited, which get contracts, which get capital. The political-tech axis is being rewritten in real time. | | If you think there's something strange about the "feud" between Trump and Musk… | You need to see THIS jaw-dropping video… | Because it explains what could REALLY be going on behind the scenes… | And how it could hand investors a stake in a $12 trillion revolution. | | Sometimes the real story is not in the feud. It is in the quiet cooperation hiding underneath it. When government becomes the largest customer, the largest allocator of capital, and the voice setting the rules—which companies win and which don't is no longer determined by markets alone. It is determined by alignment. |

| |

| | |

| | | | | Tesla's Radical Pivot | Tesla offers a vivid case study in how fast these rotations happen. | Elon Musk announced a radical shift in Tesla's strategic direction: away from consumer vehicles and toward robotics, AI infrastructure, and government-aligned projects. This was not a marginal shift. This was an abandonment of the narrative that made Tesla famous. | For years, Tesla was the story of the electric car company that would transform transportation. That story was powerful. It moved markets. It created a cult following. And now it is being abandoned by the man who built it. | The End of Tesla? (Black Friday Briefing) | "Hold onto your Tesla stock." That's the message insiders are sharing as Tesla prepares to unveil a "mind-blowing" new product: one that has nothing to do with EVs… batteries… or self-driving cars. This is a radical pivot that could mark the end of Tesla as we know it and the birth of something much bigger. | | When a company with unlimited narrative power chooses to walk away from its own storyline—you should ask why. The answer is usually that the old story is exhausted. The money has moved elsewhere. The next frontier is calling, and those on the inside can already hear it. | The Pattern That Emerges | Three threads converge into a single signal: | Insiders exiting Big Tech. Not panic selling. Methodical, prearranged liquidation at record prices. This signals that those closest to the economics know something about the trajectory. | Government becoming the primary allocator of capital in tech. Which companies have favor, which have headwinds, is now being determined by proximity to power and alignment with strategic priorities—not by market share or innovation alone. | Legacy tech narratives breaking down. The story of the all-powerful AI company, the unstoppable cloud, the inevitable tech dominance—these narratives are peaking. Even the architects are stepping away. | Together, these signals suggest not that tech is collapsing, but that capital is rotating. From Big Tech toward new frontiers. From consensus plays toward government-aligned, structure-shifting plays. From yesterday's darlings toward tomorrow's winners. | This is not fear. This is repositioning. And it happens in the shadows, long before the mainstream catches on. |  | The Three-Thread Capital Rotation Framework |

| What This Means for Regular Investors | When insiders exit and narratives peak simultaneously, it is not a coincidence. It is a pattern that precedes market rotations by weeks or months. The Nasdaq fell 1.5% in August 2025 as investors rotated out of high-momentum tech stocks. Nvidia dropped 3.5%. Palantir fell 9.4%. Defensive sectors outperformed. The rotation had begun. | The practical insight: when consensus trades become crowded and insiders flee, returns do not disappear—they migrate. They move to the periphery, to the companies and sectors positioned to capture value as the old cycle ends and the new one begins. Not to the broken players. Not to desperation plays. But to those aligned with where capital and government attention are actually flowing. | Retail attention is still glued to the Magnificent Seven. Institutional capital is already repositioning toward what comes after. The window between these two moments—between when insiders leave and when the mainstream notices—is narrow. It is also where the most significant returns accumulate. | Why Understanding This Matters Before the Announcement | The Trump administration is preparing announcements about the strategic direction of AI, critical minerals, and government-tech partnerships. When those announcements hit, capital will flood into the companies mentioned. The window for positioning ahead of the crowd—the window where you can invest before the mainstream realizes what has changed—will close. | Smart money does not wait for the headline. It positions before the headline arrives. By the time everyone sees it, the move is already priced in. | Markets Move Like Tides at Night | The markets seem stable on the surface. Earnings are solid. Valuations are stretched but defended. Growth is real, just slower than promised. | But beneath the headlines, tides are shifting in silence—just as they were at the beginning. Capital is rotating. Insiders are exiting. Narratives are peaking. And a new cycle is forming in the places where most eyes are not yet looking. | The smartest money does not predict the future. It simply leaves before everyone else realizes the story has changed. And by the time the rest of the world wakes up, it has already moved to what comes next. |

| |

| | |

|  | | | Porter & Co. | |

|

|

|

|

|

| | How Did This Post Work for You? | | (Thank you for reading, thinking, and staying curious through all of it.) | — Claire |

|

| |

|

Tidak ada komentar:

Posting Komentar